Introduction

Reflexer Finance is a decentralized borrowing protocol that enables loans denominated in RAI (Reflexer’s non-pegged stablecoin) using Ether as collateral. To deploy this system, the protocol uses the GEB framework which is a modified fork of MakerDAO’s Multi-Collateral DAI.

Unlike pegged stablecoins, RAI is self-referential and it is only pegged to itself. To achieve stability, the protocol uses a PID controller to dampen RAI’s volatility. This novel stablecoin aims to become a decentralized and self-sovereign unit of account that is independent of external monetary policies.

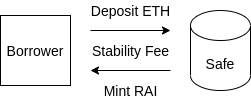

While locking collateral into the protocol, the depositor creates a position called “SAFE” that can mint new RAI. Furthermore, the system requires a minimum collateral ratio of 145%; below this threshold, the borrower’s positions are liquidated through an auction model that relies on third parties (similar to MakerDAO).

Lastly, the protocol has a governance minimized ethos, the current protocol parameters that must be governed will be gradually removed through Reflexer’s governance removal roadmap. This governance minimization allows to progressively remove human control from the protocol thus making it socially scalable.

RAI: Stability and Monetary Policy

RAI is a non-pegged and self-referential stablecoin that relies on a PID controller to dampen its volatility. This controller is based on a “Target Rate Feedback Mechanism” (originally implemented by MakerDAO), and it is responsible for automating RAI’s stability system.

In order to comprehend RAI’s stability mechanism it is necessary to understand the following characteristics of its monetary policy:

- Redemption Price – This is RAI’s target price for secondary markets such as Uniswap, additionally, this price is also enshrined in the protocol and it defines how much RAI can be minted against Ether collateral. The redemption price will fluctuate depending on market forces and it doesn’t target a specific peg;

- Market Price – This represents RAI’s price on secondary markets;

- Redemption Rate – This represents the rate at which RAI is being devalued or revalued depending on the redemption price being higher or lower than the market price. The redemption rate is therefore responsible for adjusting the redemption price (which is RAI’s stability target);

- Global Settlement – If the protocol shuts down the redemption price defines how much collateral can be redeemed from the system;

Taking into account that RAI is a self-referential stablecoin, its peg only requires relative stability. This implies that its initial target price is irrelevant for the system’s functioning (RAI was initialized at $3.14).

When market forces deviate RAI’s market price from its target price, the system’s algorithmic controller automatically sets an interest rate (redemption rate) to incentivize RAI’s market price to be closer to its target price. This “interest rate” represents a readjustment of RAI’s target price and it is done according to its redemption rate.

The protocol’s stability mechanism implies that stronger variations in RAI’s market price will generate higher redemption rates that create stronger incentives to return RAI to its equilibrium (which is reached when RAI’s market price is equal to its target price). In other words, RAI’s redemption rate depends only on the relative difference between the target price and the market price (therefore RAI’s initial price can be arbitrary).

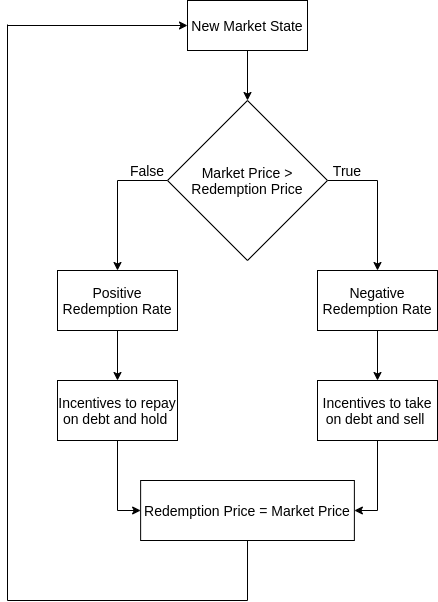

Unlike pegged stablecoins, RAI can have positive or negative interest rates due to its stability mechanism. Supposing that RAI’s market price is below its target price, the system’s redemption rate will be positive. This positive rate will incentivize borrowers to pay back their debts while holders are incentivized to hold. On the other hand, supposing that RAI’s market price is above its target price, the system’s redemption rate will be negative. This negative rate will incentivize borrowers to take out loans while holders are incentivized to sell (note that borrowing protocols such as MakerDAO cannot charge negative rates to incentivize borrowers to take out loans).

Depending on the relative difference that exists between RAI’s market and redemption prices, there is value being transferred between borrowers and holders according to the protocol’s redemption rate. This cycle of transferred value (which is represented in Figure 1) drives RAI back to its equilibrium state.

Despite this robust stability mechanism, RAI only dampens short-term volatility, thus, its redemption price will fully respond to sustained market movements. Due to this, RAI’s long-term price trajectory will be defined by the market’s supply and demand forces.

