Introduction

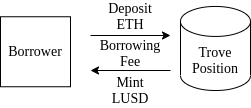

Liquity is a governance-free borrowing protocol that enables interest-free loans paid in LUSD (Liquity’s USD pegged stablecoin) using Ether as collateral. While locking collateral into the protocol, the depositor creates a position called “Trove” that can mint new LUSD.

All loans on Liquity require a minimum collateral ratio of 110%; below this threshold, the borrowers’ positions are liquidated. This low collateralization ratio represents one of Liquity’s main value propositions — high capital efficiency for overcollateralized ETH-backed loans. To achieve this low collateralization ratio, the protocol created a novel liquidation mechanism that relies on an incentivized stability pool and a redistribution system.

Furthermore, Liquity has enshrined incentives built in the protocol to stimulate the creation of multiple independent user interfaces. This guarantees the system’s decentralization at a frontend level.

Trove

ETH holders can obtain interest-free loans by opening Troves and depositing ETH as collateral. Analogous to collateral debt positions, Troves enable the management of the depositor’s collateral ratio (ratio between the collateral’s dollar value and its corresponding debt in LUSD).

Troves’ minimum collateral ratio is set at 110%. Below this threshold the collateral is sold to pay back the loan Borrowers can add collateral or repay the existing debt. Loans have 0% interest, but every time that a borrower draws LUSD from a Trove, a one-off borrowing fee is charged on the borrowed amount and it is added to the borrower’s debt. This fee is confined to a range of 0.5% to 5% and it is variable and algorithmically adjusted (i.e. if LUSD is trading below the dollar peg there’s an excess of redemptions and the borrowing fee increases thus discouraging borrowing). Under normal operation circumstances the system adopts the minimum 0.5% fee. Furthermore, when opening a Trove there is a minimum 2000 LUSD debt and a 200 LUSD liquidation reserve is applied. This reserve is returned to the borrower upon the debt’s repayment.

Stability Pool

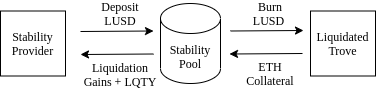

Liquity’s stability pool represents the protocol’s source of LUSD liquidity that is used to repay the debt of liquidated Troves. Due to this, the stability pool is the protocol’s main liquidation mechanism and it guarantees that LUSD remains backed at all times.

When a liquidation takes place, the protocol burns the Trove’s LUSD debt from the stability pool and it distributes its ETH collateral to the pool. Taking in consideration that Troves are likely to be liquidated at just below the minimum collateral ratio, stability providers are expected to receive a greater dollar value of ETH collateral when compared to the LUSD debt that they pay off.

In order to contribute to this pool, stability providers are required to deposit LUSD into it in exchange for liquidation gains in the form of ETH collateral and LQTY rewards (Liquity’s value capturing token).

Stability depositors can withdraw their liquidity at any time with no minimum lockup duration as long as there are no liquidatable Troves.

Furthermore, the stability pool replaces the collateral auction model used in protocols such as MakerDAO. Due to Liquity’s faster liquidation mechanism, the protocol is able to offer a lower minimum collateral ratio that is reflected in the protocol’s higher capital efficiency.

Liquidations

When a Trove’s collateral ratio drops below 110%, the position becomes eligible for liquidation. Anyone can liquidate a Trove when that condition is met. The execution of the liquidation represents the only aspect of this mechanism that requires an external entity (a bot or a person). The initiator of the liquidation process receives a gas compensation of 200 LUSD (the liquidation reserve) plus 0.5% of the Trove’s collateral (the remaining collateral is distributed among stability providers). All liquidations are executed in batches to reduce gas costs.

The owner of the liquidated Trove keeps the borrowed amount of LUSD (which is burnt from the stability pool to ensure LUSD’s full backing) and loses the Trove’s collateral. Given that the MCR is equal to 110%, this liquidation corresponds to a 10% loss. Contrastingly, the Trove’s liquidation generally corresponds to a 10% profit margin that is distributed among stability providers.

Redistribution

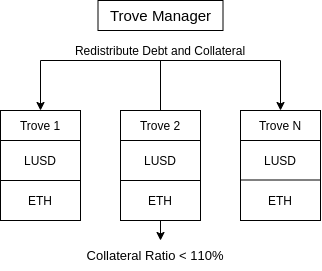

Liquity’s redistribution system represents the protocol’s secondary liquidation mechanism that is activated if the stability pool has insufficient funds to cover the debt that is associated with liquidated Troves.

Under these circumstances, the protocol redistributes the existing debt and collateral that is associated with undercollateralized Troves to all existing positions. In order to avoid subsequent cascading liquidations, the protocol executes the redistribution of collateral and debt according to the recipient’s amount of collateral. Due to this, Troves with higher collateral ratios will receive more collateral and debt from liquidated Troves.

Taking into account that most Troves are liquidated at a collateral ratio that is just below 110%, this redistribution mechanism generally represents a net gain to the remaining Troves. Furthermore, this mechanism also implies that the collateral ratio associated with recipient Troves will decrease. If recipient Troves are marginally close to the minimum collateral ratio (i.e. 111%) they can become undercollateralized.

