It’s clear that Fixed Rate Lending in DeFi was the first big use case. What’s more, DeFi is barely scratching the surface of its growth potential compared to traditional financial markets.

On March 15, 2021, Ray Dalio published an article on the decline of bonds and the need for alternative investments, saying “Nominal bond yields are just off the lowest ever made a couple of weeks ago”. Delphi Digital, leading crypto research and consulting firm, elaborated on Ray Dalio’s bond article with a deeper dive on bonds, leading to the following conclusion: “The reallocation away from sovereign debt, specifically U.S. Treasuries, in favor of alternative assets will serve as another long-term tailwind for bitcoin and crypto-assets”.

Can institutions move into DeFi? A big challenge for the DeFi lending space so far has been market volatility and floating rates. This has led to the emergence of fixed-rate (and fixed-term) products such as Notional, BainBridge, 88mph, Hifi (formerly Mainframe), and Yield.

Notional Finance

Launched in late 2020, Notional Finance is a fixed-rate lending protocol. It offers lending/borrowing with USDC and DAI. It currently supports ETH, DAI, WBTC, and WETH as collateral. Notional doesn’t have a token yet, but they’re planning to decentralized governance through a native token.

Hifi Finance

Hifi Finance (formerly Mainframe) fixed-rate, fixed-term lending protocol powered by zero-coupon bonds. The protocol issues synthetic assets called fyTokens (fixed-yield tokens), which can track any underlying asset (e.g. USDC). Borrowers would mint fyUSDC by depositing collateral, which can be any asset, say ETH. After the expiry date, any holder of fyUSDC would be able to redeem it in exchange for USDC.* HiFi launched its fixed-rate lending product on Feb 17th and is governed by the MFT token. An important part of the Hifi ecosystem is Sablier.Finance (a money streaming protocol with over $300M TVL), acquired by MFT in July 2020. At the moment, liquidity on HiFi is limited (can’t lend more than $15K and rates drop drastically for lending over $5K).

*Source: HiFi Protocol Overview

88mph

88mph offers both fixed and floating rate bonds. It incentivizes liquidity mining through rewards in MPH, the platform’s native token. While the MPH token will be used for governance of 88mph, it also provides revenue incentives/share from protocol fees and yield farming rewards for holders who stake their MPH into the platform.

BarnBridge

BarnBridge focuses on tokenizing interest rate volatility risk and market price exposure risk through tranches. Their Smart Yield product tokenizes risk by splitting it into tranches with different fixed yields and risk profiles (Smart Yield is set to launch by Q2 2021). BarnBridge’s second product – Smart Alpha bonds, is aimed to mitigate market price volatility through risk ramps – tranches with different market price exposure (as compared to different yields in Smart Yield). The project is DAO-governed through its $BOND token.

Yield

Yield is an over-collateralized fixed-rate, fixed-term lending protocol that currently works solely with DAI. Similar to Hifi, Yield uses fyTokens (such as fyDAI for DAI collateral). For example, users can buy 1 fyDai that settles a year from today for 0.95 Dai. The Yield protocol doesn’t have a native token yet.

Lending APY comparison

| Fixed APY | Rewards APY | Rewards APY Token | |||

| USDC | DAI | USDC | DAI | ||

| 88mph | 3.11% – 4.15% | 3.92% | 32% – 64 * | 32.14%* | MPH |

| Hifi | 5.22%** | – | – | – | – |

| Notional | 6.25% | 9.06% | – | – | – |

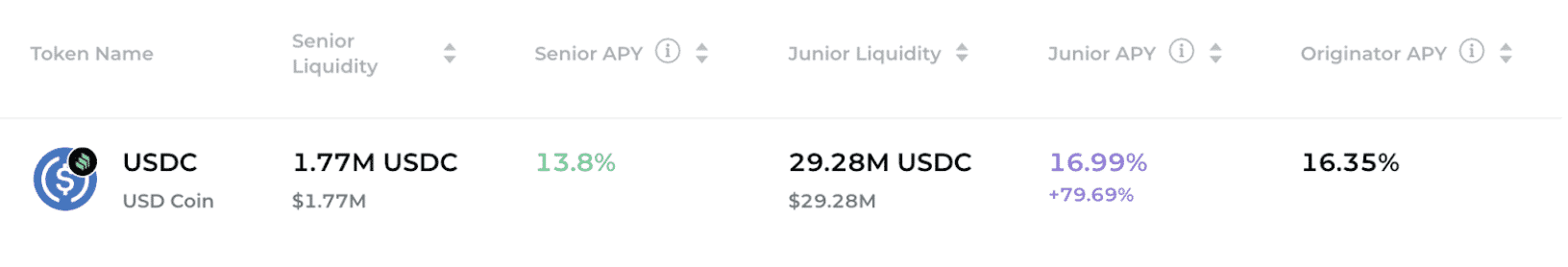

| BarnBridge | 13.8-16.99%*** | – | 79.69%*** | – | BOND |

| Yield | – | 2.81% – 5.74%**** | – | – | – |

*88mph also distributes temporary APY in MPH which needs to be paid back at the time of withdrawal. The USDC rates depend on whether lending is done through Compound or Aave.