Governance Removal

Reflexer Finance aims to become a governance minimized protocol that is as automated as possible. To reach this goal, the development team defined a roadmap to remove the vast majority of governance from the protocol’s system.

This roadmap is defined as follows:

- Phase 1 (17th of April 2022) – At this stage the protocol’s liquidation, auction and taxation mechanisms should be governance minimized;

- Phase 2 (17th of August 2022) – Once phase 2 is reached, all core contracts (with the exception of oracles, saviour contracts and the PID controller) should be governance minimized. Furthermore, at this stage all remaining governance should be passed to the community;

Once the governance removal roadmap is concluded, RAI will achieve a minimized governance and the community will only need to govern certain aspects such as the system’s oracle upgrade.

FLX Token

The FLX token is a key component of Reflexer Finance that is required for security incentives, the token has two core functions:

- Lender of last resort – Akin to MakerDAO, Reflexer Finance has surplus and debt auctions. Due to this, FLX is able to capture the protocol’s upside through the buyback and burn mechanism that uses the system’s surplus, and it can absorb the protocol’s risk by minting new FLX through debt auctions if the system becomes undercollateralized;

- Governance Removal – As the governance removal roadmap progresses and the remaining aspects of governance are passed to the community, FLX will be used to facilitate the removal of the remaining governance parameters;

Additionally, FLX can only be minted through the debt auction system and through its genesis allocation that is given as follows:

- GEB Foundation – 35% of the genesis FLX will be distributed to the GEB Foundation. This foundation will be responsible for liquidity programs, development and research of the GEB protocol, and grant programs for developers and the protocol’s community;

- DAO Allocation – 3.39% of the genesis FLX will be distributed to several DAOs that contributed with funding and helped bootstrapping Reflexer. This allocation is subject to a 2 year unlock schedule that will start on the 15th of April 2021;

- Early Supporters – 21% of the genesis FLX will be distributed to early backers of the protocol. This allocation is subject to a 2 year unlock schedule that will start on the 15th of April 2021;

- Reflexer Labs Investors – 11.3% of the genesis FLX will be distributed to Reflexer Labs investors. This allocation is subject to a 2 year unlock schedule that will start on the 15th of April 2021;

- Reflexer Team, Advisors and Service Providers – 20% of the genesis FLX will be distributed to team members, advisors and service providers that developed the GEB protocol. This allocation is subject to a 2 year unlock schedule that will start on the 15th of April 2021;

- Reflexer Labs – 9.31% of the genesis FLX will be corporate property of Reflexer Labs. This allocation has no lockup period and it can be used at the corporation’s discretion.

Safe

Borrowers can use Reflexer’s platform to obtain RAI denominated loans. To do so, it is necessary to open a Safe position and deposit ETH as collateral. Similarly to MakerDAO’s collateral debt positions, Safes enable the management of the depositor’s collateral ratio.

The minimum collateral ratio that is allowed per Safe is set at 145%. Below this threshold, the Safe position becomes eligible for liquidation and it incurs a liquidation penalty of 12% which is added to the Safe’s debt.

Safe depositors are subject to a fixed stability fee of 2% and a variable redemption rate that can incentivize depositors to repay their debt or take on new loans. To close a Safe, the user must pay its debt which is equal to the amount of RAI that was minted plus the stability fees.

Furthermore, there is a minimum amount of 800 RAI that must be generated per Safe. This guarantees that if a liquidation takes place the Safe has sufficient collateral to cover the sum of its debt, gas costs, and incentives for keepers (third parties that act as liquidators).

Lastly, it is possible to buy cover protection provided by Nexus Mutual directly from Reflexer Finance’s application. This contract covers events such as contract bugs, economic attacks (including oracle failures), and governance attacks.

Liquidations

The liquidation mechanism is necessary to ensure that RAI remains backed by the appropriate amount of collateral that is required by the protocol. When a Safe’s collateral falls below the liquidation ratio (set at 145%) it becomes eligible for liquidation.

This process is carried out by Keepers that are incentivized to monitor Safes that become undercollateralized. This class of users guarantees that the protocol maintains the required surplus of collateral.

During the liquidation process, enough collateral is sold through the collateral auction to cover the Safe’s debt plus a liquidation penalty that is set at 12%. The remaining collateral is then available for withdrawal.

The liquidation penalty is a fee that is paid by Safe owners when a liquidation takes place. This penalty is added to the Safe’s total outstanding RAI which results in more collateral being sold through the auction mechanism.

If there are no bidders to absorb the Safe’s debt in the collateral auction, the system proceeds to use its surplus buffer to liquidate this position. The surplus buffer captures the protocol’s revenue from stability fees and liquidation penalties. Currently, the minimum system surplus is set at 506K RAI, above this threshold, the protocol uses the system’s revenue to buyback and burn the protocol’s token.