Redemption Mechanism

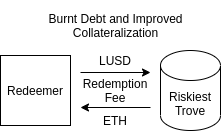

Liquity allows LUSD holders to redeem their tokens in exchange for the underlying ETH collateral at face value (1 LUSD for $1 worth of ETH). The protocol will then use the redeemed LUSD to repay the debt that is associated with the lowest collateralized Trove. By doing so, the system reduces the debt that is linked to the riskiest Trove while simultaneously improving its collateral ratio and diminishing its ETH exposure.

The redemption mechanism does not represent a net loss for the Trove that is redeemed against, however, it does imply that the position is deleveraged (which leads to a collateralization improvement). Due to this, each redemption can be seen as a repayment of the protocol’s outstanding debt.

When redeeming LUSD, the user incurs a redemption fee that is calculated as a function of the protocol’s base rate. The base rate value increases with each redemption proportionally to the amount that was redeemed (thus disencouraging runs on LUSD) and it decays with time since the last fee event. The redemption fee is therefore equal to the base rate times the amount of ETH that is drawn from the system’s collateral.

Price Stability

Liquity’s USD pegged stablecoin, LUSD, is overcollateralized by ETH and its price stability is kept through hard and soft peg mechanisms that rely on arbitrage opportunities and incentives to take and repay loans.

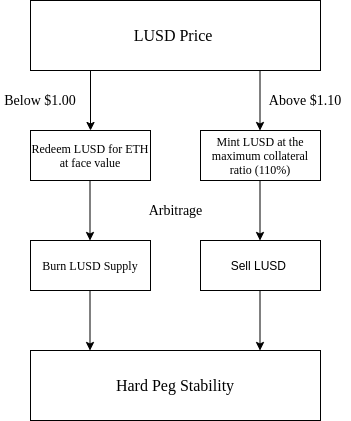

Hard Peg Mechanism

The hard peg mechanism corresponds to an arbitrage based stability system that creates a price interval where arbitrageurs are incentivized to rebalance LUSD to its peg.

If the price of LUSD is below the dollar hard peg floor (minus the redemption fee) there is an arbitrage opportunity to redeem LUSD for Ether at face value (i.e. 1 LUSD for $1 of ETH). By doing so, arbitrageurs can sell the redeemed ETH on the market at a higher price. In this arbitrage process LUSD is burnt, its supply decreases and the price increases back to its peg.

Alternatively, if the price of LUSD is above the hard peg ceiling of $1.10 there is an arbitrage opportunity for borrowers to take the maximum possible loan against their collateral and sell LUSD on the market. This hard peg ceiling is defined by Liquity’s minimum collateral ratio of 110%. If LUSD’s price goes above $1.10 there will be an arbitrage gain regardless of the collateral’s liquidation.

Soft Peg Mechanism

Liquity’s soft peg stability mechanism incentivizes users to aid LUSD’s stability through aligned interests. These interests are algorithmically adjusted with the protocol’s base rate which affects how attractive it is for borrowers to take a LUSD loan. Supposing that a large redemption takes place, the base rate increases immediately thus making new loans less attractive. This mechanism effectively slows down the growth of LUSD’s monetary base by balancing the issuance and redemption system’s in tandem.

LQTY Token

LQTY is Liquity’s secondary token that captures the fees generated by the protocol (issuance and redemption fees) and distributes that revenue among LQTY stakers. Furthermore, the token is also used to incentivize stability providers, frontend operators and liquidity providers of LUSD:ETH Uniswap pool.

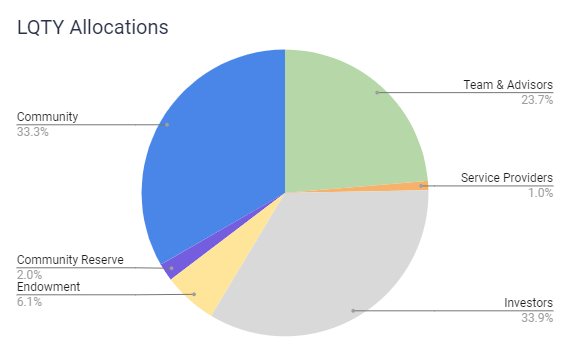

The token has a maximum supply of 100M LQTY with the following genesis allocation:

(source: Liquity Medium)

Furthermore LQTY’s distribution is subject to the following lockup periods:

- Investors (33.9% LQTY) – 1 year lockup period;

- Team and Advisors (23.7% LQTY) – 1 year lockup and are 1/4 vested after 1 year of engagement, then 1/36 every month after.

- Liquity AG Endowment (6.1% LQTY) – 1 year lockup period;

- Uniswap Liquidity Mining Rewards (1.33% LQTY) – distributed by the protocol for the course of 6 weeks post launch.

- Service Providers (1% LQTY) – 1 year lockup period;

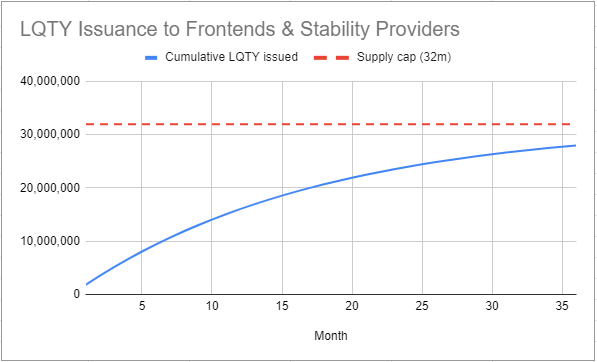

Lastly, the LQTY distribution schedule for the protocol’s community is given by the emission curve represented below:

(source: Liquity Medium)

Frontend Operators

The protocol has in-built incentives for frontends that are provided by third parties. The creation of multiple independent user interfaces reinforces the protocol’s decentralization on an end-user screen level.

