This Hegic Analysis Report covers everything you need to know about Hegic, its competitors, and other aspects of Hegic protocol.

What is Hegic?

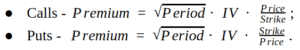

Hegic is a non-custodial on-chain options protocol built on Ethereum which enables a decentralized exchange of option contracts. The protocol is powered by liquidity pools and hedge contracts that support call and put options on ETH and WBTC. These options can be exercised anytime prior to their expiration date (American options). All options on Hegic are collateralized by liquidity providers that act as option sellers when contributing to the protocol’s liquidity pools

HEGIC Token

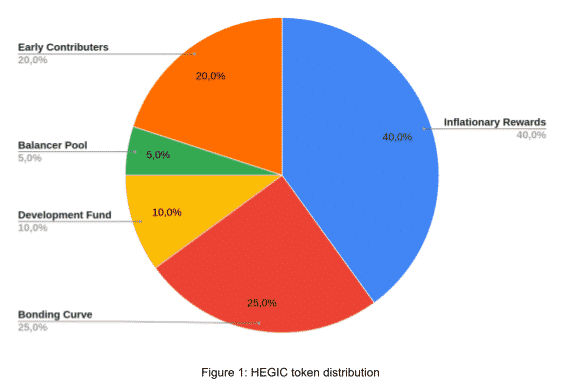

The platform’s native token, HEGIC, serves both utility and future governance purposes that coordinate the aligned interests of protocol users and token holders. The token’s total supply is capped at 3,012,009,888 HEGIC.

Hegic’s inflationary rewards are distributed to liquidity providers and option buyers through rHEGIC, this reward token is subject to a vesting schedule. Upon being released, rHEGIC can be exchanged at a 1:1 ratio with HEGIC. Unlike fixed-time vesting schedules, rHEGIC employs variable-time vesting, where tokens become unlocked as pre-set cumulative traded volume milestones are met. For example, the Phase I milestone was $100M, while Phase II is at $1B.

Option Buyers

Option purchasers can buy put and call options, select the desired strike price, the contract duration, and the traded volume. The cost of Hegic’s options consists of a paid premium and a settlement fixed fee of 1% over the strike price. This protocol revenue is entirely distributed to HEGIC holders that stake their tokens. When the option’s underlying asset price exceeds the sum of its strike price and settlement fee the purchaser is in profit.

Option Pricing

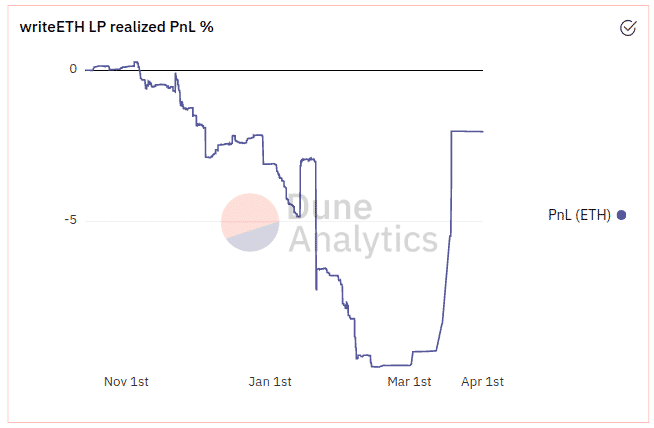

Hegic’s premium is given as follows:

, where IV represents the Implied Volatility.

Therefore, the option’s total cost is given by:

Total Cost = Settlement Fee + Premium

Incentives for Option Buyers

Option buyers are incentivized through the distribution of rHEGIC rewards (reward HEGIC). This process allows users to be involved with the platform’s governance and it decentralizes the distribution of its native token. The rewards that option buyers are entitled to are proportional to the contract size and duration. For each 1 ETH spent in premiums and fees option buyers are rewarded with 300 rHEGIC which corresponds to a 4% cashback offer.