Considering that the surplus buffer is insufficient to absorb the system’s debt, the protocol initiates a debt auction where third parties place bids to cover the outstanding debt in exchange for newly minted FLX tokens. This implies that FLX holders are diluted in order to absorb protocol debt and guarantee the protocol’s solvency.

Safe Liquidation Protection

Reflexer Finance has a liquidation engine that is able to integrate external insurance contracts (named saviours) to the protocol’s Safes. Through this mechanism, Safe users can add insurance contracts to their position thus attaining an extra layer of protection against liquidation. New insurance contracts can be built and proposed to be whitelisted through the protocol’s governance process.

As of now, these are the saviours that can be added to Safes:

- Uniswap System Saviour – This saviour withdraws liquidity from Uniswap (V2 and V3), swaps one of the tokens for the Safe’s collateral and repays debt and/or adds collateral to the Safe in order to avoid its liquidation;

- Native Underlying Uniswap Saviour – This saviour withdraws liquidity from Uniswap (V2 and V3) and repays debt and/or adds collateral to the Safe in order to avoid its liquidation;

This Safe Protection mechanism is a novel concept in DeFi that was introduced by Reflexer Finance. Besides adding an additional layer of protection to a Safe, this mechanism enables a high capital efficiency for users that want to utilize RAI in other DeFi protocols while simultaneously protecting their positions.

Liquidity providers that contribute to Uniswap’s RAI/ETH pool are one example that illustrates this new layer of composability. They can earn yield over their capital and additionally they can deposit LP tokens into the saviour contract to protect their Safe.

Auctions

Reflexer Finance relies on an auction mechanism to maintain the protocol’s collateralization and balance. This system is identical to MakerDAO’s and it also relies on a third party to bid on the auctions.

These external actors are called Keepers and they are incentivized to monitor the protocol and trigger liquidations when the liquidation threshold is breached. Keepers can participate in auctions to acquire ETH collateral, FLX debt and RAI surplus at discount prices.

Collateral Auction

When a liquidation takes place, the system sells off the Safe’s collateral until its outstanding debt (plus a liquidation penalty), is fully covered. This process is done through a collateral auction where the winning bidder pays RAI for collateral from a liquidated Safe at a fixed discount of 10%. The RAI received is used to cover the outstanding debt in the liquidated Safe.

Surplus Auction

The stability fees and liquidation penalties collected by the protocol are accumulated in a surplus buffer that has a threshold of 506K RAI. When this threshold is reached the protocol starts to auction the system’s surplus in batches of 6K RAI.

The surplus auction relies on bidders that compete with increasing bids of FLX for the RAI surplus. When the auction ends, the auctioned RAI is sent to the winning bidder and the FLX proceeds are burnt by the system. This buyback and burn mechanism reduces the amount of FLX in circulation and it represents a protocol revenue distribution to FLX holders.

Debt Auction

In the event of a failed collateral auction or a sharp drop in the collateral’s price, there can be debt in liquidated Safes that must be absorbed by the system. The first mechanism that is used by the protocol to eliminate this debt is the system’s surplus buffer. If this is not sufficient to cover the Safe’s debt the protocol will then initiate a debt auction. This auction is used to recapitalize the system by auctioning off FLX for RAI. Bidders compete with RAI for decreasing amounts of FLX. The winning bidders pay RAI for FLX to cover the protocol’s outstanding debt and FLX is minted by the system. Through this process, FLX supply increases, its token holders are diluted and the system’s debt is repaid.

Global Settlement

The Global Settlement mechanism allows Reflexer Finance to shut down its system and reimburse both Safe users and RAI holders with the collateral that is locked in the protocol. These users can then redeem collateral from the system, the amount of collateral that can be redeemed by each user is determined by RAI’s redemption price.

During the redemption process, Safe users are prioritized and they are the first ones to be allowed to redeem their collateral if their Safe is above the liquidation threshold.

The Global Settlement mechanism obeys the following settlement stages:

- System Shutdown – The system freezes user entry-points, cancels auctions and starts the cooldown period;

- System State – The system state is processed by reading off the price feed and setting a value for the protocol’s collateral. To do this, it is necessary to consider under-collateralized Safes and the system’s deficit and surplus;

- Safe Processing – During the safe processing stage, the system cancels debt from Safes. Excess collateral remains untouched and backing collateral is removed;

- Fast Track Auction – Ongoing auctions are canceled and their collateral is seized.