Frontends are incentivized with LQTY rewards that are attributed as a function of the turnover generated by the frontend. This turnover corresponds to the stability deposits that are transacted to the frontend and the reward allocation is defined by the kickback rate.

The kickback mechanism has a rate that can vary from 0% to 100%. This rate determines the distribution of LQTY rewards that are allocated to stability depositors and the frontend. Supposing that a frontend sets the kickback rate to 90%, their users would receive 90% of their earned rewards while the frontend receives the remaining 10%. Frontends are therefore incentivized to have high kickback rates to attract stability depositors.

Recovery Mode

The system’s Total Collateral Ratio (TCR) corresponds to the total ETH collateral in USD divided by the total LUSD debt. When this ratio drops below 150% the protocol activates the recovery mode.

This mechanism aims to safeguard the protocol’s solvency through protective collateralization requirements, while activated, Troves with a collateral ratio that is below 150% can be liquidated against the stability pool (the redistribution liquidation mechanism cannot be used while in recovery mode).

The protocol caps the liquidation of borrower’s collateral at a 110% ratio, if the borrower is liquidated in the 110%-150% range he can later claim the excess collateral that’s above the 110% liquidation threshold. Additionally, this mode disables all operations that could further deteriorate the protocol’s TCR.

Taking in consideration that the TCR threshold that is required to activate the recovery mode is equal to 150%, risk averse borrowers should maintain their collateral ratios above this level at all times to avoid possible liquidation scenarios. This mechanism represents a strong incentive for borrowers to maintain collateral ratios that are superior to 150%.

Tokenomics

Liquity has two different tokens, LUSD, which is the protocol’s stablecoin that is pegged to the US dollar (overcollateralized by ETH), and LQTY, which is the value accrual token that captures the revenue generated by the system.

LQTY has a maximum supply of 100M tokens and it has a long term emission schedule for the distribution of LQTY tokens to Liquity’s community. It is important to note that due to the protocol’s governance-free algorithmic policy there is no necessity to have a governance token. LQTY is therefore devoid from any governance rights over the protocol.

Most early stage DeFi protocol’s have a highly centralized initial governance that is slowly decentralized with the emission of governance tokens to the protocol’s community. Liquity’s governance-free nature implies that the protocol isn’t subject to this liability.

The issuance and redemption fees represent the protocol’s revenue sources. These earnings are captured by LQTY holders that stake their tokens in order to receive Liquity’s revenue. Taking into account that all revenue accrues to LQTY stakers, it is possible to conclude that there are robust incentives to hold the token.

The protocol’s stability pool is incentivized with LQTY rewards that represent the main source of systemic sell pressure within Liquity. As of now, most of LUSD’s supply is used to provide liquidity to the stability pool and earn LQTY rewards that are sold on the open market.

If the protocol sees an increase in adoption it would be expected to see a decrease in this systemic sell pressure provenient from stability providers due to an improved value proposition to stake LQTY tokens and earn part of the protocol’s revenue.

Liquity Analysis

LUSD

Liquity’s debt is denominated in its native stablecoin, LUSD. This stablecoin is pegged to the US dollar and it is overcollateralized by ETH. LUSD can be redeemed at all times for $1 worth of ETH collateral. In order to guarantee the system’s solvency it is crucial to guarantee that LUSD maintains its peg.

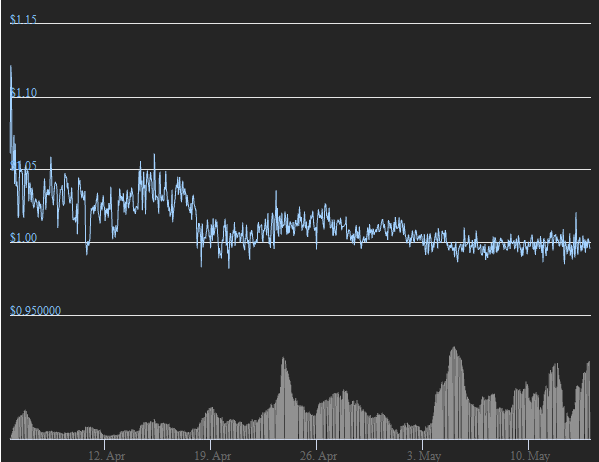

(source: Coingecko)

From its price data it is possible to conclude that since its launch LUSD has been able to maintain its peg and its price has respected the boundaries defined by the hard peg mechanism. It is worth to note that currently most of LUSD’s supply is used on the stability pool to yield farm LQTY rewards. When LUSD’s stability pool utilization rates start to decline the protocol’s solvency mechanism will be tested.

| Token | Price | Market Capitalization | 24h Volume | Nº of Holders |

| LUSD | $0.99 | $1.54B | $45.7M | 1695 |

(source: Coingecko and Dune Analytics)