Liquidity Providers

Hegic uses a pooled liquidity model as its option buyer’s counterparty. If a user decides to provide liquidity to Hegic that liquidity becomes available for purchasers thus collateralizing their contract. Hegic’s LPs are therefore option sellers that contract obligations in exchange for premiums and HEGIC rewards.

The liquidity pools used in Hegic are bi-directional, which makes it possible to provide liquidity depth for both put and call option buyers with a single liquidity pool per asset. Currently, there are two liquidity pools, ETH and WBTC. Users that wish to provide liquidity to Hegic’s pools are rewarded with rHEGIC and premiums.

| Pool | TVL |

| ETH | 17,030 ($36.5M) |

| WBTC | 455 ($27M) |

(source: Dune Analytics)

When an option is either executed or expired, the liquidity that collateralized that option is removed or returned to the pool. If the premiums that are paid to option sellers exceed the payouts that are done to option holders LPs will profit and accrue that value to their share of the liquidity pool. It is important to keep in mind that while providing liquidity to Hegic, the deposited funds are subject to a minimum lock-up period of 14 days in order to guarantee the pool’s stability.

Once funds are deposited to Hegic’s liquidity pools the depositor receives write tokens (writeETH and writeBTC) that represent an ownership share within the pool. To earn HEGIC rewards the depositor will need to stake his liquidity.

Unlike individual option sellers, Hegic’s liquidity providers have their funds diversified through multiple hedge contracts. This pooled exposure model to sell options implies that both losses and profits from net premiums will be socialized (thus inferior to individual option sellers).

Hegic Staking

Staking Lots

Users can stake their HEGIC tokens in order to claim the ETH and WBTC settlement fees generated by Hegic. Those fees correspond to 1% of the strike price defined by the option buyer. To do so, a staking lot of 888,000 HEGIC is required. At current prices, a staking lot is equivalent to $205K. Despite this value, HEGIC holders can stake their tokens using independently developed staking pools such as zLots Hegic Pools and Hegic Staking.

Staking APY

| Staking Pool | APY |

| zLots Hegic | 13.14% |

| Hegic Staking | 14.02% |

Incentives

Currently, these are the existing incentives for staking lot holders:

- Distribution of protocol revenue – staking lot holders are entitled to Hegic’s 1% settlement fee;

- LP rewards – the LP HEGIC rewards earned from the assets that were raised during the IBCO will be distributed among staking lot holders;

- Swap fees – a 5% swap fee from HEGIC tokens that are sold through the bonding curve accrues to staking lot holders.

Tokenomics

In order to evaluate Hegic’s tokenomics it is necessary to analyze the systemic selling pressure that its native token is exposed to and the intrinsic incentives to hold it. Presently, the circulating supply of Hegic’s native token, HEGIC, corresponds to roughly 14% of its maximum supply that’s capped at 3,012,009,888 HEGIC. A low circulating supply allows a long-term distribution strategy that decentralizes HEGIC to protocol users and creates incentives from inflationary rewards. Despite its low circulating supply, HEGIC is safeguarded from constant selling pressure due to the variable vesting period that Hegic’s reward token (rHEGIC) is subject to. With this mechanism in place, the rewards attributed to liquidity providers and option purchasers cannot be immediately sold to the market. As of now, the main incentives to hold HEGIC lie in the distribution of Hegic’s revenue to staking lot holders and discounts for option contract purchasers. In the future, the token will also be used to coordinate Hegic’s governance process. Hegic’s inflationary rewards are distributed as incentives to both liquidity providers and option buyers.

Simplified Protocol Overview

Liquidity

Given that Hegic uses a capital pooling model for the option seller side it is important to maintain low utilization rates of capital within the protocol in order to guarantee that liquidity providers can exit the pool.

| Pool | TVL | Utilization Rate | Available Liquidity |

| ETH | 17,030 ETH | 66.10% | 5,773 ETH |

| WBTC | 455 WBTC | 20.84% | 360 WBTC |

If the utilization rates increase the liquidity provider’s capital can be trapped within the pool due to contractual obligations with option buyers. Due to this, a higher utilization rate will imply an increased risk exposure to liquidity providers.

Traded Volume, Revenue, and Price to Sales Ratio

Hegic has impressive revenue metrics when compared with other derivatives protocols. The existing high demand for ETH/BTC American options combined with Hegic’s pooled liquidity model creates strong incentives within option buyers to use Hegic.

This model represents an undeniable improvement of user experience for option buyers by allowing them to easily define the desired contract duration, strike price, and volume as long as there’s enough liquidity present in Hegic’s pools (this model’s downside will later be addressed).

In this analysis, Hegic’s revenue will be considered as the sum of the settlement fees (revenue for staking lot holders) and gross premiums earned by LPs.

| 24h Revenue | Monthly Revenue | Cumulative Revenue |

| $20,413 | $1,62M | $26.57M |

Considering that Hegic’s inception was roughly five months ago, and comparing it to its leading DeFi competitor, Opyn (which launched over one year ago), the cumulative traded volume on the platform is fairly impressive.

| Protocol | Cumulative Options Volume |

| Hegic | $288M |

| Opyn | $160M |

| Charm | $4M |

| Synthetix | $135K |

(source: Dune Analytics)

Despite its low circulating supply (thus a fully diluted valuation far larger than its current market capitalization) Hegic sustains a healthy P/S ratio (when compared to DeFi’s average) due to the protocol’s high revenue margin.

| Fully Diluted Valuation | Price-to-Sales Ratio | Cumulative Revenue | Cumulative Settlement Fees | Cumulative Gross Premiums |

| $686M | 14x | $26.57M | $7M | $19.57M |

It is important to point out that Hegic has experienced a sudden increase in revenue (the daily revenue spiked from $20k to $844k) due to unusually large purchases of ETH calls that are mostly distributed at a $2090 strike price. As a result, Hegic’s utilization rates suffered a dramatic rise that further amplifies the risks that LPs are exposed to (liquidity traps due to contractual obligations).

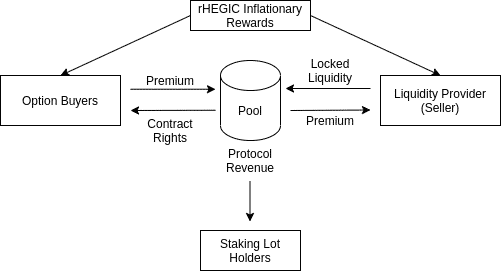

LP Metrics

Hegic’s peer-to-pool approach functions as an options AMM where liquidity providers pool their funds and risk in order to act as option sellers and collect yield in the form of premiums paid by option buyers. To evaluate Hegic’s sustainability it is necessary to analyze the incentives given to liquidity providers and extrapolate if they are viable in the long term.

Currently, Hegic’s LPs are incentivized to pool their funds with premiums and liquidity mining rewards, below we can analyze the current premiums:

| Pool | Realized PnL | Unrealized PnL | Liquidity |

| writeETH | -2.02% | 4.26% | $36.5M |

| writeWBTC | -15.39% | 0.71% | $27M |

(source: Dune Analytics)

With a negative realized PnL and a low unrealized PnL it is simple to conclude that LPs are currently subsidized by liquidity mining rewards to partake in Hegic’s pools and assume their intrinsic risks. Upon analyzing the realized PnL on both writeETH and writeWBTC it is possible to observe that so far LPs have only experienced negative returns on the realized PnL associated with premiums.

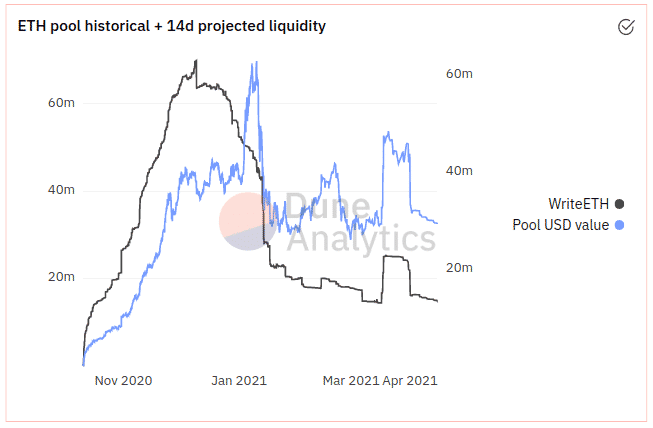

Furthermore, with the inspection of the ETH pool’s historical liquidity data (+14 days correspond to the lock-up stability period), one can observe the continuous decline in liquidity since December 2020. These conclusions are analogous to WBTC liquidity decline and negative PnL.

Point of Maximum LP Returns

As liquidity accrues to Hegic’s ETH and WBTC liquidity pools HEGIC liquidity mining (LM) rewards will decrease as its TVL grows. By defining the point of maximum LP returns as the maximum amount of liquidity that can be provided to one of Hegic’s pools before its LM rewards decrease by 1% it is possible to calculate the liquidity ceiling for its highest LM APY.

| Liquidity Pool | Point of Max. LP ROI | Maximum APY | Daily Rewards for Max. LP ROI | Monthly Rewards for Max. LP ROI |

| ETH | 265 ETH | 49% | 10109 rHEGIC ($720) | 303261 rHEGIC ($21.7k) |

| WBTC | 5.5 BTC | 55% | 6792 rHEGIC ($485) | 203752 rHEGIC ($14.5k) |

It is worth noting that this point will change as the total liquidity present in ETH and WBTC pool varies.

Net APY for LPs

| Liquidity Pool | Max. LM Rewards + Realized Premiums |

| ETH | 49% + (-2.02%) = 46.98% |

| WBTC | 55% + (-15.39%) = 39.61% |

Put-Call Ratio and Open Interest

The put-call ratio and open interest are important metrics when it comes to analyze the market’s current trend and the risk exposure that liquidity providers face while partaking in Hegic’s pooled model as option sellers.

| Pool | Call | Put |

| ETH | 98.3% | 1.7% |

| WBTC | 80.9% | 19.1% |

(source: Dune Analytics)

| Metrics | Call | Put | Total |

| ETH | $23.8M | $0.4M | $24.2M |

| WBTC | $6.2M | $1.5M | $7.7M |

(source: Dune Analytics)

It is trivial to conclude that the market is extremely biased towards call options and it is currently out of balance to the buy-side (comparatively Opyn has a ratio of 63% calls and 37% puts). This behavior is normal during bull markets, however, it poses a great risk within a socialized pool of option sellers. If utilization rates keep on increasing in Hegic’s liquidity pools while the ratio between puts and calls remains heavily out of balance the inherent risk for LPs will become too high to be ignored and they will start to abandon the pool in order to avoid being trapped with contractual obligations.

Staking Lots

| Staking Lot | Nº of Lots | Cumulative Revenue per Lot |

| ETH | 94 | $55.6k |

| WBTC | 111 | $68.5k |

(source: Dune Analytics)

DeFi Composability and Yield Farming

The success of DeFi protocols is highly dependent on their composability, this property allows projects to amplify their network effects leveraging existing and well-established protocols that create added utility.

As of now, these are Hegic’s most important components in terms of composability:

- Yearn yHEGIC Vault;

- C.R.E.A.M. Lending;

- SushiSwap Pool;

- Whiteheart Finance;

- Hetoro.