- Free Collateral – This stage allows the removal of collateral from Safes;

- Outstanding Coin Supply – This function fixes the total outstanding supply of coins;

- Cash Price – This step calculates the amount of system coins per unit of collateral and it adjusts the cash price in the case of system deficit or surplus. Once this stage is concluded, RAI holders can claim their collateral;

- Redeeming Preparation – Holders transfer their RAI and initiate their collateral claim;

- Redeeming Collateral – In this final stage holders are able to exchange RAI for ETH collateral;

Tokenomics

Reflexer Finance has two different tokens, RAI, which is the protocol’s non-pegged stablecoin that is overcollateralized by ETH, and FLX, which is the value accrual token that captures simultaneously the protocol’s upside and risk.

The system’s stability mechanism implies that RAI ignores small and short-lived market movements, however, the stablecoin’s market and redemption prices will respond to prolonged and sustained market movements. Due to this, RAI’s long term price trajectory is unknown and it is determined by the market’s supply and demand for RAI and ETH leverage.

Despite the existing similarities with MakerDAO, Reflexer Finance has a governance minimized ethos. Because of this, FLX’s governance rights over the protocol are extremely limited and its centralization among token holders does not represent a major liability to the protocol’s governance.

The protocol’s sources of revenue are stability and penalty fees. Considering that the system is able to protect itself from debt creation exclusively through overcollateralization, these fees will be accumulated in the surplus buffer. These proceeds are subsequently used in surplus auctions to buy back and burn FLX. Otherwise, if the system isn’t able to cover its outstanding debt, this surplus buffer will be used. If that is not sufficient to cover the protocol’s liabilities, a debt auction takes place and FLX is minted to eliminate the system’s outstanding debt.

This stability mechanism ensures that RAI remains overcollateralized and the protocol’s success and failure is reflected in its FLX token. As a result, FLX has a variable supply that increases with debt auctions (dilution to absorb debt), and decreases with surplus auctions (revenue distribution). The interests of FLX token holders are thereby aligned with the protocol and both risks and gains are shared.

Lastly, if Reflexer Finance expands the forms of collateral that are accepted by the protocol there will be an increase in RAI’s demand due to the new types of leverage that will be created. The addition of new forms of collateral is generally conservative and its expansion should be carefully evaluated.

Reflexer Finance Analysis

Redemption and Market Price

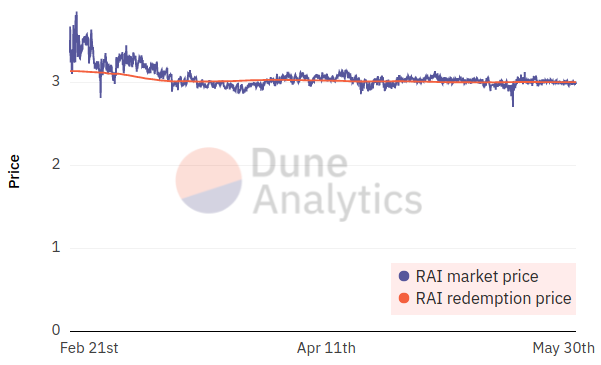

Reflexer Finance uses a PID controller to stabilize RAI. This controller proportionally opposes market forces with a redemption rate that incentivizes users to return RAI to its redemption price whenever a deviation occurs. Due to this, RAI’s redemption rate will dampen market forces thus ignoring small and short-lived movements. Figure 3 shows RAI’s redemption and market prices in US dollars.

(source: Dune Analytics)

As expected, RAI’s redemption price filters short term price action that is only reflected in RAI’s market price. According to present data, it is possible to conclude that RAI’s stability mechanism has been successful and RAI’s market price has so far converged to its redemption price.

This stability mechanism has sustained severe market crashes (such as the one observed on the 19th of May), with a quick subsequent price convergence from RAI’s market price to RAI’s redemption rate (-3.90% deviation during the crash).

The convergence between RAI’s market and redemption prices is incentivized through the protocol’s redemption rate that acts as the lever that stabilizes the system. Unlike MakerDAO, Reflexer Finance uses a 2% fixed stability fee to price risk.

RAI Metrics

Reflexer’s debt is denominated in its native stablecoin, RAI. As aforementioned, this is a non-pegged stablecoin that is overcollateralized by ETH and stabilized with a PID controller.

| Token | Market Price | Redemption Price | Redemption Rate (8-hourly) | Supply | Market Cap. |

| RAI | $2.98 | $3.01 | 0.003% | 10,854,795 | $32.5M |

(source: Coingecko and Reflexer Finance)

Considering that RAI’s current market price is below the protocol’s redemption price, the redemption rate needs to be positive to restore both prices back to equilibrium. This positive redemption rate implies that RAI will appreciate in value. As a result, safe depositors are incentivized to repay their debt and RAI holders are incentivized to hold.

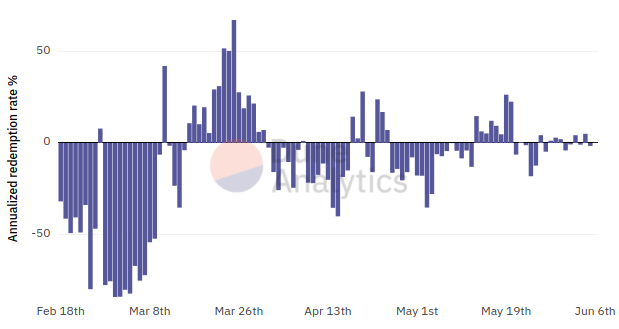

While conducting this report it was possible to observe that Reflexer’s UI occasionally displays a redemption rate that doesn’t reflect the existing relation between the market and redemption prices. Upon further research it was determined that Reflexer only updates the rate setter in 8 hour periods, therefore there can be a rate mismatch. Figure 4 depicts the oscillation between periods with positive and negative redemption rates.

(source: Dune Analytics)

Positive rates correspond to periods when RAI’s market price is below the redemption price while negative rates correspond to periods when RAI’s market price is above the redemption price.

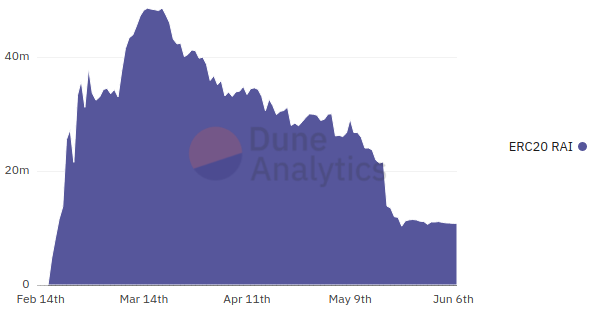

Figure 5 shows RAI’s outstanding supply over time. From this fluctuation, it is possible to infer that the decline in RAI’s outstanding supply signals a decreased interest in RAI as a stablecoin. This can be largely attributed to DeFi’s demand for stablecoins pegged to the U.S. Dollar as a medium of exchange and collateral.

(source: Dune Analytics)

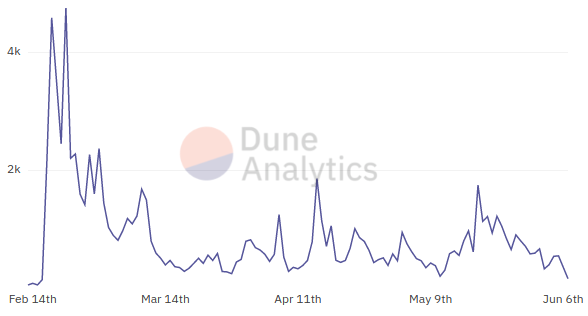

A steep decline in RAI’s outstanding supply can be attributed to large Safe holders that closed their positions for multiple reasons such as a reduced interest in RAI as a stablecoin, a reduction in Reflexer’s inflationary incentives to provide liquidity to RAI, or an ETH leverage reduction. In order to assess if RAI’s outstanding supply decrease corresponds to a reduction in its adoption metrics, it is important to evaluate the fluctuation in daily active RAI wallets. Figure 6 represents this fluctuation.

Analyzing figure 6, it is possible to observe that the number of daily active RAI wallets is at an all-time low. Due to this, it is possible to deduce and confirm that the decline in RAI’s outstanding supply is motivated by a decrease in Reflexer’s active users.

(source: Dune Analytics)

FLX Metrics

FLX is responsible for aligning protocol incentives related to the system’s debt and surplus. Similar to MakerDAO’s MKR token, FLX shares the system’s surplus among its holders through a buyback and burn mechanism while simultaneously sharing the system’s risk that stems from the protocol’s debt auctions. Besides its genesis allocation, FLX can only be minted through the debt auction or burnt through the surplus auction.

| Token | Market Price | Circulating Supply | Market Cap. | Nº of Holders |

| FLX | $240.41 | 57,577 | $13.84M | 1558 |

(source: Coingecko)

Total Value Locked

The protocol’s Total Value Locked (TVL) represents an important metric while evaluating the adoption scale of a protocol. Additional metrics are also required to guarantee a holistic approach to the protocol’s adoption and to avoid skewed indicators that can be influenced by external factors such as inflationary incentives.

| TVL | Nº of Safes | Nº of RAI Holders | Nº of FLX Holders |

| 42K ETH ($90.13M) | 2002 | 1918 | 1560 |

(source: Dune Analytics and Reflexer Finance)

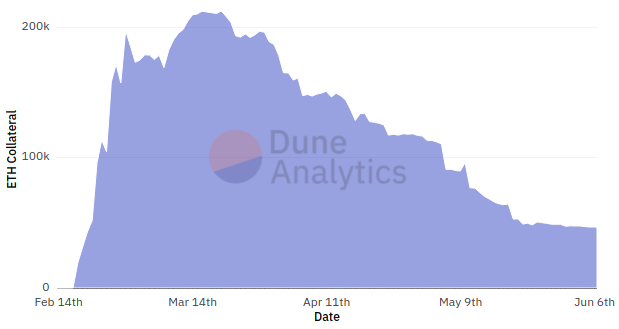

Furthermore, it is necessary to analyze these metrics as a function of time to determine current adoption trends. Figure 7 represents Reflexer’s TVL over time.