Utilization Rates

The utility that is intrinsic to a stablecoin can be assessed through its utilization rates. Highly concentrated utilization rates typically imply that the stablecoin is either in its early stage or that its use cases are limited. On the other hand, highly distributed utilization rates generally imply a successful integration and adoption.

| Metric | Stability Pool | Curve LUSD/3Pool | Uniswap V2 LUSD/ETH | Other |

| Utilization Rate | 84.5% | 8.4% | 6.6% | 0.5% |

(source: Dune Analytics)

Analyzing LUSD’s utilization rates, it is possible to conclude that most of its supply is currently used to provide liquidity to Liquity’s stability pool. This concentration of LUSD within this pool is justified through the high liquidity mining rewards that the protocol is currently giving to stability providers. Due to this, yield farming is currently LUSD’s main use case.

Considering that Trove owners and LUSD owners are highly overlapped (due to the stability pool 84.5% utilization rate) it may be inferred that the system is highly solvent and there is a low risk of LUSD breaking its peg. Regardless, as LQTY rewards decrease, the liquidity that is allocated to the stability pool will experience a decline due to less attractive incentives to stability providers. This decline will decrease the amount of capital that is available to absorb ETH price fluctuations thus hindering the system’s solvency. Additionally, by comparing the 24h volume with the stablecoin’s market capitalization it is possible to infer its utility as a stable unit of exchange.

| Metric | USDT | USDC | BUSD | DAI | UST | LUSD | PAX |

| Volume / Market Cap | 3.88 | 0.23 | 1.35 | 0.2 | 0.07 | 0.04 | 0.1 |

(source: Coingecko)

Comparing the utilization rate of the largest stablecoins by market capitalization it is evident that LUSD is the least utilized stablecoin. This value will likely increase over time with LUSD’s integration within DeFi and its decrease in Liquity’s stability pool.

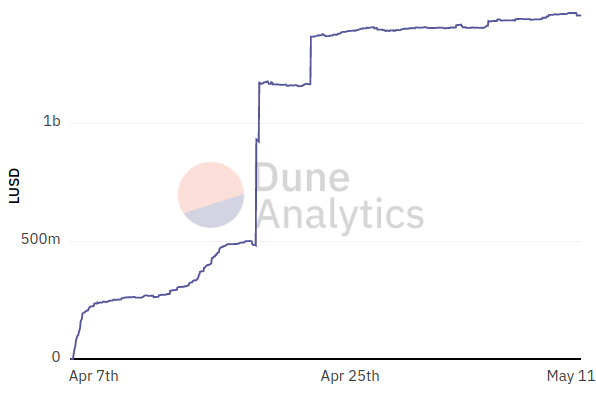

LUSD Supply

Liquity’s stablecoin experienced a rapid growth within its first month of operation. This growth can be attributed to the current high demand for ETH backed loans and Liquity’s liquidity mining incentives. LUSD’s supply is currently at 1.54B tokens and it is now the 6th largest stablecoin by market capitalization.

(source: Dune Analytics)

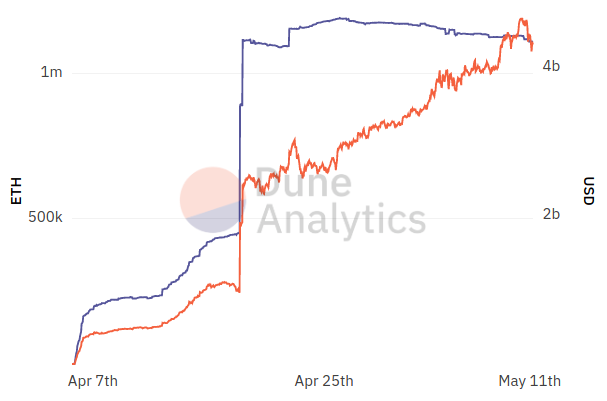

Liquity’s TVL

The present bull market created a high demand for loans collateralized by ETH where borrowers can leverage their holdings in exchange for liquidity over their collateral. Liquity’s interest-free and low collateralized loans are therefore extremely attractive for the present market circumstances.

(source: Dune Analytics)

| Metric | ETH | USD |

| Total Value Locked | 1.04M | $4.13B |

(source: Dune Analytics)

As expected, Liquity’s TVL had a rapid increase that was catalyzed by the market’s current demand for ETH collateralized loans. Additionally, the spike seen on the 18th of April was caused by a large Trove position that corresponds to the following address: “0x903d12bf2c57a29f32365917c706ce0e1a84cce3”. This address alone represents roughly 61% of Liquity’s total value locked.

| Collateral (ETH) | Debt (LUSD) | Collateral Ratio |

| 636.28K | 900M | 284.8% |

(source: Dune Analytics)

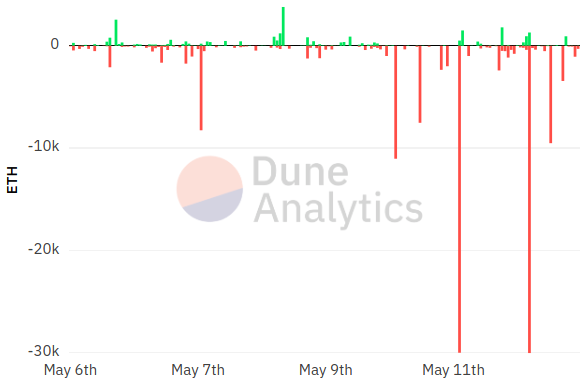

Moreover, this address has recently started to reduce its amount of deposited ETH collateral. Both spikes observed in the chart below represent ETH withdraws that correspond to 60K ETH that has been removed from Liquity ($225M at current prices).