**Hifi rates change drastically depending on volume. The percentage is shown for a $10K deposit, while there’s not enough liquidity to lend more than $15K

*** BarnBridge rates depend on bond seniority (junior/senior), while the Additional APY is only distributed to junior bondholders for 25 weeks starting 1st of April

**** Yield rates depend on term/maturity.

Market Cap / Total Value Locked

| Circulating Market Cap | Total Value Locked | Market Cap / TVL | % of TVL in liquidity mining (not core product) | |

| 88mph | $52,478,491 | $50,295,926 | 1.06 | 12% |

| Hifi | $285,275,086 | $204,013* | 1398.31 | |

| Notional | $13,301,142 | – | ||

| BarnBridge | $88,277,797** | $403,703,038 | 0.218 | 91.9% |

| Yield | – | – | – |

* Hifi has $204K in total debt on the platform and no liquidity mining program

** For BarnBridge, the circulating supply from the official website is used, multiplied by the current market price to calculate CMC. The supply on coingecko is significantly lower than the one on the official website.

- Hifi (MFT) has the highest-circulating market cap, however, the token has been around since 2018.

- BarnBridge has the most attractive Market Cap / TVL ratio, however, >90% of the liquidity is in the liquidity mining program which is about to end.

- Hifi has a very low TVL compared to its market cap.

- 88mph’s core product (fixed-rate lending) has the most traction out of all protocols

Token Utility

MPH (88mph) – The MPH token is used for governance, liquidity mining, and additional rewards to 88mph’s fixed-rate products. For example, users can earn 5.9% APY on their DAI an additional 23% APY in MPH (APY varies with MPH price). Stakers of MPH earn a % of protocol fees. In the future, the protocol will also enable yield farming rewards to be earned through protocols in the 88mph ecosystem.

Hifi (MFT) – MFT tokens were launched back in 2018. While not part of the current protocol, Hifi tokens are planned to be used for decentralized governance and liquidity mining in the future. The roadmap also includes a transition from MFT tokens to the new HiFi tokens.

BOND (BarnBridge) – The BOND token is used for the governance of the BarnBridge DAO. To participate in governance, users can stake their BOND tokens and they will also receive additional staking rewards. APY rewards and voting power can increase by up to 2x if holders lock their tokens for up to 1 year. The BOND token can also be used in projects within the BOND ecosystem. The first one that has been integrated is Bond.Bet: a decentralized gambling platform that launched a “no-loss-lottery” (a fork of Pool Together) and will expand to no-loss-slots and p2p sports betting.

Notional – The platform doesn’t use a native token at the moment.

Yield – The platform doesn’t use a native token at the moment.

Analytics

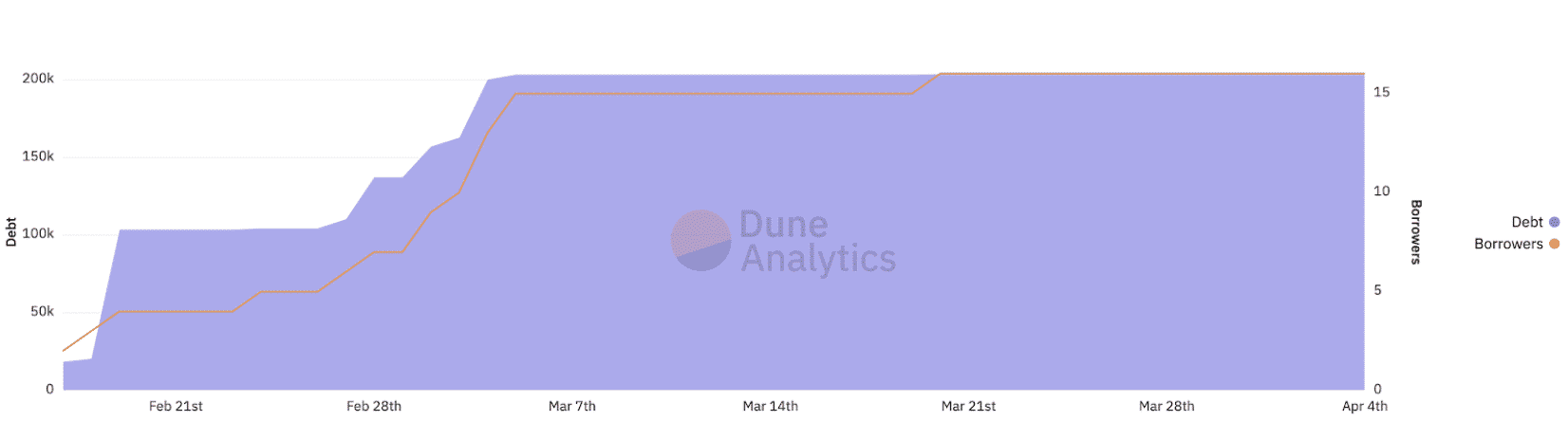

HiFi – Total Debt and Borrowers

- There has been $200K of debt on the HiFi platform, spread across 15 borrowers.

