Introduction

Decentralized exchanges based on automatic market-makers (AMMs) are a crucial component within the decentralized finance (DeFi) ecosystem. Initially, AMMs such as Uniswap adopted constant product bonding curves which evenly distributed liquidity across all prices. Then, Curve Finance introduced its Stableswap invariant which allowed the protocol to concentrate liquidity around a specific price and greatly minimize slippage. By doing so, Curve became the most important decentralized exchange for pegged assets such as stablecoins or pools of tokenized ETH and BTC.

Due to Curve’s success and its unique token economics, yield aggregators such as Yearn Finance developed auto-compounding strategies on top of it to maximize yield for vault users. In Yearn’s particular case, the protocol relies on the “backscratcher” vault which vote-locks CRV into Curve and provides Yearn users Curve’s boosted CRV rewards without the need to vote-lock CRV directly into Curve. Furthermore, it is important to note that Yearn charges its users a 20% performance fee over gains and a 2% management fee over the deposited capital. These fees accrue to Yearn’s treasury and its strategists.

Alternatively, Convex Finance provides a boosting service that allows Curve liquidity providers to benefit from CRV’s boost without locking CRV. Liquidity providers can also earn trading fees, liquidity mining rewards, and CVX (Convex’s native token). Unlike Yearn, Convex distributes all CRV revenue generated by Curve’s liquidity providers to its users and it only charges a 16% performance fee. By doing so, Convex creates incentives that are better aligned with the user’s interests while simultaneously providing much lower fees when compared to Yearn (this is especially evident in pools with low APYs due to Yearn’s management fee).

The emergence of boosting services that rely on the accumulation of veCRV (vote-locked CRV) created a fierce competition that is reflected in CRV’s growing demand and decreasing supply. Ultimately, Curve and CRV holders benefit from this competition which promotes CRV’s long-term scarcity through CRV’s boost and Curve’s unique token economics. Currently, veCRV’s voting power and its respective boost factor represent the base layer that fuels most of Ethereum’s yield economy through the distribution of CRV’s inflation.

This report is focused on the analysis of Convex Finance, its stakeholders, the existing incentives to use the protocol, and a comparison of Convex and Yearn which highlights both the existing competition and complementary nature between both protocols.

Convex Finance

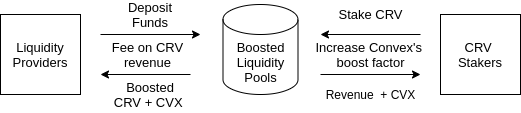

Convex Finance is a DeFi protocol that maximizes yield for Curve liquidity providers. While using Convex, Curve liquidity providers can earn boosted CRV rewards, trading fees, and liquidity mining rewards without locking any CRV into the protocol. Furthermore, Convex has 16% trading fees over CRV revenue. These fees are entirely distributed to Convex users.

The protocol has two main stakeholders, liquidity providers, and CRV stakers. In order to maintain the protocol’s capital efficiency, CRV stakers receive a share of boosted CRV rewards earned by liquidity providers. Through this mechanism, Convex creates aligned incentives that enable a TVL growth (catalyzed by liquidity providers) while simultaneously stimulating users to stake more CRV.

This incentive that is provided to CRV stakers is crucial to maintain an equilibrium between the capital that is provided by liquidity providers and the amount of CRV that is necessary to sustain Convex pools with Curve’s maximum boost (factor of 2.5x).

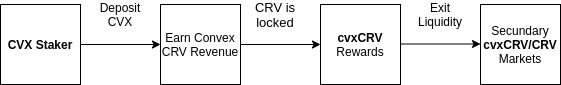

Besides the aforementioned stakeholders, it is also possible to stake Convex’s native token, CVX. Both CRV stakers and liquidity providers are entitled to CVX liquidity mining rewards. These rewards can be further compounded through a staking mechanism that is enshrined in the protocol and sustained with part of the protocol’s revenue.

Lastly, Convex has no withdrawal fees, and the only protocol revenue that is not distributed to protocol users is a minimal fee that is used to pay for gas costs that are associated with Convex’s harvests.

Liquidity Providers and CRV Stakers

As aforementioned, the two main stakeholders that exist in Convex Finance are liquidity providers and CRV stakers. These two stakeholders have a symbiotic relationship where CRV stakers rely on liquidity providers in order to generate revenue and liquidity providers rely on CRV stakers in order to maintain liquidity pools with the maximum boost factor.

Liquidity Providers

Convex liquidity providers can claim boosted CRV without being required to lock CRV into the protocol. Additionally, they can earn trading fees and receive liquidity mining rewards as they normally would if they were to provide liquidity directly to Curve.

Besides the previously mentioned earnings, Convex liquidity providers are also entitled to CVX rewards. It is worth mentioning that Convex charges no deposit nor withdrawal fees.

To provide liquidity to Convex Finance, users need to stake their Curve LP tokens into the platform. Upon staking their liquidity, users can withdraw their LP tokens at any time.

CRV Stakers

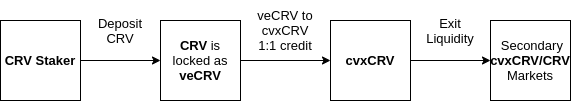

Convex CRV stakers are entitled to a share of boosted CRV revenue that is generated by liquidity providers. To stake CRV with Convex it is necessary to deposit CRV into the platform, this CRV is then locked into Curve as veCRV to increase the protocol’s boosted CRV rewards. Upon depositing CRV into Convex, stakers are credited with cvxCRV at a 1:1 ratio with veCRV. Secondary markets such as Sushiswap allow CRV stakers to remain liquid and swap cvxCRV back to CRV.