(source: Dune Analytics)

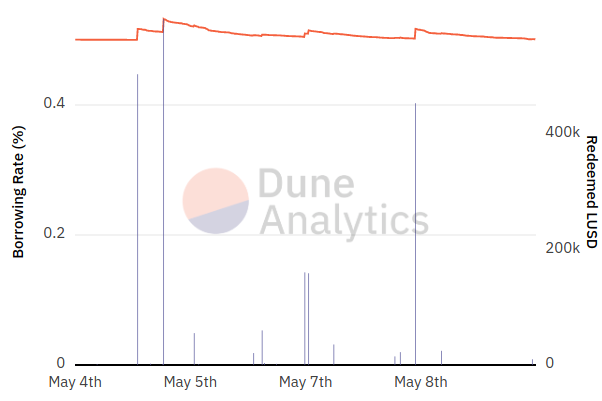

Borrowing Rates

Liquity balances its system with an algorithmical “baseRate” that increases with each redemption and decays over time. Both redeeming and borrowing fees are linked by this common underlying rate that makes borrowing and redeeming more or less attractive.

(source: Dune Analytics)

As expected, upon a large redemption event there is a substantial increase in the protocol’s borrowing rate that is followed by its decay with time if no further redemptions occur. If a large run on LUSD occurs, the “baseRate” will increase thus discouraging both borrowing LUSD and redeeming LUSD.

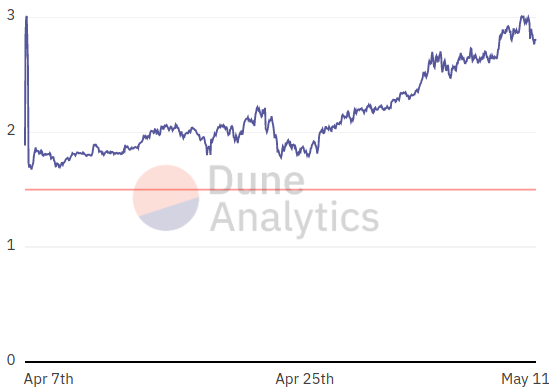

Total Collateral Ratio

In order to remain solvent, it is crucial that Liquity is able to sustain a total collateral ratio that is well above the minimum collateral ratio. Furthermore, the protocol should remain at all times above a 150% collateral ratio to avoid the liquidation of borrowers through the activation of the protocol’s recovery mode.

(source: Dune Analytics)

| Metric | Current Ratio | Minimum Ratio | Maximum Ratio |

| Total Collateral Ratio | 268.0% | 167.5% | 301% |

(source: Dune Analytics)

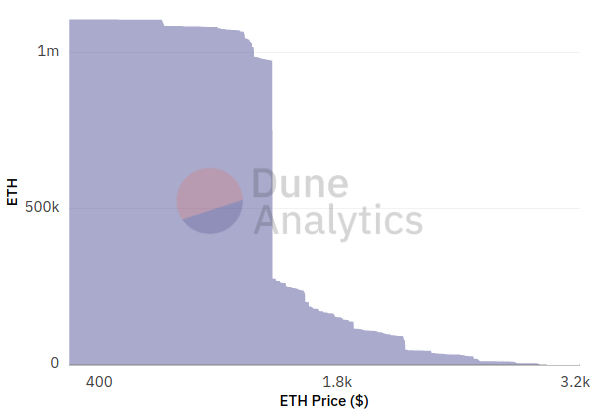

Cumulative Liquidation Price Distribution

With the system’s cumulative liquidation price distribution it is possible to determine the price of ETH that is associated with the liquidation of the system’s ETH collateral.

(source: Dune Analytics)

Analyzing this distribution’s data it is possible to conclude that most of the system’s ETH collateral has an ETH liquidation price of $1485. This spike in the cumulative distribution of ETH’s liquidation price is caused by the aforementioned large Trove position.

Total Liquidations

Liquity’s long term sustainability relies on organic incentives that are sufficiently attractive for stability providers. As LQTY liquidity mining rewards decrease according to the protocol’s inflation schedule, Liquity will rely on ETH liquidation gains to incentivize stability providers. These gains correspond to approximately 10% of the Trove’s liquidated collateral if the liquidation is executed just below 110%.

Given that the returns associated with ETH liquidations cannot be predicted (they depend mostly on ETH’s volatility) it is uncertain whether Liquity’s model that socializes ETH tail risk (thus benefiting borrowers) is sustainable once LQTY rewards become negligible.

| Total Liquidated Collateral | Total ETH Liquidation Gains |

| 666 ETH | 66.60 ETH |

(source: Dune Analytics)

The total liquidated collateral corresponds to the summation of all ETH liquidations since the protocol launched on the 5th of April. Considering that as of now the stability pool has 1.3B LUSD in deposits it is possible to conclude that the incentives associated with ETH liquidations aren’t sufficient for stability providers if LQTY rewards are excluded. Due to this, the protocol will experience a decline in the liquidity that is available in the stability pool to absorb the protocol’s debt when liquidations occur.