- Only $400 of debt has been generated from the 6th of March onwards.

BarnBridge: Smart Yield bonds overview

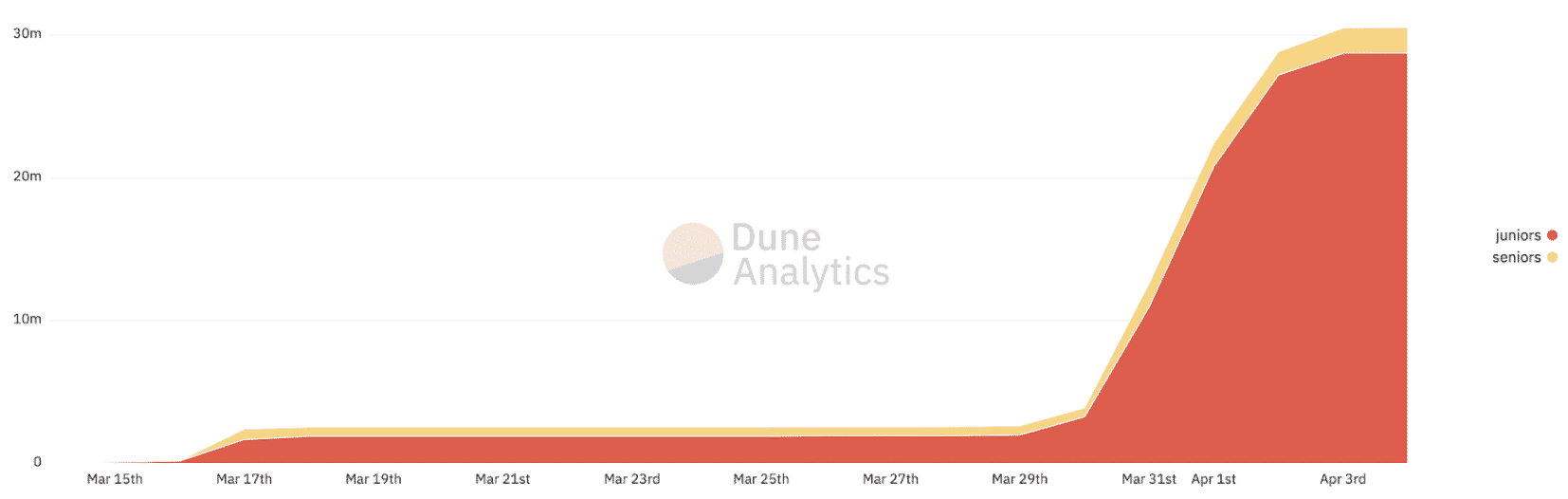

BarnBridge: TVL in Smart Yield by bond seniority

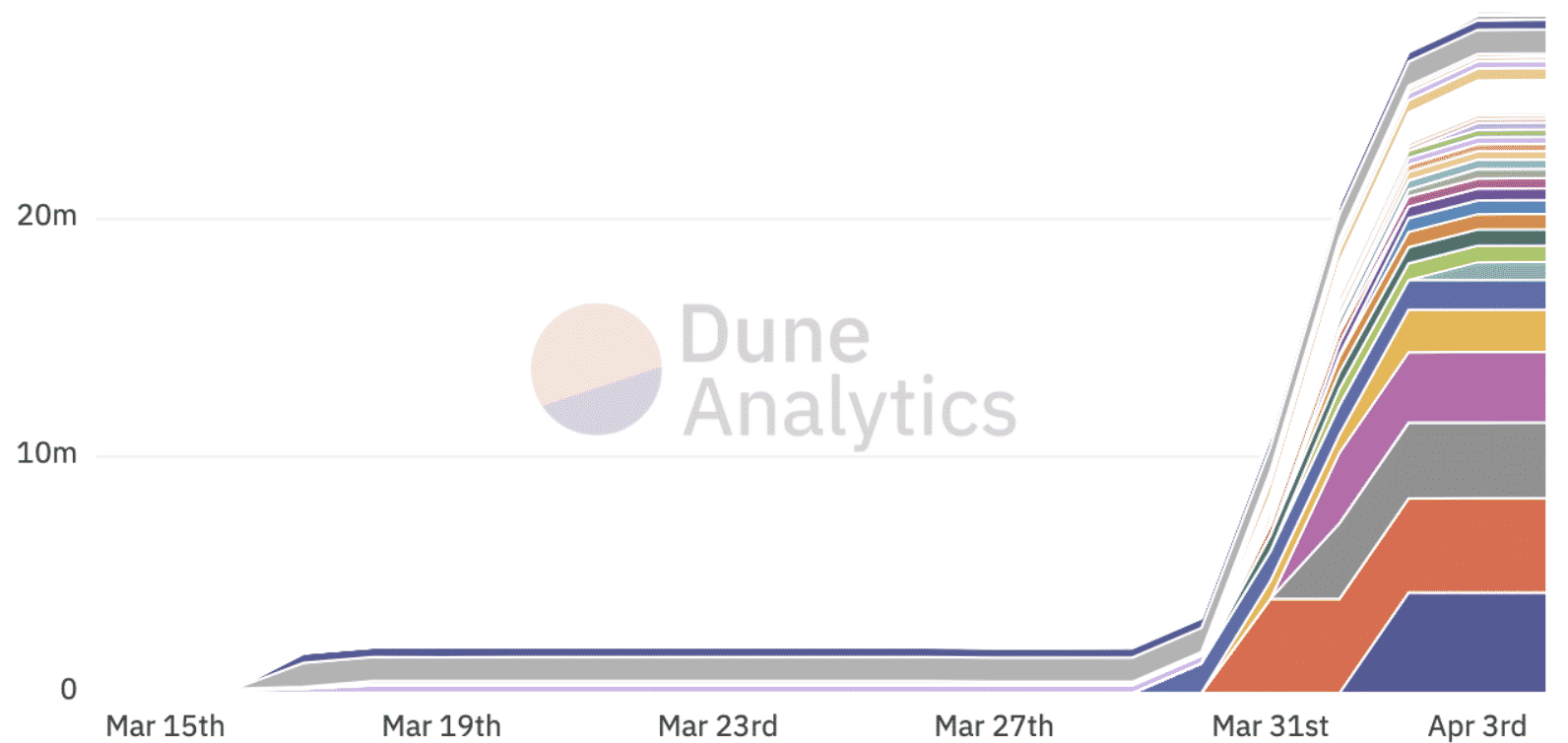

BarnBridge: TVL in Smart Yield Junior Bonds by user/address

BarnBridge: TVL in Smart Yield Senior Bonds by user/address

- There’s a total of $31M in liquidity in BarnBridge Smart Yield bonds

- Most of the volume is in junior bonds ($29.28M vs. $1.77M), as those have a higher APY than senior bonds + additional rewards in $BOND.

- Most of the volume in junior bonds accumulated once the $BOND incentive mechanism kicked off

- In senior bonds, we see that 2 addresses hold most of the liquidity ($1.6M out of $1.77M).