Besides the aforementioned share of boosted CRV revenue, CRV stakers are also entitled to a share of Convex’s fees, trading fees from Curve (3CRV), CVX rewards, and all airdrops provided to veCRV holders (such as EPS).

Fee Structure

Convex Finance has a 16% fee on all CRV revenue generated by Curve liquidity providers. These fees are crucial to align incentives between CRV stakers and liquidity providers. With the exception of costs associated with gas fees, this revenue is entirely distributed to the protocol’s stakeholders.

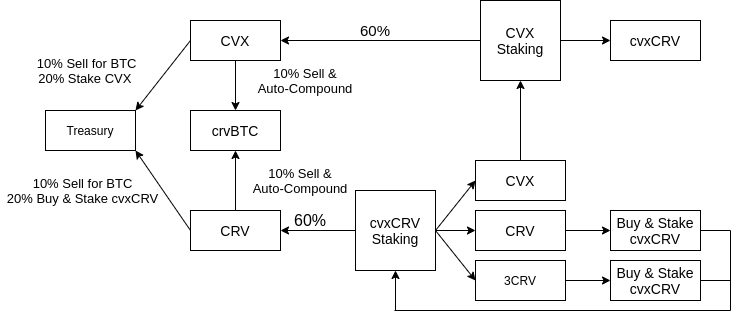

As of now, Convex’s 16% fees are distributed as follows:

- CRV Stakers – 10% are distributed to cvxCRV stakers (paid in CRV);

- CVX Stakers – 5% are distributed to CVX stakers (paid in cvxCRV);

- Harvest Caller – 1% is distributed to the harvest caller (paid in CRV);

It is important to emphasize that, unlike Yearn, Convex only takes fees from CRV revenue. This implies that Convex liquidity providers entirely receive all reward tokens and veCRV admin fees that they are entitled to. Furthermore, the 5% revenue that is distributed to CVX stakers (in CRV) is locked into Convex as veCRV once the staker claims his reward. At that point, cvxCRV is minted at a 1:1 ratio with veCRV thus allowing CVX stakers to use Sushiswap’s cvxCRV/CRV secondary market.

CVX Token and Staking

Convex Finance has its own native token, CVX. This is a fee-earning token that is entitled to part of Convex’s revenue from the platform’s performance fees. Furthermore, CVX is distributed to Convex CRV stakers and liquidity providers.

While providing liquidity to Convex, the user will receive CVX rewards pro-rata to the amount of CRV that is generated. This implies that liquidity providers that choose pools with high CRV rewards are entitled to more CVX. Additionally, this mechanism incentivizes a concentration of liquidity in pools that generate more CRV revenue for Convex.

Besides Convex users, CVX is also distributed to liquidity providers that contribute to incentivized Sushiswap liquidity pools such as cvxCRV/CRV and CVX/ETH. These incentives are crucial to guarantee the exit liquidity that is required for Convex’s CRV stakers.

CVX holders can stake their tokens on Convex in order to earn a share of the platform’s performance fees. While doing so, CVX stakers will receive part of Convex’s CRV revenue as cvxCRV (this is intended to maintain CRV in the platform to increase the system’s boost). Whenever CVX stakers want to realize their earnings they can do so through Sushiswap’s cvxCRV/CRV liquidity pool.

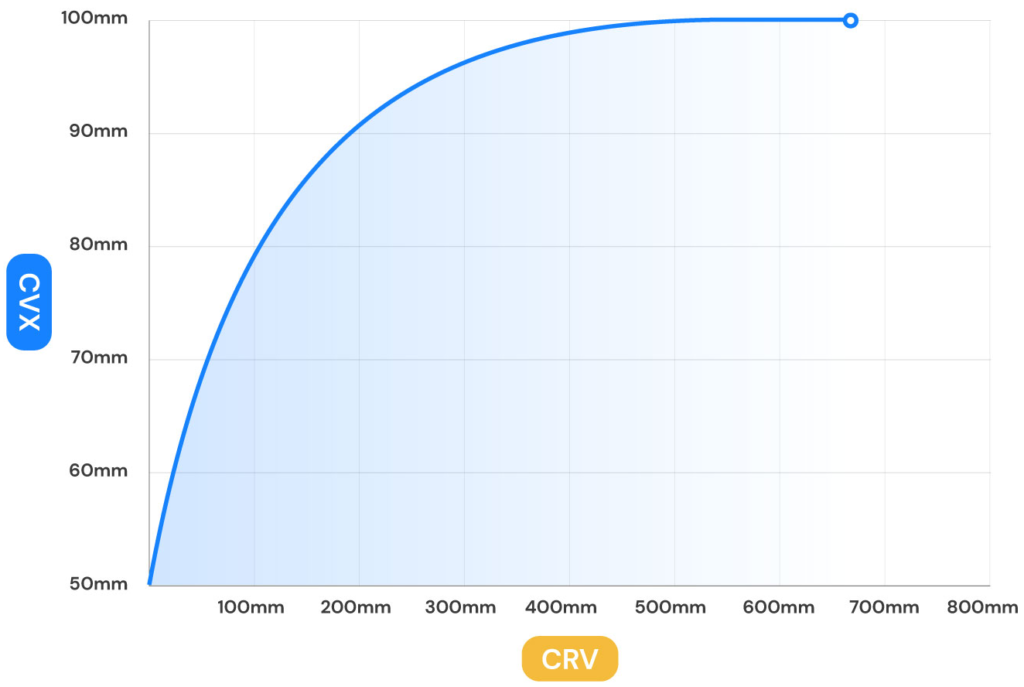

CVX’s minting process is a pro-rata function of CRV tokens that are claimed by Curve LP’s on Convex. The CVX/CRV mint ratio reduces with every 100k CVX that is minted. Figure 4 shows the existing relationship between both tokens.

(source: Convex Finance)

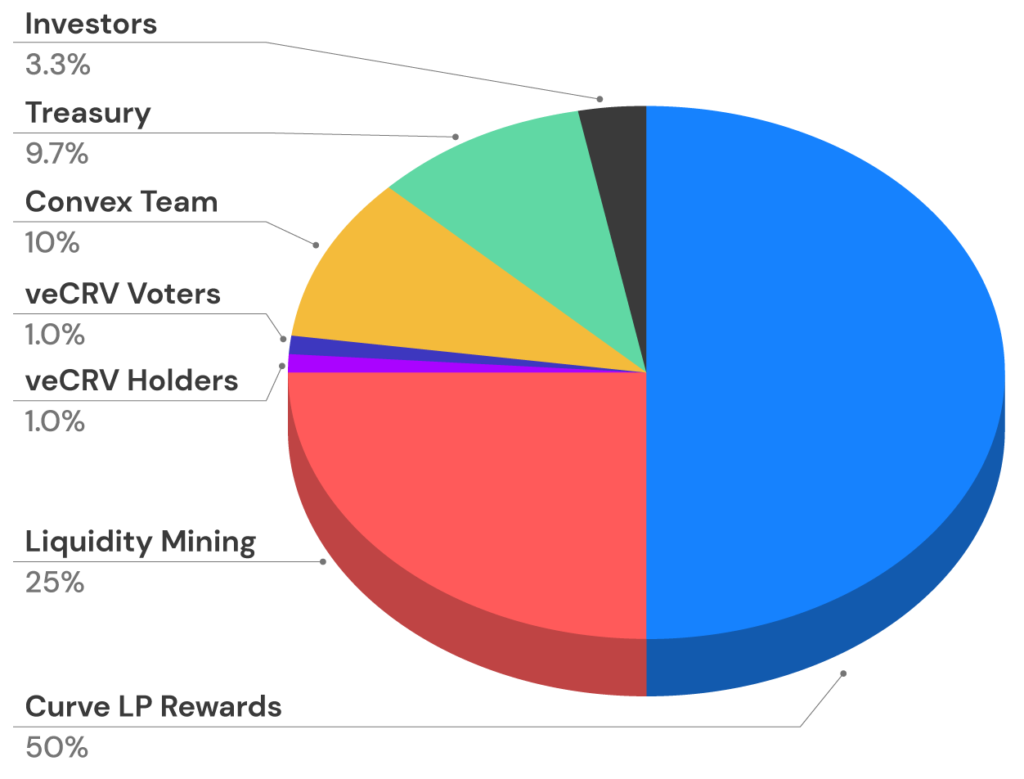

Lastly, CVX has a maximum supply of 100M tokens with the following distribution:

- Curve LP Rewards – 50% of CVX’s supply will be distributed pro-rata to the CRV revenue received on Convex;

- Liquidity Mining Rewards – 25% of CVX’s supply will be distributed to liquidity programs over 4 years;

- Treasury – 9.7% of CVX’s supply is allocated to Convex’s treasury vested over 1 year.

- veCRV Holders – 1% of CVX’s supply was distributed to veCRV holders as an instantly claimable airdrop;

- Convex Whitelist Vote – 1% of CVX’s supply was distributed to veCRV holders who voted to whitelist Convex;

- Investors – 3.3% of CVX’s supply was allocated to investors who pre-seeded Convex’s boost and locked their CRV (with no cvxCRV minted), these funds are vested over 1 year;

- Convex Team – 10% of CVX’s supply was allocated to Convex’s team, these funds are vested over 1 year;

(source: Convex Finance)

Convex APR

Convex liquidity providers are shown two different APR values while staking their liquidity on the platform. These two values correspond to the current APR and the projected APR.

Current APR

This APR is based on the current active harvests which have already been claimed. These harvests are streamed to all active participants in Convex’s pools over a 7 day period from the instant when the harvest is called. Due to this, the current APR corresponds to the immediate yield received per block while joining a Convex staking pool. It is important to note that all fees are already abstracted from this value.

Projected APR

The projected APR represents the yield that is currently being generated by the pool. This value is based on multiple parameters associated with the pool such as the current boost, the total value locked (TVL), and the USD price associated with liquidity mining rewards in incentivized pools.

Supposing that all parameters remain constant (Curve boost, TVL, CRV price, CVX price, and liquidity mining rewards), the projected APR converges to the current APR once the harvest is called. Due to DeFi’s volatility, this is an unlikely scenario and the projected APR will typically experience significant deviations when compared to its corresponding present APR in future harvests.

Voting and Gauge Weights

Currently, Convex Finance relies on an autonomous strategy that deposits veCRV into liquidity pools that maximize the protocol’s CRV revenue. To do so, Convex has a multisig address that functions as a voter delegate and assigns weights to the pools that generate the most CRV revenue.

In time to come, the protocol will allow CVX holders to vote on how Convex assigns its veCRV holdings to gauge weights. Through this process, CVX holders will be able to vote on the distribution of CRV inflation by assigning gauge weights to Curve pools.