As the protocol’s stability pool liquidity declines, ETH liquidation gains will reach a threshold where they are once again attractive to stability providers. It is uncertain if this threshold will be sufficient to support the system’s liquidation mechanism without relying on the protocol’s redistribution system. Furthermore, some stability providers might want to continue contributing to the stability pool to maintain their exposure against ETH price drops that correspond to higher ETH liquidation returns.

It is important to note that during periods of low volatility the stability pool becomes less attractive for stability providers, however, the amount of liquidity that is required to absorb liquidations is also inferior. Constrastingly, during periods of high volatility the stability pool becomes more attractive for stability providers due to an increase in liquidations.

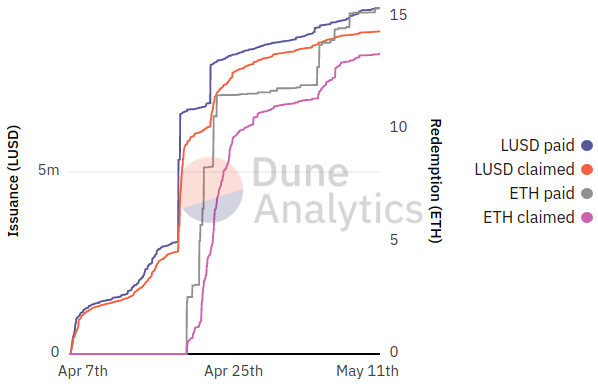

Protocol Revenue

Liquity’s revenue is derived from borrowing and redemption fees that are required to enter and exit the system. Due to the current high demand for ETH collateralized loans the protocol experienced a high revenue growth since its launch in April.

| Metric | LUSD Paid | LUSD Claimed |

| Borrowing Revenue | 9.51M | 8.9M |

(source: Dune Analytics)

| Metric | ETH Paid | ETH Claimed |

| Redemption Revenue | 15.39 | 13.36 |

(source: Dune Analytics)

(source: Dune Analytics)

Analyzing the revenue distribution from borrowing and redemptions, it is possible to conclude that most of Liquity’s revenue (denominated in USD) comes from users entering the protocol. Furthermore, it is relevant to note that on the 18th of April Liquity’s revenue had approximately a 120% increase due to the address aforementioned in “Liquity’s TVL” section. This address opened a large Trove position that immediately impacted the protocol’s borrowing revenue.

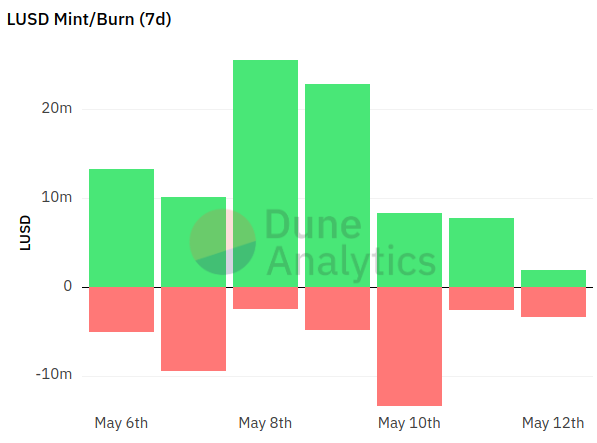

(source: Dune Analytics)

The LUSD Mint/Burn rate confirms that during the last week most of the protocol’s revenue can be attributed to borrowing fees.

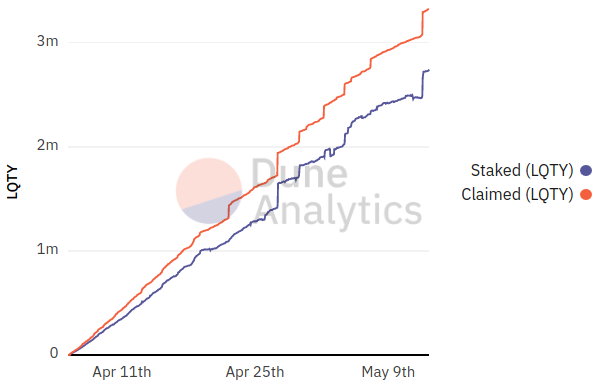

LQTY Token and Staking

Liquity’s secondary token captures the system’s borrowing and redemption fees and distributes that revenue pro rata to LQTY stakers. Borrowing fees are distributed in LUSD and redemption fees are distributed in ETH. Furthermore, these rewards have no lockup period and can be withdrawn at any time.

| Token | Circ. Supply | Max. Supply | Nº of Holders | Price | Staked | Staking APR |

| LQTY | 3.05M | 100M | 3847 | $19.47 | 2.80M | 51% |

(source: Dune Analytics)

(source: Dune Analytics)

Inspecting the total staked LQTY, it is possible to infer that most LQTY liquidity miners are compounding their rewards by staking their LQTY tokens to get exposure to the protocol’s high revenue APR.