- There are 5 users/addresses in senior bonds and >70 in junior bonds

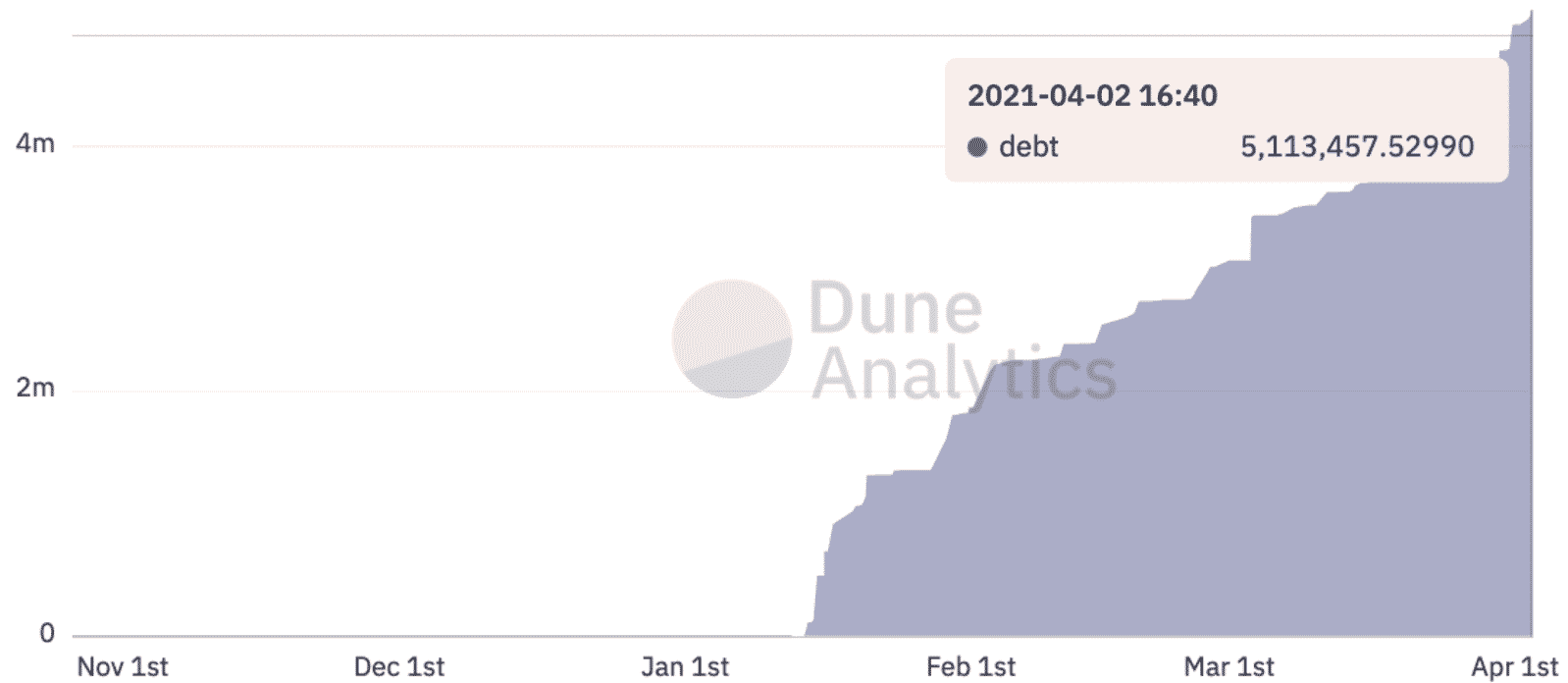

Notional: Total Debt

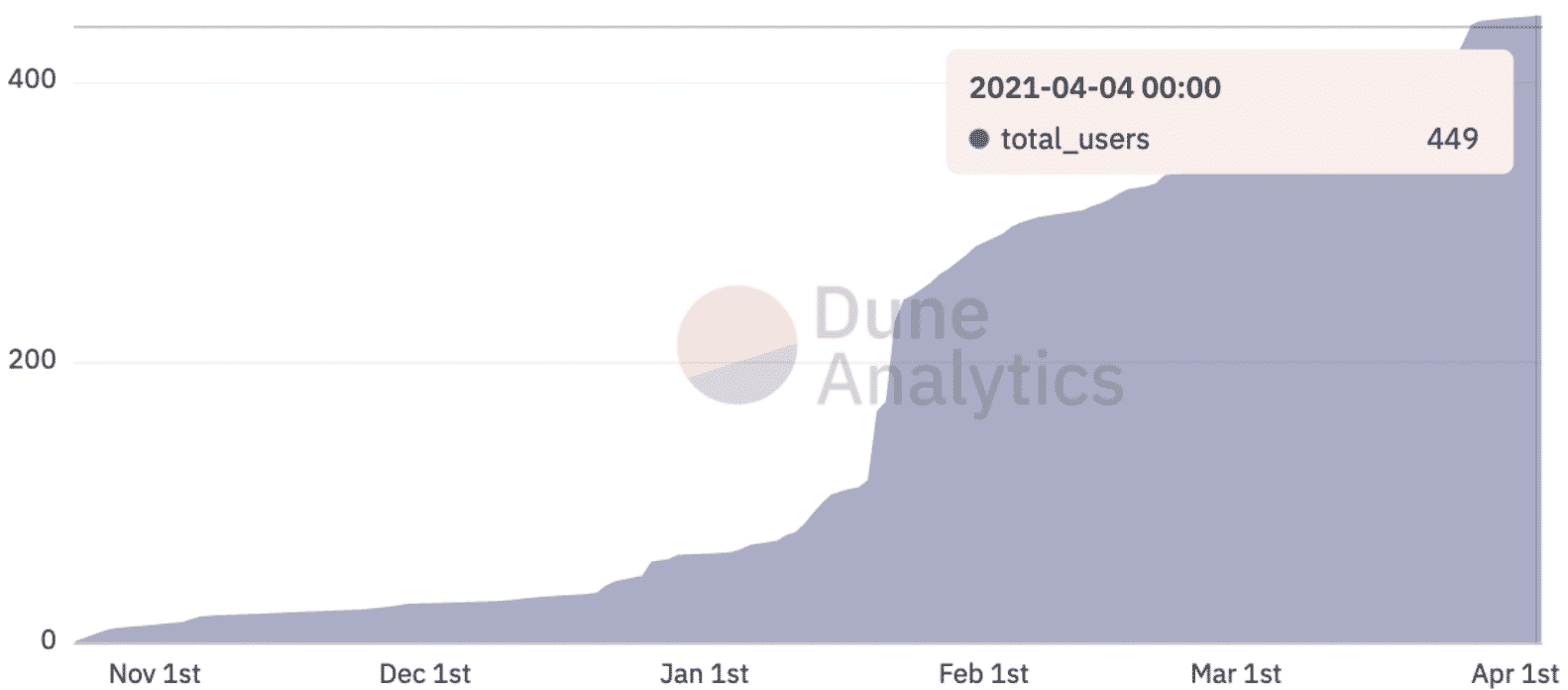

Notional: Total Users (across LPs and lending)

- Notional has steady growing debt, currently $5.1M

- The same growth is shown in users, with currently over 400 users. Most of those have come with the launch of the lending protocol in early 2021.