Once CVX voting rights are implemented, the protocol will be able to provide liquid governance power through CVX. Due to this, users and protocols will be able to lend and borrow CVX to leverage its governance power without losing liquidity. This feature will create a novel mechanism where it is possible to vote on the distribution of CRV’s inflationary rewards through CVX. Given that liquidity has an inherent premium, CVX holders are expected to benefit from this implementation with a novel form of utility.

Tokenomics

Convex Finance has a value proposition that lies in the maximization of yield through boosted CRV rewards for Curve liquidity providers. In order to fulfill this purpose, the protocol relies on an economic model that creates aligned incentives between liquidity providers and CRV stakers. These incentives are enabled through the system’s performance fees which are entirely distributed to Convex users (10% for CRV stakers, 5% for CVX stakers, and 1% for the harvest caller).

As Convex accrues liquidity to its pools and grows its TVL, it requires more CRV (that is vote-locked as veCRV), to maintain the system’s boost. Taking into account that Convex’s performance fees go to CRV and CVX stakers, it is possible to conclude that a liquidity increase in Convex pools will also increase the revenue for stakers. As a result, this revenue generates a higher yield for CRV and CVX stakers which incentivizes users to lock more CRV into Convex and increase the system’s boost.

The protocol has its own native token, CVX. This is a fee-earning token that collects protocol revenue which is subsequently distributed to CVX stakers as cvxCRV. Considering that Convex rewards CVX stakers in cvxCRV, it is possible to infer that stakers maintain a positive pressure on cvxCRV’s peg. This design choice incentivizes stakers to increase the amount of CRV that is locked in Convex Finance. Currently, CVX is distributed to the protocol’s liquidity providers and CRV stakers. Furthermore, CVX is also used to incentivize liquidity providers on Sushiswap as a reward token. These incentives are crucial to ensure that CRV stakers remain liquid through Sushiswap’s cvxCRV/CRV pool.

Lastly, Convex Finance has an economic model that creates a symbiotic relationship between liquidity providers and CRV stakers. This mechanism ultimately benefits CRV by increasing the amount of vote-locked CRV (thus decreasing its circulating supply), and by providing its holders the option to earn high yields as CRV stakers whilst remaining liquid through secondary markets.

Convex Finance Analysis

TVL, Revenue and veCRV

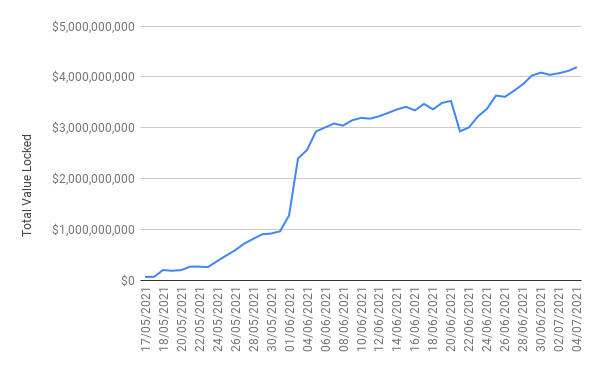

After launching on the 17th of May, Convex Finance experienced a rapid increase in its TVL which now stands at $4.19 billion. This impressive growth can be attributed to the fact that Convex provides higher yields when compared to Curve and better incentives and lower fees when compared to yield aggregators such as Yearn.

(source: DeFiLlama)

Additionally, Convex is the most profitable protocol on Ethereum relative to its native token’s market capitalization. Table 1 shows Convex’s revenue and veCRV metrics.

| Revenue | veCRV Holdings |

| $26.8M | 56M ($105.2M) |

(source: Convex Finance)

CRV Stakers

Convex has accrued impressive earnings in CRV revenue since its launch. These earnings have allowed the protocol to incentivize stakers to lock more CRV into the system thus increasing the platform’s boost factor. As a result, Convex was able to add utility to CRV token holders that can now earn a high yield over CRV while simultaneously remaining liquid through Sushiswap’s cvxCRV/CRV secondary market.

| Token | APR | TVL |

| CRV | 71.79% | $90.8M |

(source: Convex Finance)

When a user deposits CRV into Convex, the protocol converts those holdings to veCRV and credits cvxCRV to the depositor at a 1:1 ratio with veCRV. By staking cvxCRV, the staker will earn Curve’s fee distribution in 3CRV plus all airdrops that veCRV token holders are entitled to. Furthermore, cvxCRV stakers will also earn a 10% share of Convex boosted CRV revenue and CVX reward tokens.

CVX Stakers and Token Metrics

Convex Finance rewards users with its native token, CVX. This token has a value accrual model that relies on a fee-earning mechanism. In the future, CVX holders will be able to vote on important parameters such as gauge weights.

| Token | Market Price | Circulating Supply | Market Cap. | Nº of Holders |

| CVX | $3.70 | 9.08M | $33.6M | 2502 |

(source: Coingecko and Bloxy)

Users can further compound CVX rewards by staking it. While doing so, stakers are entitled to a 5% share of the protocol’s CRV revenue in cvxCRV.

| Token | APR | TVL |

| CVX | 61.81% | $23.5M |

(source: Convex Finance)

Comparing CVX’s market capitalization with its total value locked in staking, it is possible to observe that 70% of its circulating supply is staked in Convex. This high staking percentage is a positive indicator for the existing incentives that Convex has in place for CVX stakers.