Yearn yHEGIC Vault

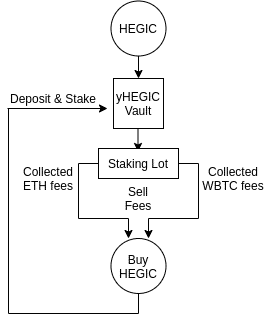

The yHEGIC Vault is used to buy staking lots on Hegic. The generated fees are then reinvested into more HEGIC thus compounding the total amount that is staked on the staking lot. This strategy’s flowchart can be analyzed below.

C.R.E.A.M.

C.R.E.A.M. Finance has a lending pool where users can borrow/lend HEGIC. As of now the APY to supply HEGIC to CREAM’s pools is at 2.01% and the borrowing rate is equal to 12.56%.

SushiSwap

| Pool | Liquidity | Volume (24h) | APY |

| HEGIC-ETH | $7.4M | $0.94M | 13.93% |

(source: Sushi.com)

Whiteheart

Whiteheart is an on-chain hedging protocol that’s built on Hegic. While using Whiteheart, DeFi users can protect their USD value of both ETH and WBTC in exchange for an insurance cost. Presently, users can protect their holdings for a period of 14 to 28 days, if the value of their holdings falls below the contracted price the user is paid that difference in USD.

Furthermore, WHITE holders (Whiteheart’s token) can stake their tokens and receive in return a share of fees generated by the protocol.

Hetoro

Hetoro is a platform powered by Hegic that serves as a secondary market and analysis venue of on-chain options data. Besides the available options within its secondary market, users can also stake HEGIC and earn settlement fees or provide liquidity to H2M (Hegic’s secondary market).

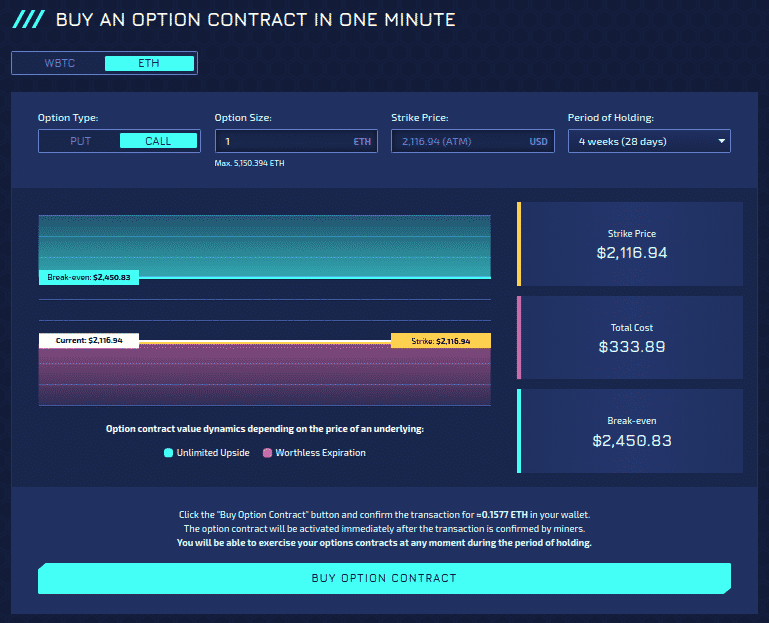

UI and UX

Hegic’s UI is outstanding and extremely intuitive. While using it the user has to select the option type, size, strike price, and period of holding. Upon defining these parameters Hegic’s UI displays a visual representation of that contract’s in the money, out of the money, and at the money regions.

The following transaction represents a call option purchase defined at the money for the maximum contract duration (thus maximum total cost for a size equal to 1 ETH).

| Option Type | Size | Strike Price | Duration | Total Cost | Gas Fee |

| Call | 1 ETH | $2,116.94 | 28 days | $333.89 | 0.056 ETH |

(source: hegic.co)

Community Metrics

In DeFi, a strong community can be a catalyst for innovation and protocol adoption. There are numerous cases of protocols that greatly benefited from community contributions throughout their development, this ethos associated with decentralized platforms sparks new ideas and improvement proposals that wouldn’t take place in traditional organizations. Below it is possible to analyze some of Hegic’s quantitative metrics with regard to its community.

| Social Network | Number of Users |

| Discord | 3476 |

| Telegram | 3700 |

| 16.7k |

These numbers alone do not reflect the responsiveness that was experienced during this protocol’s research. Upon posing technical questions on Hegic’s discord, the answers were promptly given by the development team and a consistent small group of community members that actively contributed to the project’s discussions. Albeit a subjective metric, Hegic’s community is a positive indicator for the protocol’s future development and present ease to onboard new users that will have their doubts quickly clarified.

Limitations and Risks

While analyzing Hegic’s LP metrics it was possible to conclude that the liquidity present in Hegic’s pools has been experiencing a steep decline since December. The negative realized PnL on premiums aligned with the increasing risk of being trapped in active options contracts (due to higher utilization rates and lower available liquidity) appear to have been the major underlying motives for this decline. Additionally, the pooled exposure model represents an added layer of risk for option sellers besides the inherent risks associated with selling options (unlimited downside and limited upside).

As of now, these are Hegic’s main risks and limitations:

- Negative Realized PnL – since Hegic’s inception the realized PnL on premiums has always been negative;

- Liquidity trap – as LPs remove liquidity from Hegic pools, utilization rates will increase while the available liquidity decreases, LPs with high volumes incur the risk of having their capital locked in the pool due to active option contracts that are collateralized by the LP’s capital;

- Implied Volatility Manual Update – given that Hegic’s implied volatility isn’t dynamically priced there can be arbitrage opportunities between Hegic and other venues;

- Put-Call Ratio – with a put-call ratio that’s out of balance, and no form to manually hedge LP positions as option sellers, LPs can incur large losses that are socialized by the liquidity pool, if utilization rates are high this can represent outstanding losses;

- Non-tokenized options – given that Hegic’s options aren’t tokenized they aren’t transferable (however they are currently available on Hegic’s secondary market Hetoro).

Hegic’s base assumption that in the long run the returns obtained by liquidity providers beat the returns obtained from individual option sellers has yet to be proven. It is worth noting that Hegic was launched during a period of high volatility. Taking into account that option sellers are short volatility (thus their PnL is inversely correlated with high volatility) it is possible to argue that a longer observation period is required to confirm that a pooled exposure is a flawed model to sell options.

Improvement Proposal and Future Implementations

Several issues that were encountered throughout this analysis can either be improved or solved with tokenomics improvements that create adequate incentives to existing needs or with solutions that are planned for Hegic’s upcoming V888.0.1 version.

- Dynamic Implied Volatility Update – Hegic’s future roadmap contemplates a dynamic and real-time update of its implied volatility parameters once Chainlink supports IV oracles;

- Tokenized Options – the upcoming V888.0.1 version will include tokenized options, this improvement is extremely important as it will render Hegic’s options transferable;

- Option Buyer Rewards – instead of equally distributing liquidity mining rewards to both calls and puts Hegic could implement a distribution system that dynamically allocated those rewards in order to incentivize a balanced put-call ratio (given that the options market is too fragmented across durations and strikes 50-50 ratios aren’t viable);

- Revenue Distribution to LPs – assuming that Hegic is able to increase its traded volumes (and halt the decline in liquidity) the protocol could use part of its revenue to either create an insurance fund for LPs (i.e. if the LPs PnL dips below a predefined threshold the fund would cover those losses) or subsidize LPs with organic revenue that’s currently fully distributed to stakers;

- Hedging Strategies – the protocol’s development team is working on LP hedging strategies in order to mitigate the downside experienced by LPs.

Conclusion

Derivatives represent DeFi’s largest addressable market by several orders of magnitude and the demand for this type of financial instrument, such as options, is poised to grow. As this market matures it is expected that besides pure speculation an increasingly larger number of users will start using options as insurance against a price downside for their assets.

Hegic’s differentiating factor lies in its options AMM peer-to-pool approach. With this design, liquidity providers pool their capital and risk thus creating an easy way to sell options where buyers have full control over the desired contract parameters. This improved user experience for purchasers is enabled by Hegic’s fundamental assumption that in the long run the returns obtained by liquidity providers beat the returns of solo options writers.

In this report, it was possible to conclude that Hegic’s fundamental assumption has yet to come to fruition and liquidity providers are effectively subsidized by liquidity mining rewards. Unlike other design models, Hegic LP returns from premiums aren’t correlated with its traded volumes. Due to that, a future increase in volume metrics would only benefit Hegic stakers (more settlement fees) leaving LPs still dependent on liquidity mining rewards.

The bullish thesis for Hegic would be a scenario where the platform leverages its superior user experience for option buyers and subsidizes LPs with organic revenue originated from settlement fees. What this implies is that HEGIC stakers would see their returns diminished in order to compensate LPs for their incurred risks (unlimited losses, trapped liquidity due to high utilization rates, negative or low PnL from premiums, magnified socialized losses due to an out of balance Put-Call ratio). Another important observation is that Hegic was launched at the beginning of the bull run, given that LPs are short volatility one could argue that the sample size for LP PnLs isn’t an accurate representation of a full market cycle.

The bearish thesis for Hegic (which is corroborated with present data) is that the decline in staked liquidity will continue due to an asymmetric risk/reward for LPs. As liquidity decreases in Hegic pools, and utilization rates increase, the platform’s value proposition will be hindered for option buyers that will have their order sizes limited and for LPs that will have a progressively higher risk of having their liquidity trapped by active options. This reflexive effect can create a downward spiral where pool sizes keep on decreasing. Even if the current decline in staked liquidity is halted and reversed, LPs would still need to be subsidized by liquidity mining rewards. Considering that the premium’s PnL remains negative/low while LM rewards decrease according to Hegic’s inflation schedule, an unsustainable point would eventually be reached where organic revenue would be needed as an incentive for LPs.

In summary, Hegic’s fundamental assumption has yet to be proven and current data suggest that pooled exposure for option sellers isn’t sustainable if they have to rely strictly on the earned premiums. The success of Hegic’s future is therefore dependent on a tokenomics upgrade that would entail a revenue redistribution from stakers to LPs or an insurance fund to cover their losses.

Disclosure: This report is not investment advice, it is strictly informational. Do not trade or invest in any tokens, companies, or entities based solely upon this information. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. Investors should conduct independent due diligence, with assistance from professional financial, legal, and tax experts, on topics discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision. Albaron Ventures abides by a No Trade Policy for the assets listed in this report for 3 days following its public release. At the time of publication, Albaron Ventures does not own HEGIC, but has a position on SNX. This article is a summary of the full analysis that was performed.

References

- Wintermute, M. (2020, February). Hegic: On-chain Options Trading Protocol on Ethereum, from https://ipfs.io/ipfs/QmWy8x6vEunH4gD2gWT4Bt4bBwWX2KAEUov46tCLvMRcME

- Medium. (2020, August). Announcing HEGIC Token, Liquidity Mining & Utilization Rewards and Staking. Retrieved March 29, 2021, from https://medium.com/hegic/announcing-hegic-token-liquidity-mining-utilization-rewards-and-staking-d1dd6605f2cd

- Github. (n.d.). Hegic Resources. Retrieved March 30, 2021, from https://github.com/jmonteer/hegic-resources/blob/main/docs/Hegic%20FAQ.md

- Medium. (2020, September). Hegic 2020 Roadmap. Retrieved March 29, 2021, from https://medium.com/hegic/hegic-2020-roadmap-f32b098e547d

- Options Trading. (n.d.). How to Manually Price an Option. Retrieved April 2, 2021, from https://www.optiontradingtips.com/pricing/a-quick-pricer.html