Stability Pool

The stability pool is crucial to absorb the LUSD debt associated with liquidations and to guarantee that Liquity’s stablecoin remains fully backed. During periods of low volatility, the stability pool becomes less attractive to stability providers and the amount of liquidity that is required to absorb liquidations is also inferior. Constrastingly, during periods of high volatility the stability pool becomes more attractive to stability providers due to an increase in liquidations.

| Pool | LUSD Deposits | LUSD Utilization Rate | LQTY Remaining | LQTY APR |

| Stability Pool | 1.30B | 84.7% | 30M | 19.73% |

(source: Dune Analytics)

Frontend Operators

Liquity has incentives enshrined in its propotcol to incentivize the creation of multiple frontends in order to further decentralize the protocol’s user interface. These incentives rely on a kickback rate that determines the amount of LQTY rewards that stability depositors receive versus the percentage that is captured by the frontend operator. High kickback rates create strong incentives for stability depositors to use the protocol.

| Frontend | Total LQTY | Frontend LQTY | Depositor LQTY | Active Depositors |

| liquity.app | 1.55M | 16K | 1.53M | 478 |

| eth.liquity.fi | 144K | 0 | 144K | 187 |

| freely.finance | 118K | 135 | 117.90K | 34 |

| lusd.eth.link | 116K | 6.55K | 109.45K | 27 |

(source: Dune Analytics)

Examining the top 4 frontend operators (by LQTY deposits), it was possible to determine that the lowest kickback rate is equal to 95% and the highest rate is equal to 100%. Interestingly, the most popular frontend isn’t “eth.liquity.fi” (100% kickback rate) but it is rather “liquity.app” which has a 99% kickback rate. This is an indicator that the frontend’s UI quality is an important factor for stability depositors while using Liquity.

Liquidity Programs

Currently Liquity has one active liquidity program on Curve to bootstrap LUSD’s liquidity and catalyse its growth and adoption. Furthermore, the protocol had an active liquidity program on Uniswap’s LUSD:ETH pool that lasted for 6 weeks, as of now the pool is no longer incentivized with LQTY rewards.

| Pool | TVL | 24h Volume | Base APY | Rewards APY |

| LUSD/3CRV | $252.5M | $26.3M | 1.79% | +16.70 CRV +11.67 LQTY |

(source: Curve)

Community Metrics

Liquity’s team is extremely active on Discord. Despite the lack of innovation related discussions due to the protocol’s immutable nature, the development team answered promptly all answers that were posed throughout this research. This ease of communication is an important catalyst to onboard new users to the protocol and grow its adoption.

| Social Network | Number of Users |

| Discord | 4.4k |

| 13.4k | |

| Telegram | 12.5k |

(source: Discord, Twitter and Telegram)

Limitations and Risks

While researching Liquity it was possible to conclude that despite the protocol’s resilient liquidation mechanism there are scenarios where the system’s solvency can be jeopardized. Furthermore, its immutable design implies that adjustments at a protocol level for hard-coded parameters are not feasible.

As of now, these are Liquity’s major limitations and risks:

- Liquidations below 100% – If ETH drops by more than 9.09% between two price feed updates, Trove liquidations will be executed at a collateralization ratio that is inferior to 100%. This implies that under such circumstances stability providers would incur in losses;

- Trapped Collateral – The LUSD deposits made by stability providers to the stability pool are slowly drained in return for ETH collateral from liquidated Troves and LQTY rewards. In an extreme scenario where stability providers want to pay their debt to close Trove positions and there is a low availability of LUSD in decentralized exchanges, the stability provider won’t be able to repay his debt. Due to this, that collateral would be locked in the Trove until LUSD became once more available in decentralized exchanges;

- Broken LUSD Peg – Redemptions are made against the system’s riskiest Trove to eliminate debt and maintain LUSD fully backed. As long as there is enough collateral in the system, this mechanism works, however, if a ETH flash crash occurs, or if the protocol experiences mass Trove closures, LUSD’s peg could break due to insufficient USD collateral value to repay redemptions. This scenarios likelihood decreases as the protocol grows its ETH TVL;

- Insufficient Liquidation Reserve – Upon opening a Trove position the protocol charges a 200 LUSD liquidation reserve to cover gas costs in case of an eventual liquidation. Given that this is a hardcoded parameter the protocol won’t be able to update this value if ETH gas costs rise above the liquidation reserve’s value;

- USD Losses for Stability Providers – Given that the LUSD that is deposited into the stability pool is gradually depleted (in exchange for ETH liquidation gains), the stability provider is vulnerable to ETH price fluctuations. These fluctuations can lead to liquidation gains that are inferior to the amount of LUSD that was depleted to cover the liquidated debt. This scenario does not take into account LQTY rewards.

Future Implementations and Improvement Proposals

Liquity’s governance-free nature implies that all protocol parameters are either algorithmically controlled by the protocol itself or preset and immutable. Due to this, the only improvement proposals that can be added to the protocol are the ones related to Liquity’s frontend and integrations within DeFi. Once Liquity’s Chainlink feed is finalized, the protocol will be able to be further integrated in the DeFi ecosystem.