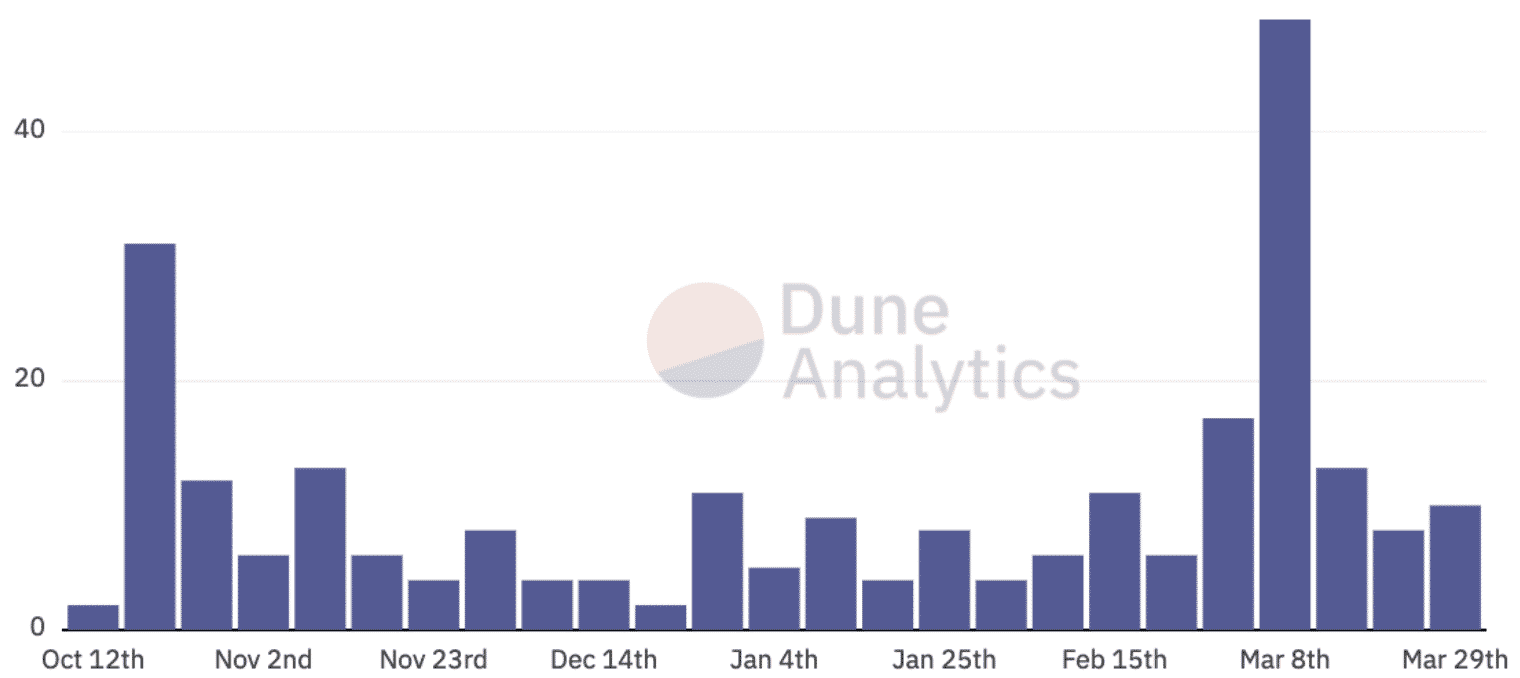

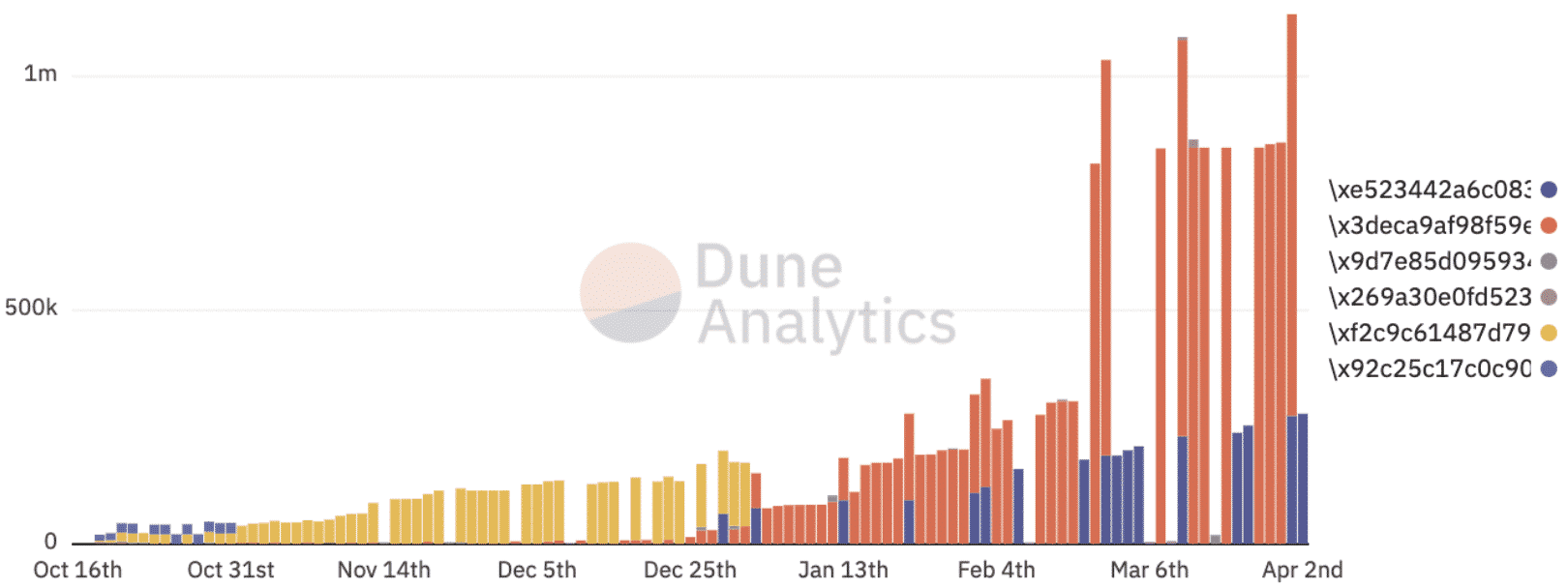

Yield: Weekly Users

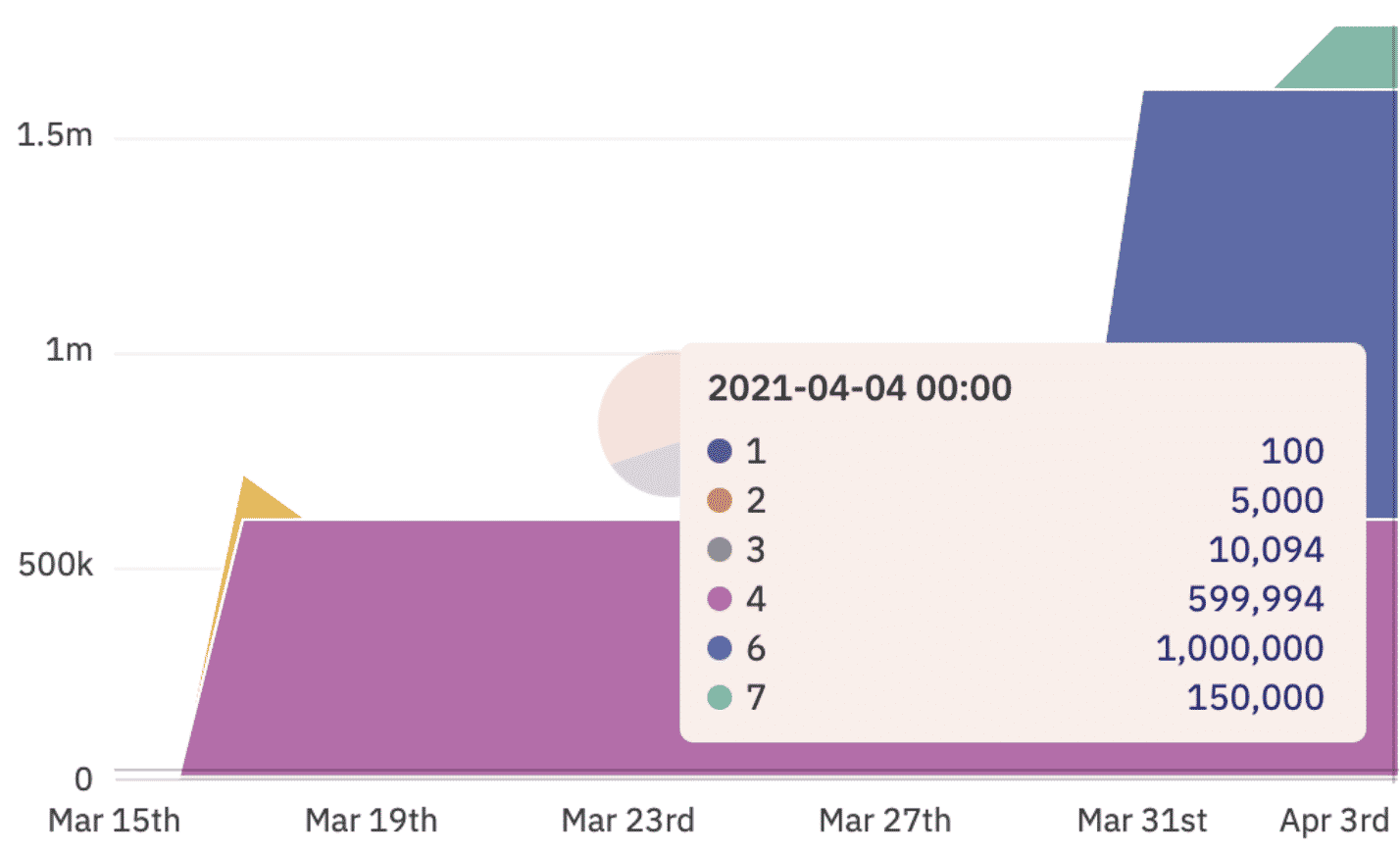

Yield: Outstanding debt by maturity

- While yield has had on average about 15 weekly users, most of the volume on the platform is coming from 1 address

- The dark orange address/volume is the contract of fyDAI debt expiring March 31st, 2021, meaning most of the outstanding debt in terms of volume has already been closed.