(source: Dune Analytics)

Analyzing the variation of Reflexer’s TVL over time it is possible to conclude that it has been downtrending since March. Considering that the demand for ETH leverage hasn’t experienced this decay in the DeFi ecosystem, it is possible to infer that this decline signals a decreased interest in RAI denominated loans.

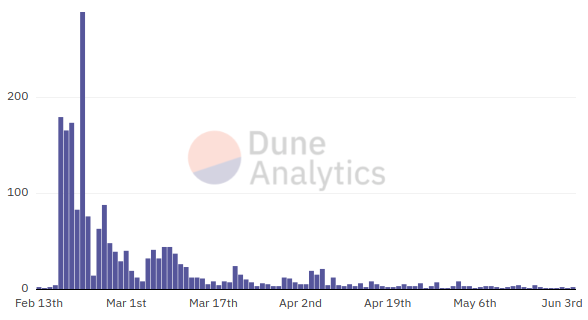

Lastly, Figure 8 demonstrates that the number of Safes created per day has also experienced a severe decline. Currently, there are merely 397 active Safe positions.

(source: Dune Analytics)

System Surplus and Revenue Metrics

Reflexer Finance’s revenue is derived from stability fees (fixed at 2%) and liquidation penalties that are applied whenever a Safe is liquidated. These fees are equally split to the protocol’s treasury and system surplus.

| Token | System Surplus | Treasury Surplus | Total Surplus |

| RAI | 334,865 RAI | 88,170 RAI | $1.3M |

(source: Dune Analytics)

Once the system surplus reaches 506K RAI (which is the protocol’s reserve for black swan events), the protocol will begin to auction the additional surplus in the surplus auction. This auction will be triggered in batches of 6K RAI whenever this amount is accrued on top of the system’s 506K RAI reserve.

The treasury surplus is a reserve that is meant to pay for oracle, PID and state management costs for at least 6 months. Considering that the protocol’s revenue is equally distributed among the treasury and system surplus, it is possible to conclude that so far Reflexer Finance has spent 246,695 RAI in its operational costs (which is the system surplus minus the treasury surplus).

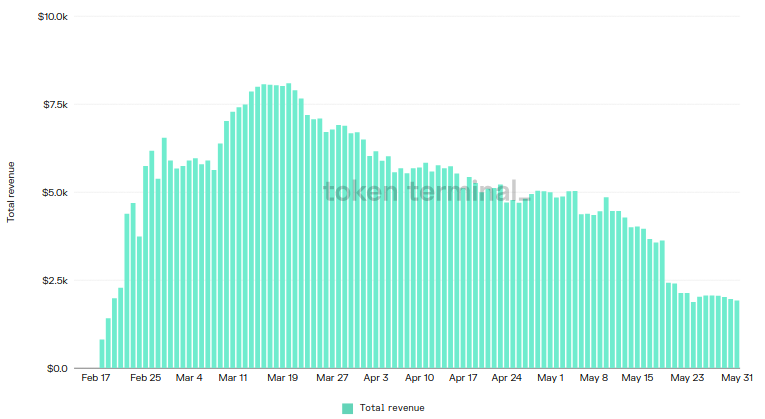

Figure 9 shows that Reflexer’s revenue peaked in March and it has been downtrending ever since. This decrease in protocol revenue represents a -76.5% decline from its peak.

(source: Token Terminal)

RAI Utilization Metrics

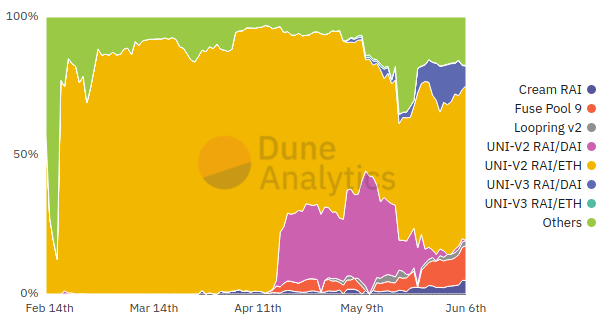

The supply distribution associated with a stablecoin is an indicator that enables the assessment of its intrinsic utility. As a general rule, highly distributed utilization rates imply a strong integration and adoption within the DeFi ecosystem. Contrastingly, scarcely distributed utilization rates generally imply limited use cases which hinder the value proposition associated with the stablecoin under analysis. Figure 10 shows RAI’s supply distribution over time.

(source: Dune Analytics)

| Metric | CREAM | Fuse | Uni-V2 RAI/ETH | Uni-V3 RAI/DAI | Uni-V3 RAI/ETH | Loopring | Others |

| Utilization | 4.9% | 12.5% | 55.5% | 7.2% | 0.2% | 2% | 17.7% |

(source: Dune Analytics)

From RAI’s supply distribution it is possible to conclude that the stablecoin is integrated into multiple DeFi protocols. As of now, the largest RAI allocation is concentrated in Uniswap V2 RAI/ETH pool, however, this capital allocation will gradually be transferred to Uniswap V3. This capital migration has already happened from Uniswap V2 RAI/DAI pool (which has since deprecated) to Uniswap V3 RAI/DAI pool. Besides the protocols listed above, RAI is also integrated in Sushiswap’s Kashi pool and Idle Finance.

Total Liquidations

The revenue associated with Reflexer Finance relies on stability fees and liquidation penalties, therefore, an analysis of the protocol’s total liquidations allows to estimate the revenue generated by the system through liquidated Safes. During periods of high volatility, the protocol’s stability fees generally decrease due to a reduction in demand for ETH leverage. As a result, liquidation penalties represent an important hedge against volatility for Reflexer’s revenue.

| Liquidation Penalty | Total Liquidations | Total Revenue |

| 12% | $8.11M | $0.97M |

(source: Dune Analytics)

RAI Incentive Program

Currently, Reflexer Finance has ongoing incentive programs that aim to bootstrap RAI’s liquidity and catalyze its adoption. This distribution rewards liquidity providers with Reflexer’s FLX token.

| CREAM | Fuse Pool 9 | Kashi Pool | Uniswap V2 | Idle Finance |

| 15 FLX/day for Borrowers | 15 FLX/day for Borrowers | 10 FLX/day for Borrowers | 334 FLX/day for LPs | 10 FLX/day for Lenders |

(source: Reflexer Finance)

Community Metrics

An active community can be a catalyst for both innovation and protocol adoption. Throughout this report it was possible to observe that such contribution from Reflexer’s community is negligent, nonetheless, the development team is extremely active on Discord and answered all questions promptly.

| Social Network | Number of Users |

| Discord | 5k |

| 10.8k |

(source: Discord, Twitter and Telegram)

Limitations and Risks

Reflexer Finance has a governance minimized ethos that is enabled through the algorithmic stability of RAI which is executed by the system’s PID controller. Given that PID controllers represent a novel concept within stablecoin stability systems, there are several failure scenarios that need to be addressed while analyzing the risks that are inherent to this mechanism. Furthermore, there are governance-defined parameters that might be suboptimal and can jeopardize the system’s auctions and settlement mechanisms.

As of now, these are Reflexer Finance’s major limitations and risks:

- Lack of Liquidity on Exchanges – The PID controller relies on RAI’s market price to adjust the system’s redemption rate, if the percentage of RAI’s total outstanding supply that is available on exchanges sharply decreases, its stability mechanism will be hindered due to unreliable market price data;

- Positive Feedback – Reflexer Finance relies on its PID controller’s negative feedback mechanism to maintain RAI’s stability, regardless, even with sufficient liquidity on exchanges, it is possible that the market might not react to the redemption rate incentives and RAI’s redemption price becomes unstable (trending for an extended period of time in a single direction). In control theory, this would correspond to a positive feedback mechanism that would render RAI unstable;

- PID Interference – Considering that the protocol’s governance creates a liquidity program that incentivizes RAI’s growth, the system can become unstable due to inferences with the protocol’s PID controller;

- Suboptimal Parameters – The parameters defined through governance can be suboptimal and lead to inefficient collateral auctions (fixed discount incentives might not be sufficient) and debt auctions (excessive printing of FLX);

Future Implementations and Improvement Proposals

Reflexer Finance liquidation protection mechanism enables a new form of capital efficiency that leverages DeFi’s composability in favour of its borrowers. Aside from the implementations that will be addressed below, this new mechanism allows further improvements that have the potential to further integrate RAI within the DeFi ecosystem.