Liquidity Programs

Convex Finance has an active distribution of CVX tokens to incentivize Sushiswap’s cvxCRV/CRV and CVX/ETH pools. The cvxCRV/CRV pool guarantees that stakers can exit Convex through secondary markets and the CVX/ETH pool ensures that Convex’s native token remains liquid.

| Pool | APR | TVL |

| cvxCRV/CRV | 66.67% | $25.4M |

| CVX/ETH | 99.21% | $14.2M |

(source: Convex Finance)

CVX and Liquid Governance

Once CVX voting rights are implemented, CVX holders will be able to leverage Convex’s governance power and vote using the protocol’s veCRV holdings. Through this mechanism, Convex will create a new primitive within DeFi that will allow CVX holders to lend governance power. This new functionality will be particularly appealing for protocols and users that want to vote on gauge weights to distribute CRV’s inflation.

| CVX Market Cap. | veCRV Market Cap. | Ratio (CVX/veCRV) |

| $33.6M | $105.2M | 32% |

(source: Convex Finance and Coingecko)

Considering that CVX will control veCRV’s governance power, it is possible to conclude that there is an asymmetric opportunity within this 32% ratio. Furthermore, the novel form of liquid governance power provided by CVX will likely have a liquidity premium associated with it.

Convex versus Yearn

Yearn Finance is the largest yield generating protocol in DeFi with $4.19B in TVL. The protocol has a vault structure that allows users to deposit funds and earn yield through Yearn’s vault strategies.

Additionally, these vaults auto-compound the existing returns, thus increasing the quantity of the vault’s underlying assets. This process is extremely gas efficient and convenient for users that aim to reduce the gas costs associated with the auto-compounding process.

Most of Yearn’s vaults rely on strategies based on Curve Finance. To maximize yield for Curve-based vault strategies, Yearn locks CRV into Curve as veCRV. By doing so, the protocol can earn boosted CRV rewards.

To increase the system’s CRV boost, Yearn relies on the “backscratcher” vault. This vault allows users to deposit CRV into the protocol while remaining liquid through yveCRV (credited at a 1:1 ratio with veCRV). Similar to cvxCRV, yveCRV holders remain liquid through secondary markets (yveCRV/CRV).

Furthermore, the protocol auto-compounds returns into the “backscratcher” vault. This compounding mechanism allows Yearn to increase the CRV boost associated with all vaults that rely on strategies based on Curve.

Given that the majority of Yearn’s strategies revolve around Curve, the protocol needs to progressively accrue more CRV (to be vote-locked as veCRV), in order to maintain or increase the system’s boosts and attain the highest possible yield for its Curve dependent vaults.

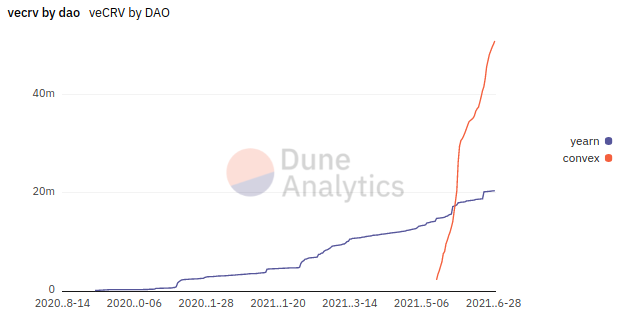

The emergence of Convex Finance represents the end of Yearn’s monopoly when it comes to the accumulation of CRV. Due to its better incentives, Convex is the leading DAO in veCRV holdings by a large margin, this implies that the platform has a higher boosting and governance power than Yearn.

Fee Structure

Despite its recent emergence, Convex is the leading protocol in veCRV holdings. This is particularly impressive taking into account that it took merely two weeks for Convex to surpass Yearn in terms of veCRV holdings.

The underlying reason for Convex’s success is directly attributable to its fee structure. Considering that Convex entirely distributes its performance fees to the protocol stakeholders, one may infer that the protocol has robust incentives in place to attract users.

Contrastingly, Yearn Finance has a fee structure that only benefits the protocol’s treasury and its strategists. Both fee structures are addressed in the table below.

| Metric | Convex Finance | Yearn Finance |

| Management Fee | – | 2% |

| Performance Fee | 16% | 20% |

(source: Convex Finance and Yearn Finance)

The management fee is deducted from the depositor’s total balance while the performance fee is deducted exclusively from the depositors income. Given that the management fee is applied over the depositor’s total balance, one may conclude that if yields are compressed, Yearn’s fees become progressively larger.

For example, considering a hypothetical $1000 deposit into a Yearn vault with a 4% APY, the 2% management fee over the depositor’s total capital would be sufficient to offset 50% of the depositor’s yield without even considering Yearn’s 20% fee over performance.

In comparison to Yearn, Convex charges merely 16% performance fees that entirely accrue to the protocol’s stakeholders (10% to CRV stakers, 5% to CVX stakers and 1% to the harvest caller). Due to this, a Convex user can further compound its CVX and CRV rewards to earn part of Convex’s 16% performance fees. In Yearn’s case, these fees belong to the protocol and its strategists.

Vote-locked CRV and TVL

Upon analyzing the fee structure associated with both platforms, it is possible to infer that Convex has better incentives for strategies based on Curve Finance. This is particularly evident in a negative momentum scenario where yields are compressed. Such compression is able to further magnify the impact associated with Yearn’s management fees.

Due to this, Convex is able to distribute the protocol’s revenue to CRV stakers that are incentivized to stake CRV into Convex thus increasing the protocol’s outstanding veCRV holdings.

| Metric | Convex Finance | Yearn Finance |

| TVL | $4.19B | $4.06B |

| veCRV | 56M | 20.6M |

(source: DefiLlama and Dune Analytics)

Despite Convex’s recent launch (on the 17th of May), the protocol has already surpassed Yearn’s TVL. Considering that Yearn represents DeFi’s largest yield aggregator, Convex’s feat is extremely impressive and it proves that improved incentives for protocol stakeholders can quickly disrupt well established protocols within DeFi.

As of now, Convex has 2.7 times more veCRV holdings than Yearn; present data confirms that this trend will continue for the foreseeable future if both protocols maintain the current fee structures and incentives. This competitive advantage in terms of vote-locked CRV grants Convex a higher overall boost factor when compared to Yearn. Additionally, it is also important to note that Convex is the protocol with the largest influence in terms of governance power over Curve Finance. This is particularly useful to vote and determine gauge weights associated with Curve’s pool. As a result, Convex is able to influence the distribution of CRV inflation according to its best interests.

Moreover, Convex was able to surpass Yearn’s veCRV holdings merely two weeks after its launch. Figure 8 shows this rapid accumulation of veCRV which can be attributed to Convex’s existing incentives that simultaneously benefit liquidity providers and CRV stakers.

(source: Dune Analytics)

Yield Comparison

Upon being surpassed by Convex in terms of veCRV holdings, Yearn began to utilize Convex for its Curve-based strategies. Consequently, all Yearn vaults now have a portion of their deposits in Convex Finance.

As of now, Yearn splits its vaults into two different parts. The first part uses the protocol’s veCRV holdings to yield farm a portion of the vault’s funds at a 2.5x boost factor. The second part deposits the remaining funds into Convex to maximize the yield associated with the remaining deposits.

In order to assess the most efficient protocol for a given pool, it is necessary to evaluate its boost factor, the total value locked in it, and the price of CVX. Disregarding any fees associated with both protocols, it is possible for Yearn to achieve a higher efficiency when compared to Convex in certain pools. To do so, the protocol requires a dynamic rebalancing of its vaults where the remaining liquidity that is not covered by the 2.5x boost is funneled to Convex.

Regardless, Yearn’s fees typically erase any competitive advantage when compared to Convex. In fact, if one disregards the gas costs associated with the compounding process, a solo liquidity provider can beat the yield offered by Yearn due to the protocol’s 2% management fee. This generally happens in pools that have a low gauge weight and therefore benefit less from the CRV boost (i.e. Yearn’s APY for stETH is lower than Curve’s APY).

As yields become further compressed, the impact of Yearn’s 2% management fee plus the 20% fee over performance is drastically amplified. For that reason, Convex generally offers the highest yield for most of Curve’s pools.

Stablecoin Pools

In order to establish a proper comparison ground between both protocols it is necessary to convert Convex’s APR into an APY to account for compounding effects. Given that Yearn’s vaults have different compounding frequencies (ranging from hours up to a week), the least efficient frequency (pessimistic scenario for Convex) will be the one that is considered to assess Convex’s APY on a weekly basis. Furthermore, the selected stablecoins were picked based on Curve’s volume and TVL metrics.

| Metric | 3pool | sUSD | lusd | usdp | eurs |

| TVL | $107.5M | $41.7M | $224.6M | $223.5M | $154.4M |

| Boost Factor | 2.50x | 2.50x | 1.46x | 1.50x | 1.60x |

| APR | 9.73% | 15.30% | 16.42% | 12.07% | 25.10% |

| APY | 10.20% | 16.50% | 17.81% | 12.81% | 28.45% |

(source: Convex Finance)

| Metric | 3pool | sUSD | lusd | usdp | eurs |

| TVL | $4.84M | $12.03M | $65.90M | $29.58M | $53.91M |

| Boost Factor | 2.50x | 2.50x | 2.50x | 2.41x | 1.80x |

| APY | 5.64% | 10.25% | 10.29% | 6.35% | 11.60% |

(source: Yearn Finance)

Despite the fact that Yearn has a higher boost factor in certain stablecoin pools, Convex is still the protocol that provides the highest yield for all pools that were analyzed. As previously mentioned, this is due to Yearn’s management fee which is applied to the depositor’s total capital plus the performance fee over revenue.

At the time of writing, Convex Finance provides the highest APY for all stablecoin pools listed in both protocols. Regardless, due to the fact that Yearn currently uses Convex for all Curve-based vaults, it is possible that in certain cases Yearn provides the highest APY due to a more efficient veCRV distribution among its pools.

Tokenized Ethereum and Bitcoin Pools

The comparison of tokenized Ethereum and Bitcoin pools follows the aforementioned selection criteria (based on TVL and volume), and it assumes a weekly compounding frequency for Convex’s APY estimation.

| Metric | stETH | sETH | BBTC | HBTC |

| TVL | $410.6M | $270M | $186.9M | $194.8M |

| Boost Factor | 2.50x | 1.77x | 1.56x | 1.89x |

| APR | 8.18% | 5.88% | 14.20% | 5.97% |

| APY | 8.52% | 6.05% | 15.24% | 6.15% |

(source: Convex Finance)

| Metric | stETH | sETH | BBTC | HBTC |

| TVL | $180.82M | $58.82M | $87.51M | $39.14M |

| Boost Factor | 2.50x | 2.50x | 2.50x | 2.50x |

| APY | 4.70% | 3.24% | 11.49% | 2.40% |

(source: Yearn Finance)

As previously observed, Yearn has an overall boost factor that is higher than Convex. This is possible due to Yearn’s capital distribution which uses Convex Finance for its own vaults. Regardless, Yearn’s APYs for tokenized Ethereum and Bitcoin pools are lower than Convex due to Yearn’s fee structure. At the time of writing, Convex Finance provides the highest APY for all tokenized Ethereum and Bitcoin pools listed in both protocols.

In vaults with a high Convex dependency, depositors are mostly paying for Yearn to re-stake funds. In this scenario, Yearn is only the most capital efficient protocol if the depositor has a low amount of capital invested that doesn’t justify a self-compounding strategy due to gas costs.

An example of this is Yearn’s crvBBTC vault. For this strategy, Yearn deposits all funds into Convex, consequently, depositors pay a management and performance fee just for Yearn to sell the reward tokens (CRV and CVX), rebuy BBTC and re-stake those funds. On top of this, the depositor is also paying Convex’s performance fee due to the fact that Yearn uses Convex for its vault deposits.

Vote-locked CRV and Circulating Supply

Despite the existing competition for the accumulation of veCRV between Yearn and Convex, both protocols have developed a complementary relationship that is mutually beneficial. Yearn is able to offer its vault depositors higher APYs by using Convex for its Curve-based strategies and Convex benefits from the TVL that is funneled into the protocol through Yearn (which implies more CRV revenue).

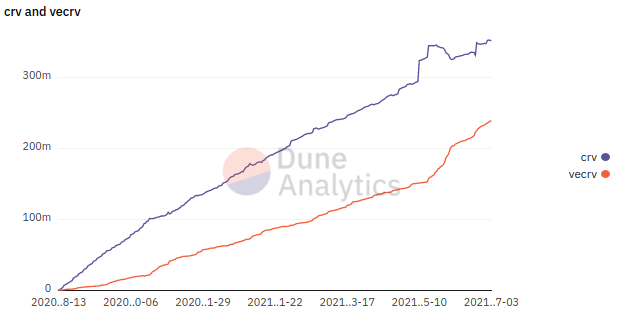

The competition for veCRV creates a sustained source of demand for CRV which is ultimately beneficial for Curve Finance and CRV holders. This demand is reflected in the growing percentage of vote-locked CRV as a function of its circulating supply. Figure 9 shows the relation between CRV and veCRV as a function of time.

(source: Dune Analytics)

| CRV | veCRV | Locked CRV % |

| 351.70M | 238.66M | 67.86% |

(source: Dune Analytics)

This simultaneous increase in demand and decrease in supply is further amplified by the decrease of CRV emissions enacted according to Curve’s inflation schedule (CRV’s inflation rate will drop in August 2021). Ultimately, this trend can lead to a CRV liquidity crisis due to Curve’s token economics which promote CRV’s scarcity. As shown in table 13, 67.86% of all CRV is currently locked as veCRV.

BadgerDAO – Partner First Approach

Upon creating a proposal for the attribution of a gauge weight to an alETH pool, Alchemix saw its request denied by Curve’s community due to the inherent recursive inflation that would be associated with that pool. This recursive inflation argument was raised due to the fact that Alchemix’s self-repaying loans rely on Yearn’s farm and sell auto-compounding strategy.

After this event a new trend emerged in DeFi politics where protocols started to adopt a partner first approach instead of relying exclusively on auto-compounding farm and sell strategies. An example of this is BadgerDAO which recognized the long-term value that lies in the collaboration with both Curve and Convex due to their leading role in Ethereum’s yield economy.

In order to express this commitment, Badger altered its original BTC Badger Setts strategies (which relied on a CRV farm and sell auto-compounding mechanism), and it introduced a new strategy that only sells 20% of earned CVX and CRV rewards for BTC while the remaining 80% rewards are re-staked and locked into Convex in the form of cvxCRV.

By re-staking CVX and CRV rewards into Convex, Badger is able to simultaneously optimize its yield and support Convex. Due to Badger’s new approach and vault design, Convex has already expressed its support by voting in Badger’s pools to increase their gauge weight. Furthermore, Badger will also be able to leverage CVX’s voting power to boost its own pools once CVX’s voting rights over Convex’s veCRV holding are implemented.

Community Metrics

Convex’s community and its team are both extremely active on Discord and all answers regarding the protocol were promptly answered (unlike Yearn’s Discord). This approach facilitates the onboarding of new users to Convex and it improves the protocol’s user experience due to the quick resolution of any possible issues. Furthermore, despite the anonymous nature of Convex’s 4 core contributors, it is known that one of its members also belongs to Curve’s team. Given that Convex has an ethos that is closely aligned with Cuve, there is a significant overlap between both communities.

| Social Network | Number of Users |

| Discord | 3619 |

| 9648 | |

| Telegram | 2230 |

(source: Discord, Twitter and Telegram)

Limitations and Risks

Convex Finance is a boosting service built on top of Curve that maximizes yield for liquidity providers. Considering that this is a recent protocol, there are inherent security risks associated with its smart contracts that must be considered while interacting with the platform.

In order to minimize these risks, Convex pursued an external security audit carried out by MixBytes that helped identify potential vulnerabilities within the platform. The external audit identified one critical and three major vulnerabilities which were subsequently fixed.

Given that Convex is directly integrated with Curve, users are also liable to risks and vulnerabilities associated with it. It is important to note that Yearn Finance currently uses Convex for its vault strategies, therefore, Yearn is also liable to Convex’s risk premium.

Future Implementations and Improvement Proposals

Given that Convex Finance has launched recently, there are multiple implementations and improvement proposals that can be added to the protocol. One example of this lies in the governance utility that can be unlocked from its veCRV holdings through CVX. By leveraging this novel form of liquid governance, Convex’s native token has the potential to become a crucial tool that controls the distribution of CRV inflation whilst preserving liquidity.