Currently, Liquity’s development team is working on the following integrations:

- Alchemix V2 – Liquity’s development team is working on LUSD’s integration as collateral in Alchemix V2;

- WETH Integration – Liquity.app is developing a Proxy architecture that will allow users to deposit directly WETH into the frontend;

- Reinvestment Mechanism – The protocol’s development team is working on a function that allows users to claim LUSD from staking and directly reinvest it to the stability pool;

Additionally, these are the following improvement proposals that can be added to Liquity’s frontends:

- Trove Risk Display – Displaying the Trove’s risk of being redeemed against would alert borrowers to the possibility of being deleveraged from their positions;

- Rari Fuse Pool Strategy – Liquity could be integrated into Rari Fuse pool thus allowing the deposit of LQTY in Fuse to loan against LQTY. This would allow users to leverage their LQTY while Rari locks LQTY into LQTY staking;

- Stability Providers LUSD depletion – Given that LUSD balances in the stability pool decrease over time, frontends could display a personal record for each Trove address of LUSD redemptions for liquidated collateral;

- Leveraged Yield Farming – A frontend focused on leveraged yield farming could be created. Due to Liquity’s design, this frontend could allow users to deposit ETH and leverage their deposits up to 11x into their assets of choice;

- Compound Mechanism – A function that would allow users to claim LUSD rewards from LQTY staking, swap those rewards for more LQTY and stake them;

Conclusion

The growth of Ethereum’s ecosystem created a high demand for loans collateralized by ETH. Liquity seeks to capture this growing demand with a unique value proposition that offers borrowers low collateralization ratios and interest-free loans that are denominated in its native stablecoin, LUSD.

The protocol is able to offer interest-free loans by replacing floating interest rates with a one time issuance fee that is algorithmically modulated by the protocol’s base rate. This rate reflects market forces thus making loans more or less attractive to borrowers. Additionally, Liquity can provide its users low collateralization ratios due to its stability pool that allows quicker settlements of liquidations when compared to MakerDAO’s liquidation auction model (which requires a price-buffer to account for the auction’s time duration).

In this report it was possible to conclude that Liquity does not rely on third parties to maintain its system’s solvency (i.e. MakerDAO’s third party liquidators). Instead, Liquity socializes ETH tail risk to stability providers thus benefiting borrowers.

The bullish thesis for Liquity is a scenario where the platform leverages its superior user experience for borrowers to catalyze the protocol’s growth and adoption at the expense of liquidity mining rewards and pooled risk for stability providers. This value proposition, supported by Liquity’s interest-free loans and low collateralization ratios, can increase the protocol’s revenue thus reinforcing LQTY’s value accrual model by benefiting its stakers. Present revenue data confirms this high revenue scenario that is reflected in high LQTY staking returns.

The bearish thesis for Liquity lies in the uncertainty of its stability pool sustainability. By pooling risk, stability providers collectively agree to absorb price fluctuations and ultimately act as Liquity’s insurance fund. This would be sustainable if ETH liquidation gains were sufficiently attractive to bear that risk, however, taking into account that it isn’t possible to predict ETH liquidation returns, the protocol will rely on LQTY rewards to incentivize stability providers. Without these rewards, stability providers would rely on ETH volatility scenarios that are high enough to trigger profitable liquidations but low enough to avoid ETH flash crashes that could lead to losses due to the execution of liquidations below a 100% collateral ratio. As LQTY rewards decrease according to Liquity’s emission schedule, the protocol’s stability pool LUSD deposits will decline. If ETH’s volatility decreases alongside LQTY incentives, the protocol will experience a decrease in stability provider’s deposits and the stability pool will shrink to levels that might be insufficient to absorb debt from liquidations. This would imply that the protocol would need to use its redistribution mechanism. In the event of a steep ETH decline or mass Trove closures, Liquity can become undercollateralized and lose its solvency.

In summary, Liquity offers a novel value proposition for borrowers by socializing ETH tail risk to stability providers. The protocol’s long term sustainability will rely on stability providers that act as insurance writers and accept the risk profile that is inherent to the protocol’s unknown long-term liquidation proceeds.

Disclosure: Albaron Ventures maintains policies designed to manage conflicts of interest related to its investment activities. Albaron Ventures abides by a No Trade Policy for the assets listed in this report for 3 days following its public release. At the time of publication, Albaron Ventures does not own LQTY or using the platform.

References

1. Lauko, Robert (2021, April). Liquity: Decentralized Borrowing Protocol, from

https://docsend.com/view/bwiczmy

2. Medium. (2021, March). Liquity Launch Detail. Retrieved May 1, 2021, from

https://medium.com/liquity/liquity-launch-details-4537c5ffa9ea

3. Medium. (2020, July). On Price Stability of Liquity. Retrieved May 3, 2021, from

https://medium.com/liquity/on-price-stability-of-liquity-64ce8420f753

4. Medium. (2021, April). Understanding Liquity’s Stability Pool. Retrieved May 5, 2021, from

https://medium.com/liquity/understanding-liquitys-stability-pool-212cec402db5

5. Liquity. (n.d.). Liquity Documentation. Retrieved May 8, 2021, from

6. Medium. (2021, February). How Faster Liquidations Improve Capital Efficiency. Retrieved May 10, 2021, from

https://medium.com/liquity/how-faster-liquidations-improve-capital-efficiency-5589174f75c0