Currently, Reflexer’s development team is working on the following integrations:

- FLX Staking – The protocol’s development team is working on a staking function that allows user to stake FLX and earn a share of the system’s surplus;

- Multi-Collateral – Reflexer’s development team is ideating the expansion of collateral for its stablecoin beyond ETH;

- Increasing Discount Collateral Auction – The protocol’s team is developing an increasing discount collateral auction to improve the system’s resilience in the event of a black swan event. This system creates increasing incentives for bidders if the demand for liquidated collateral is too low;

Additionally, these are the following improvement proposals that can be added to Reflexer Finance:

- Yearn Saviour – Once Yearn creates a vault for RAI the protocol can implement a new saviour focused on Yearn that is able to lend RAI to its vaults and repay a Safe’s debt in a liquidation event;

- Money Market Saviour – This saviour can lend RAI to money markets and repay the Safe’s debt when the safe reaches its liquidation ratio. This saviour can be generalized to money markets such as AAVE and Compound;

- Alternative Redemption Rate Basis – The protocol could change its redemption rate basis to track the U.S. Dollar inflation instead of its value. This would effectively bound the redemption rate to a U.S. Dollar index that would be adjusted to its inflation;

Conclusion

The expansion of DeFi created a new financial ecosystem that requires stability for both collateral and exchange purposes. To fulfil its utilitarian value proposition, the DeFi ecosystem adopted stablecoins pegged to the U.S. Dollar as reserve assets. This logical adoption implies that DeFi’s decentralized nature is subject to the centralized inflationary policies of the US Federal Reserve.

Reflexer Finance aims to provide an alternative to pegged stablecoins as a novel form of collateral and reserve asset for DeFi protocols. For this purpose, the protocol relies on its non-pegged native stablecoin, RAI, which is self-referential and exclusively backed by ETH. In order to achieve credible neutrality, Reflexer Finance acknowledges that control is a liability. As a result, the protocol has a governance minimized ethos that is carried out through its governance removal roadmap.

The bullish thesis for Reflexer Finance lies in a growing demand for an independent and stable unit of account. This scenario could be catalysed by a macroeconomic context where the U.S. Dollar is subject to high rates of inflation caused by the excessive growth of its money supply. This hypothesis would validate RAI’s value proposition which can be seen as a hedge to the U.S. Dollar. Considering that RAI becomes widely integrated within the DeFi ecosystem, the protocol can become an attractive solution for security cautious borrowers through Reflexer’s novel liquidation protection mechanism which allows a capital efficient management of borrower’s funds that are external to the protocol. This mechanism is executed through “saviour contracts” that are able to use capital that is allocated to liquidity pools (i.e. Uniswap’s RAI/ETH pool) as an extra layer of security against liquidations. Furthermore, Reflexer’s stability mechanism enables positive and negative interest rates that incentivize borrowers to repay or contract new loans depending on RAI’s market price (this isn’t possible in pegged stablecoins such as DAI). With this robust stability system in place, the protocol is able to offer 2% fixed stability fees which accrue to the protocol’s surplus reserve. This fixed stability fee is extremely competitive when compared to the variable stability fees that are offered by other protocols such as MakerDAO.

The bearish thesis for Reflexer Finance (which is corroborated with present data) is that the demand for stablecoins pegged to the U.S. Dollar will maintain its current uptrend thus hindering RAI’s adoption within DeFi. In fact, while analyzing Reflexer’s revenue metrics, it was possible to conclude that the protocol has experienced a steady downtrend since March. Given that the protocol’s revenue is a function of the demand for ETH leverage, and taking into account that such demand is a reflection of market cycles, it is possible to infer that a steep revenue decline during a bull market signals a reduced interest in RAI as an alternative to pegged stablecoins. Furthermore, taking into account that RAI is self-referential, it is excluded from pegged decentralized exchanges such as Curve that are crucial elements of the DeFi ecosystem.

In summary, RAI represents a long-term hedge against the U.S. Dollar dependency that exists within DeFi and it does so by providing an independent and stable unit of account. Present market conditions imply that the demand for non-pegged stablecoins will remain extremely limited for the foreseeable future. Despite its current lack of adoption and declining revenue metrics, novel layers of capital efficiency (such as the liquidation protection mechanism), reveal Reflexer’s potential to innovate and improve its value proposition for borrowers that seek ETH leverage with fixed stability fees.

References

1. Reflexer Finance. (n.d.). Reflexer Documentation. Retrieved May 19, 2021, from https://docs.reflexer.finance/

2. Medium. (2020, October). Introducing Proto RAI. Retrieved May 21, 2021, from

https://medium.com/reflexer-labs/introducing-proto-rai-c4cf1f013ef

3. Medium. (2021, February). Introducing FLEX. Retrieved May 23, 2021, from

https://medium.com/reflexer-labs/introducing-flx-20755214a465

4. Medium. (2021, February). Crypto Native Stability. Retrieved May 24, 2021, from

https://medium.com/reflexer-labs/rai-is-live-f151490b1b02

5. G.C. Goodwin et al. (2001). Control System Design. Retrieved May 25, 2021.