- The blue marker is the contract of fyDAI debt expiring June 30th, 2021, with 18 holders and $152K in total debt.

88mph: Fixed-rate deposits

| Total Deposits | Fixed APY | MPH APY | Temporary APY in MPH | |

| Total | $44,366,735 | |||

| Top 5 Assets | $36,480,808 | |||

| CRV:RENWBTC (Harvest) | $13,005,936 | 0.43% | 46.70% | 66.71% |

| UNI (Compound) | $10,735,716 | 0.49% | 17.99% | 25.69% |

| 3CRV (Harvest) | 6,969,529 | 3.72% | 76.27% | 108.95% |

| CRV:oBTC (Harvest) | $3,939,553 | 7.39% | 47.02% | 67.17% |

| USDC (Compound) | $1,830,074 | 3.12% | 64.48% | 92.11% |

- There are $44.36M in fixed-rate LP deposits on 88mph, with CRV:RENWBTC accounting for ~30%, while UNI and 3CRV (3pool CRV) accounting for ~23% and ~16% respectively.

- There are a total of 16 assets / LP on 88mph fixed-yield deposits

- The temporary APY could be utilized during the period of the deposit (until maturity) for staking, borrowing collateral on some platforms( Rari, Unit, MantraDAO), or yield farming / LPs on Uniswap and Sushiswap.

- MPH Rewards are vested progressively over the maturation period

Recent Developments, Roadmap, and Integrations

Notional Finance

- Notional launched its lending protocol in January 2021.

- Insurance on Notional smart contracts is available on Nexus Mutual as of March 2021.

Hifi Finance

- Mainframe rebranded into Hifi in early February 2021.

- Hifi launched its public beta on February 17th, 2021.

- Hifi is also planning on migrating to a Hifi token (as opposed to the old MFT token) later in 2021.

88mph

- 88mph recently got listed on MXC, however, volume is still quite low across all exchanges with around $1M in total daily volume.

- In the end of February, 88mph launched their zero-coupon bonds product. In 88mph, zero-coupon bonds are ERC20 tokens that wrap around multiple fixed-rate deposits. Essentially, users are getting a loan backed by future cash flows from the multiple fixed-rate deposits.

- 88mph will be launching v3 of its protocol with headline changes including transfers of vested rewards (as NFTs), time-proportional & partial withdrawal of fixed-interest deposits, and perpetual yield futures.

BarnBridge

- BarnBridge recently launched its first product – Smart Yield bonds, currently working with USDC loans on Compound. Integrations with Aave and Yearn Finance for Smart Yield are coming up next.

- Liquidity Pool #1 which currently holds ~$380M is closing in early April and would be interesting to see where the liquidity goes.

- BarnBridge also got whitelisted for staking on Bancor.

- BarnBridge’s second product – SmartAlpha bonds are coming up in middle 2021.

- Partnerships/Integrations with Aave and Synthetix are also on the roadmap for 2021 with no clear timeline.

Yield

- Yield fixed-rate fixed-term lending/borrowing has been voted to be integrated into MakerDAO, meaning the Maker platform would directly allow fixed-rate fixed-term lending/borrowing through Yield. The integration will take shape as a “Term Lending module (TLM)” in Maker.

Valuations and Token Supply Inflation

| Circulating Supply | Total Supply | |

| 88mph | 355,627 | 384,739 |

| Hifi | 9,386,552,598 | 10,000,000,000 |

| BarnBridge | 1,985,109 | 10,000,000 |

| Notional** | – | – |

| Yield*** | – | – |

Data Source: CoinGecko, BarnBridge

* The BarnBridge website shows a higher circulating supply than CoinGecko.

** Notional doesn’t have a token yet

*** Yield doesn’t have a token yet

- Hifi and 88mph have most of their supply in circulation, while BarnBridge only has ~20%.

- BarnBridge’s remaining supply will be put into circulation in the next 2 years and will be used mostly for community-based incentives

Governance

Currently, only 88mph and BarnBridge are governed by their community. Although, it’s to be perceived that the majority of voting power is still held by the founding teams and investors.

| Governance | |

| 88mph | DAO |

| Hifi | Centralized |

| BarnBridge | DAO |

| Notional | Centralized |

| Yield | Centralized |

Community Comparison

| Telegram | Discord | # of users | Token Holders | ||

| 88mph | 10,400 | 2,565 | 2,633 | – | 5645 |

| Hifi | 31,300 | – | 5,907 | 16 | 27,891 |

| BarnBridge | 15,600 | – | 5,346 | 94 | 5,301 |

| Notional | 2,990 | – | 960 | 449 | – |

| