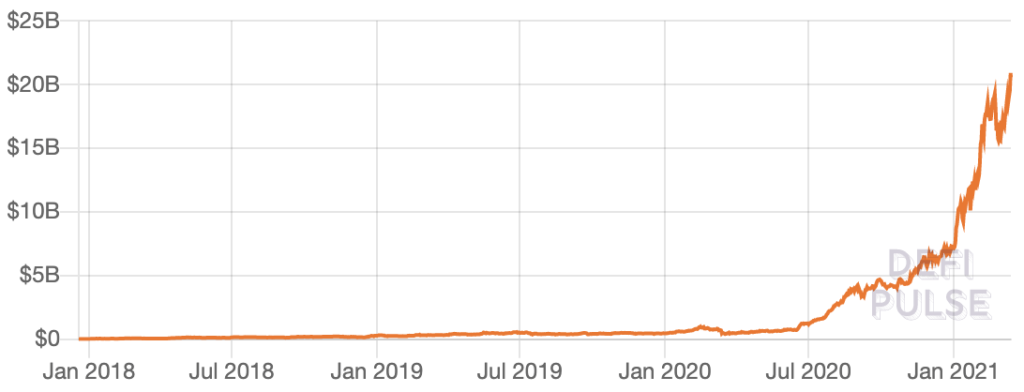

Lending/borrowing emerged as a top DeFi use case with the introduction of MKR / DAI in 2018. The DeFi lending pace has grown exponentially since with Maker, Compound, and AAVE (formerly ETH Lend) leading the pack.

At the moment, there is over $21 billion worth of assets locked in the lending space (DeFi Pulse) with $19 billion of those coming from the top 3 protocols: Maker, Compound and AAVE.

While DeFi lending has seen exponential growth, $19 billion is still a fraction of the $128 trillion global bond market size. This shows that there’s still a lot of room for growth in DeFi compared to traditional financial markets.

Use cases of lending in DeFi

- Long-term borrowing: Users can borrow funds to leverage a long position. For example, a user can deposit ETH to borrow DAI and use the DAI to buy more ETH. Additionally, with the increasing prevalence of crypto-fiat onramps/offramps, this has made it possible for borrowers to use the borrowed fiat to purchase non-crypto assets, such as real estate, cars, or paying out loans in traditional finance.

- Short-term trading & arbitrage: Users can use short-term borrowing to exploit different arbitrage opportunities on-chain or on centralized exchanges.

- Flash loans: Uncollateralized loans that are opened and repaid in the same Ethereum block. Aave was the protocol that pioneered this use case.

- Lending interest: Users can also lend assets (stablecoins or other tokens) to earn interest. DeFi platforms offer much larger APY on USDC or DAI compared to what banks would offer for USD deposits. The gap has increased significantly in 2021 given the global trend of lower interest rates.

Maker

Maker / DAI is a dual-token DeFi protocol and the first lending protocol on Ethereum. The DAI stablecoin, minted through taking loans with crypto collateral powered much of the initial DeFi space. Currently, Maker is the project with highest TVL (total value locked) with $7.3B in assets locked and over $2.7B in outstanding loans. The MKR token is used for governance of the Maker / DAI ecosystem. In addition to their lending ecosystem, Maker has a DEX called Oasis Trade.

Compound

Compound is the leader in the money-market DeFi space with outstanding loans of over $5B and sits at third place in TVL with $6.87B. The introduction of Compound’s governance token – COMP and the liquidity mining incentives ignited the “DeFi summer” of 2020. Compound is also working on their own blockchain – Compound Chain, with a recently launched testnet. It will support assets from different blockchains and will be governed by the Ethereum-based COMP token.

Aave

Aave (formerly ETHLend) is the lending protocol with the largest asset diversity while also having 2x lower collateral requirements when compared to Maker/DAI. Aave is also perceived to be the most innovative and fast-moving of the “DeFi blue chips” with $5.2B+ TVL and just under $500M in outstanding loans. An important use case created by Aave is “flash loans” – trustless, uncollateralized loans where borrowing and repayment happen in the same Ethereum block. While Aave focuses on variable rate loans, it also has a fixed-rate borrowing offering, where users commit to a higher interest rate, in exchange for a predictable rate.

| Circulating Market Cap (billions, USD) | Total Value Locked (billions, USD) | Outstanding Loans (billions, USD) | Interest Per Year (millions, USD) | Circulating Market Cap / TVL | |

|---|---|---|---|---|---|

| Maker | 1.87 | 6.98 | 2.92 | 103.66 | 0.26 |

| Compound | 1.81 | 6.25 | 5.21 | 433.03 | 0.28 |

| Aave | 4.54 | 5.15 | 0.20 | 229.45 | 0.88 |

Aave currently has the highest valuation across all lending protocols with its Circulating Market Cap / TVL much higher than Maker and Compound. Aave is perceived as the most innovative and fastest moving DeFi lending protocol, which could potentially be explained due to a wider range of products such as fixed-rated borrowing, flash loans and higher number of assets used as collateral.

| Loan to Value Ratio | Borrowing Fees | Borrow APY | ||||||

| Collateral | ETH | WBTC | BAT | ETH | WBTC | BAT | USDC | DAI |

| Maker | 66%-75%* | 66% | 66% | 5.5% – 9% | 4.50% | 6% | -* | -* |

| Compound | 75% | 65% | 65% | – | – | – | 7.78%*** | 10.34% |

| Aave | 80% | 70% | 70% | 0.00001% – 0.09%** | 0.00001% – 0.09% | 0.00001% – 0.09% | 3.91% | 6.73% |

* When it comes to ETH-backed loans, Maker has a higher stability fee (9%) for the higher LTV Ratio product and a lower stability fee (5.5%) for the lower LTV Ratio product. Maker stability fees are essentially the borrowing interest rate and continuously accrue on the debt over time.** AAVE charges borrowers 0.00001% on regular loans and 0.09% on flash loans

*** Compound rewards both lenders and borrowers with COMP tokens as an incentive for using the protocol. The APY rates are not COMP-adjusted. Users get 2-3% in COMP tokens.

| Lending APY | |||

| Asset | ETH | USDC | DAI |

| Maker | – | – | 0.01% |

| Compound | 0.17% | 5.94%* | 7.4%* |

| Aave | 0.18% | 5.99% | 6.77% |

* Compound rewards lenders with COMP tokens as an incentive for using the protocol. The APY rates are not COMP-adjusted. Lenders get an additional 2-3% in COMP tokens.

| Number of assets used as collateral | |

|---|---|

| Maker | 18 |

| Compound | 9 |

| Aave | 24 |

* Aave now also offers additional 16 liquidity pool tokens as collateral in their AMM market

- Across the three platforms, Aave has the highest loan to value ratio.