As of now, these are the following improvement proposals that can be added to Convex Finance:

- Liquid Governance Power – Once the protocol implements CVX’s governance mechanism (which allows holders to vote on the assignment of veCRV to gauge weights), Convex Finance will be able to implement a “borrow to vote” feature. This feature would allow CVX holders to temporarily lend CVX through money markets such as AAVE or Compound and it could be used by protocols and users that want to borrow CVX to vote on the distribution of CRV’s inflationary rewards;

- Re-Stake CVX Feature – By implementing a re-stake feature next to the “Claim All” button, Convex would be able to create a positive feedback loop where more people would likely re-stake their funds in a single transaction;

- APY Feature – In order to evaluate compounding effects for solo stakers, Convex could implement a column in its user interface where the APY associated with a daily, weekly and monthly compounding frequency would be displayed;

- Voting Power Delegation – This feature would allow CVX holders to delegate their voting power to another address, through this mechanism CVX holders would be able to support projects through governance;

Conclusion

The expansion and innovation that is intrinsic to DeFi is sustained at its core by AMM-based decentralized exchanges. These exchanges represent the baselayer of DeFi’s composability stack and provide the required liquidity to power this ecosystem. An example of this is Curve Finance, which is currently the largest decentralized exchange in terms of TVL. Characteristics such as minimized slippage, the reduced risk of impermanent loss and its unique token economics are among the reasons why Curve became a fundamental building block within DeFi and its yield economy.

Curve’s economic model allows its users to lock CRV into the protocol as veCRV and therefore promote its token’s scarcity. Through this process, the protocol grants governance rights, trading fees and a boost factor over CRV rewards to veCRV holders. This model creates incentives for yield aggregators, such as Yearn Finance, to build strategies that vote-lock CRV into Curve and thereby increase the yield associated with CRV’s inflationary rewards.

With the emergence of Convex Finance, Yearn’s veCRV monopoly was disrupted and the competition associated with the accumulation of veCRV began. The fundamental difference between both protocols lies in the existing approach towards compounding and fee structures. Yearn relies on an auto-compounding mechanism that sells farmed rewards to increase the underlying asset associated with each vault. While doing so, the protocol charges its users a 2% management fee plus a 20% performance fee. Both fees accrue to Yearn’s treasury and its strategists. On the other hand, Convex provides a boosting service that is exclusive to Curve Finance and it charges merely a 16% performance fee which is distributed to the protocol’s stakeholders (CRV and CVX stakers).

The bullish thesis for Convex Finance lies in its adoption as the leading boosting service for Curve pools. The catalyst for such adoption can be attributed to its fee structure which efficiently aligns interests among its stakeholders (this is reflected in the protocol’s rapid TVL growth). As liquidity providers increase the system’s TVL, the protocol increases its CRV revenue thus improving incentives for both CRV and CVX stakers. The key for this mechanism lies in the protocol’s performance fees which allow Convex to create a symbiosis that coordinates liquidity providers and stakers.

Upon being surpassed in terms of veCRV holdings, Yearn began to use Convex for its Curve-based vaults. By doing so, Yearn improved its value proposition (through higher APYs) while simultaneously increasing Convex’s TVL (which increased its CRV revenue). This approach creates a dynamic relation between both protocols that is simultaneously complementary and competitive.

Furthermore, Convex provides novel utility to CRV holders that can benefit from high yields over CRV whilst remaining liquid. As a result, the protocol is able to increase its veCRV holdings which will eventually be controlled by CVX holders. Once that happens, the CVX token will represent a new strategic mechanism within DeFi which will likely be loaned and borrowed to leverage the governance power that is inherent to veCRV. This new functionality will allow protocols and users to vote and control CRV’s inflationary rewards without locking capital directly into Curve. In a “borrow to vote” process, CVX will represent a liquid solution that controls the distribution of CRV’s inflationary rewards. Given that liquidity has a premium associated with it, CVX’s value proposition will be improved.

Considering that Convex is merely another layer that is built on top of Curve, the existing bearish scenarios for the protocol are tied to the inherent smart contract security risks (Yearn is also liable to this risk due to its Convex dependency). Taking into account how recent Convex is, there is a non-negligible risk premium associated with potential vulnerabilities that have yet to be found.

In summary, Convex is poised to grow as a boosting service that maximizes yield with low fees. These fees are essential to sustain the protocol’s incentives for CRV and CVX stakers which in return maximize yields for liquidity providers. Besides its core value proposition, Convex will also be able to lend and leverage the governance power associated with its veCRV holdings through the CVX token. This mechanism introduces a new liquid governance primitive to DeFi that will ultimately be used to vote on the distribution of CRV’s inflation and fuel Ethereum’s yield economy.

References

1. Convex Finance. (n.d.). Reflexer Documentation. Retrieved June 22, 2021, from https://docs.convexfinance.com/convexfinance/

2. Medium. (2021, April). Convex Finance: Pre-Launch Announcement. Retrieved June 24, 2021, from

https://convexfinance.medium.com/convex-finance-pre-launch-announcement-3630b2a428d0

3. Medium. (2021, May). Sushi Rewards. Retrieved June 26, 2021, from

https://convexfinance.medium.com/sushi-rewards-whats-new-bb491126f187

4. Medium. (2021, June). BadgerDAO Launching Curve Optimizer Vaults in Collaboration with Convex Finance. Retrieved June 28, 2021, from