- Aave also offers flash loans and fixed-rate borrowing at a premium

- Aave also has the largest number of asset that can be used as collateral

| AAVE | Borrow APY | Fixed Borrow APY | ||

| USDC | DAI | USDC | DAI | |

| 3.91% | 6.73% | 10.96% | 14.71% | |

Analytics

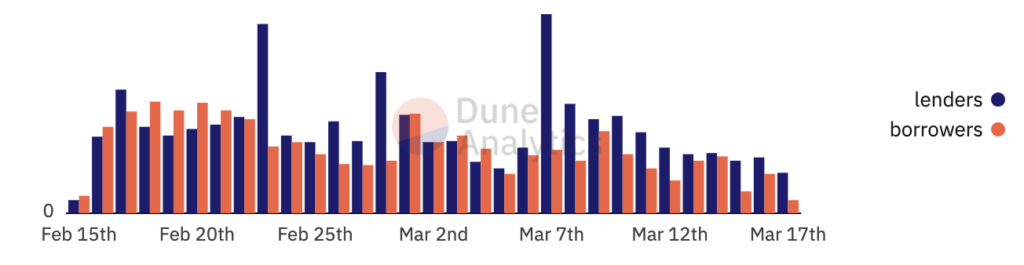

Aave: lenders vs borrowers 30 days

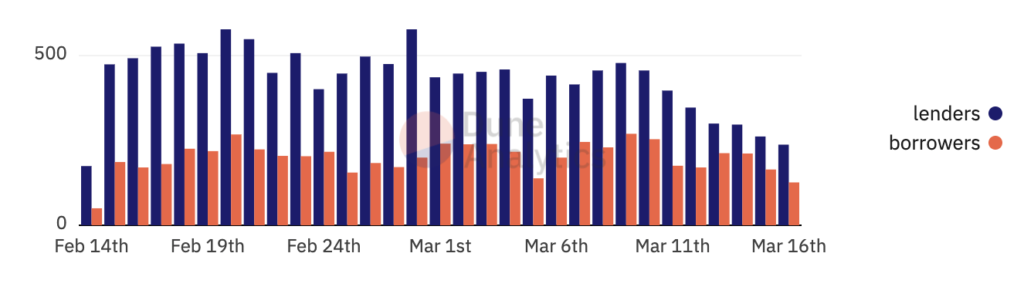

Compound: lenders vs borrowers 30 days

- Compound has more lenders than borrowers, while Aave shows a better balance

- Compound has an average of ~500 unique daily users (lenders+borrowers), while Aave has ~ 100-150.

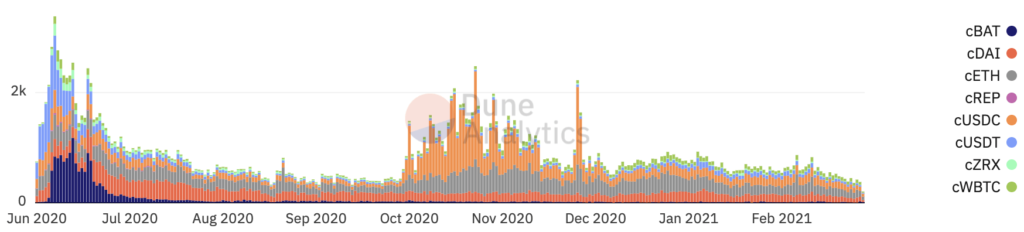

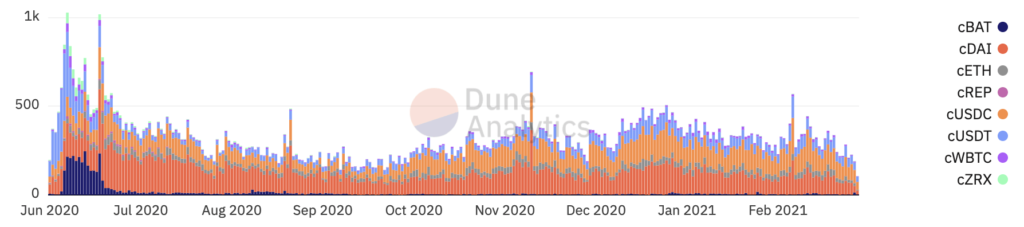

Compound Unique Lenders by Asset (daily)

Compound Unique Borrowers by Asset (daily)

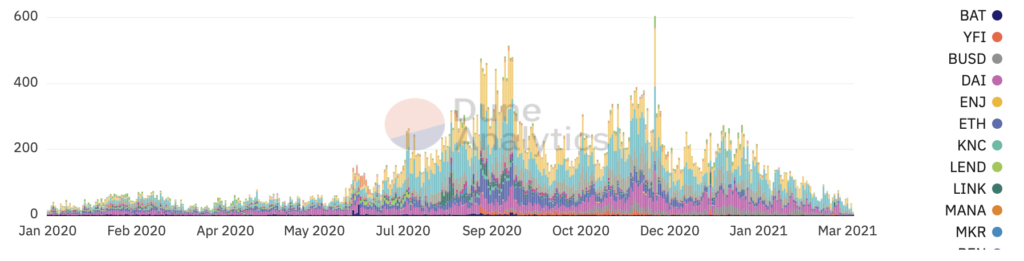

Aave Unique Borrowers by Asset (daily)

- Compound’s peak in users was in June 2020 when they launched their COMP token and liquidity mining incentives. Aave had large spikes in September 2020 and December 2020, when Aave V2 was launched.

- Most of the liquidity on Compound has been in DAI, ETH, and USDC. The same applies for Aave with the addition of USDT as a notable asset in terms of volume.

- While Compound’s usage has been relatively stable in Q1 of 2021, Aave is seeing a slight decline in terms of borrowing.

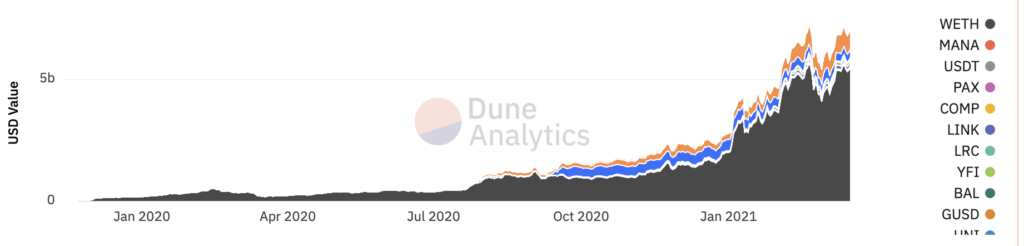

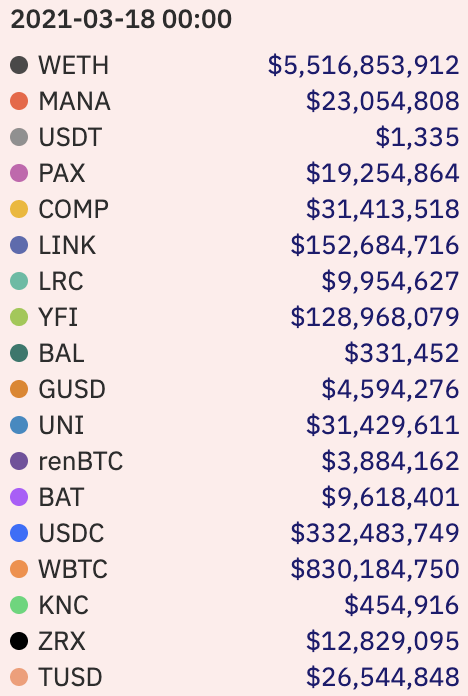

Collateral USD Value – Maker (daily)

- Since a large portion of the collateral is in crypto assets (mainly ETH), the USD value of the collateral has also grown due to the increasing price of ETH and other tokens.

- The most used asset for collateral on Maker is by far Ethereum with $5.5B, accounting for nearly 80%. Bitcoin is second with $830M , followed by USDC with $332M. LINK (Chainlink) with $152M and YFI (Yearn) with $128M are also popular collateral assets.

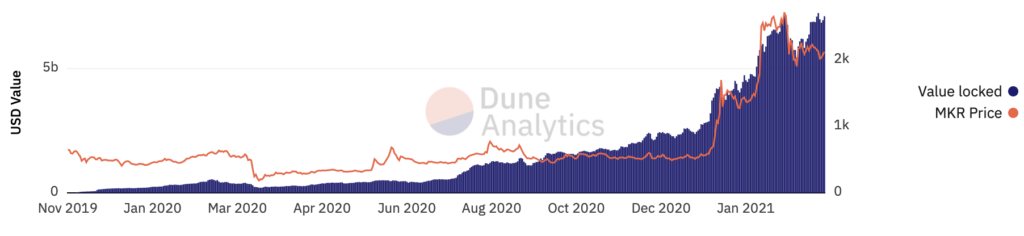

TVL vs MKR Price

- Since August 2020, MKR’s price has been correlated with the TVL on the platform.

- Discrepancies in November-December 2020 and January 2021 have been followed by a serious leg up in the MKR price. A similar discrepancy has been formed in March 2021.

Token Utility

AAVE – the AAVE token is used for governance of the Aave platform, as well as for their Safety Module – a staking mechanism for AAVE tokens to act as insurance against Shortfall Events. Stakers earn AAVE as Safety Incentives (SI) along with a percentage of protocol fees. Protocol fees are collected from borrowers and are allocated to AAVE stakers and the Ecosystem Reserve Fund, which is used to finance future developments of the ecosystem. The reserve is governed by the community through the AAVE token.

MKR (Maker) – MKR is Maker’s governance token. The MKR token also acts as a final backstop of the loans in the case of under-the-water loans. For example, in the market crash of March 2020, ETH dropped 50% resulting in the liquidation of Maker vaults which led to a $5.4M DAI shortage. In order to remain solvent, the Maker governance auctioned $5.3M worth of MKR tokens. Maker’s business model revolves around the MKR token. As Dai stability fees earned on Vaults accrue within the Maker Protocol, MKR holders can vote to sell Dai surplus for MKR. Once the auction is complete the Maker protocol burns the MKR, reducing MKR supply. The MKR token can also be used for lending and borrowing collateral on AAVE and other protocols.

COMP (Compound) – COMP is the governance token of the Compound platform. In addition to decentralized governance voting, it can be used for lending and borrowing collateral and is used as an additional incentive for lenders to provide liquidity. For example, if users lend DAI, they will receive a floating yield of 3.31% in DAI and an additional 3.31% in COMP.

Valuations and Token Supply Inflation

| Circulating Supply | Total Supply | Circulating Market Cap (CMC) | Fully Diluted Market Cap (FDV) | |

|---|---|---|---|---|

| Maker | 995,238 | 1,005,577 | $1,880,233,207 | $2,096,878,976 |

| Compound | 4,482,056 | 10,000,000 | $1,810,215,26 | $4,038,805,556 |

| Aave | 12,444,636 | 16,000,000 | $4,555,057,38 | $5,856,411,860 |

- Market cap: Aave has the largest market capitalization.

- Circulating supply: MKR has most of its token supply already in circulation, with no future incentive mechanisms in place. The Compound has scheduled most of its remaining supply to be put into circulation / distributed to users in the next 5 years. The COMP tokens are distributed as rewards for liquidity providers on the platform.

Community Comparison

| Telegram | Discord | # of users | Token Holders | ||

|---|---|---|---|---|---|

| Aave | 155,100 | 12,945 | 14,537 | 45,751 | 69,118 |

| Maker | 125,000 | 7,397 | – | 22,160 | 77,086 |

| Compound | 108,100 | – | 16,303 | 310,644 | 145,014 |

- Aave is the most popular on social media, while its community group on Discord is just behind Compound’s

- Even though Maker was the first DeFi lending platform (launched in 2018), Compound and Aave surpassed Maker’s community in 2020. Compound’s liquidity mining incentive program was a big factor, while Aave continues to push the boundaries of lending with flash loans and fixed-rate borrowing.

- The Compound is the clear leader in both # of users and token holders, likely due to the COMP token airdrop and liquidity mining program.

Governance

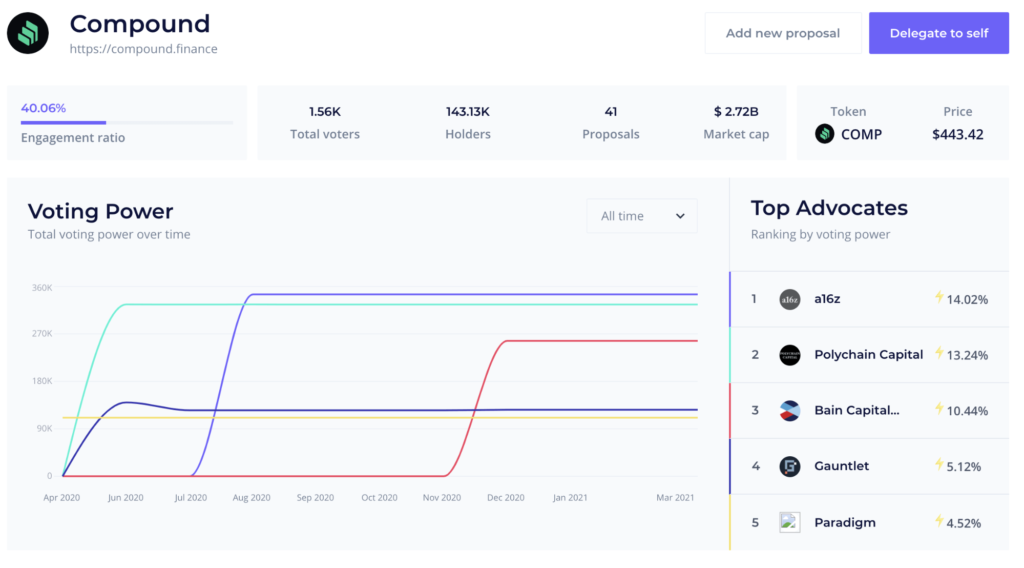

All three protocols have decentralized governance and are governed by their community of token holders. While decentralized, the most voting power is often owned by the project’s team and key investors. Let’s look at Compound’s governance analytics:

- A big challenge for protocols has been governance participation. In the case of Compound, we can see that just over 1% of the total token holders have been participating in governance. A big part of that are transaction fees.

- We can also see that Compound’s investors have most of the voting power with over 40% combined, while Robert Leshner, CEO, has 4.27% (not shown).

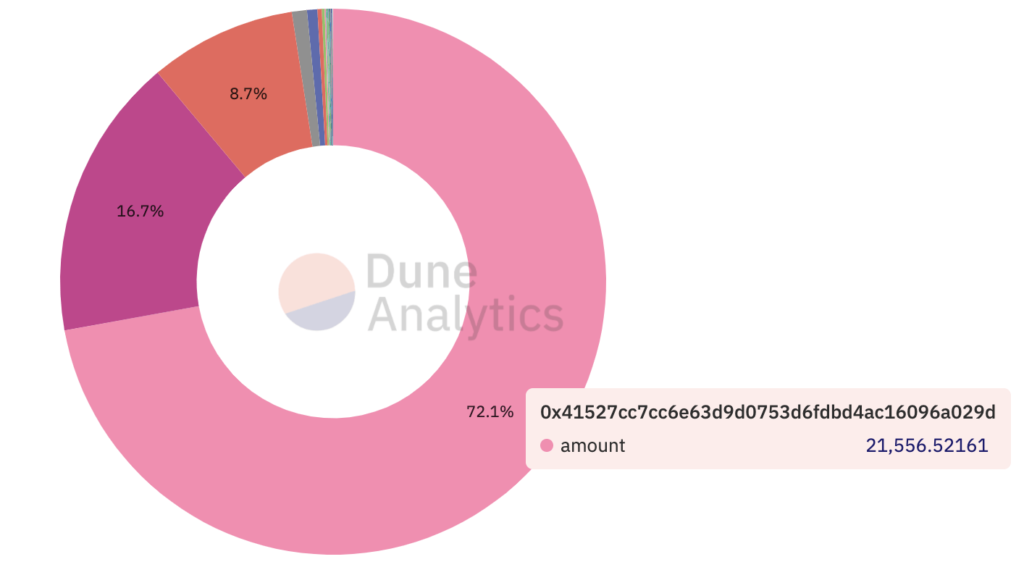

- We can see that the centralization of voting power is even more striking with Maker. One address holds 72% of the voting power and the top three addresses hold 97.5% of the voting power.

Recent Developments, Roadmap and Integrations

Aave

- Aave received a European e-Money institution license in 2020 and has shown ambitions to issue a payment card

- Ааve’s governance recently voted on increasing Safety Incentives by 37.5%. The primary mechanism for securing the Aave Protocol is the incentivization of AAVE holders to lock tokens into a Smart Contract-based component called the Safety Module (SM).*

- Aave recently got integrated into Curv’s enterprise DeFi solution, enabling institutions to lend and borrow. On March 8, 2021, Paypal acquired Curv for ~$200M. There were additional integrations with Hex Trust’s custody platform and Matrixport.

- Aave loans are also getting integrated into BarnBridge fixed-yield bond product as part of CLO-like tokenized bonds.

- On March 16, 2021, Aave launched their AMM Market, enabling liquidity providers (“LPs”) of Uniswap and Balancer to use their LP tokens as collateral in the Aave Protocol. The AMM Market offers 16 LP different LP tokens.

- Aave has also announced that it’s working with RealT to enable borrowers to use tokenized real estate as collateral.

* Source: Aave docs

Maker

- Implemented a liquidity pool called the Peg Stability Module (PSM) in Dec 2020. PSM enables users to mint DAI against stablecoins or redeems DAI for stablecoins. Since its launch, it has generated over $140K in fees.*

- Governance proposal to launch ETH-C vaults – essentially lending/borrowing with a lower (57%) loan to value ratio and lower stability fee (3.5%).

- Plans for direct Aave and Compound integrations, enabling users to lend their DAI on Aave and Compound markets.

- Plans to expand asset classes beyond crypto assets. The community has voted to greenlight 2 new asset classes for later inclusion into the protocol. Real estate through REINNO and digital bonds through SolidBlock.

* Source: Delphi Digital

Compound

- Launched a prototype of their blockchain called Gateway – a Substrate blockchain, governed by COMP token-holders on Ethereum. The goal of Gateway is to enable users to borrow assets native to one chain (e.g. ETH), with collateral from another chain (e.g. DOT).

- The USDC market on Compound was integrated into BarnBridge fixed-yield bond product as part of CLO-like tokenized bonds. It currently holds around $2.5M in liquidity.

Teams and Investors

AAVE – Aave is founded by Stani Kulechov (CEO) and has a team of about 40 people. Stani is one of the most active seed investors in the DeFi space, both as an angel and as a partner in Variant, with DeFi composability being a big focus of his. Aave is backed by leading crypto and DeFi investors such as Parafi, Blockchain Capital, Winklevoss Capital, and Defiance Capital among other investors.

Maker – Maker has a team of 56 people, led by Rune Christensen (CEO) and Steven Becker (President and COO). The Maker has raised $27 million from investors such as Andressen Horowitz and Polychain Capital.

Compound – Compound is founded by serial entrepreneurs Robert Leshner and Geoffrey Hayes. With a team of 14 people, Compound has some of the top investors in the industry, such as Andressen Horowitz, Coinbase Ventures, Paradigm, Polychain Capital, Dragonfly Capital, and BainCapital Ventures.

Key Takeaways

- Maker, Compound, and Aave have emerged as the market leaders in lending/borrowing from the first Defi wave. Space is still poised for a lot of growth and is expected that these protocols will continue to lead the way.

- Well-executed community incentive programs such as the COMP airdrop and their liquidity mining program have shown to be extremely effective in community building

- Meanwhile, Aave’s attractive risk parameters and continuous innovation (i.e.. flash loans) have been reflected by the market in terms of valuation.

- Floating rates (due to market volatility) are still a big risk and protocols are exploring fixed-rate products or integrations with emerging lending protocols focusing on fixed-rate/fixed-term products.

- Lending protocols are looking to move beyond crypto-assets as collateral and exploring the real estate and other TradFi assets

- The DeFi leaders are also becoming cross-chain, which could make the underlying settlement/infrastructure layer (Layer 1: Ethereum, BSC, Solana) become less important for end-users. A similar thing happened to the Internet 20 years ago where most of the value capture happened in the upper Application layers (instead of TCP/IP).

Disclosure: This report is not investment advice, it is strictly informational. Do not trade or invest in any tokens, companies, or entities based solely upon this information. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. Investors should conduct independent due diligence, with assistance from professional financial, legal, and tax experts, on topics discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision. Albaron Ventures abides by a No Trade Policy for the assets listed in this report for 3 days following its public release. At the time of publication, Albaron Ventures owns COMP, AAVE, and MKR through its exposure within the sDEFI index. This article is a summary of the full analysis that was performed.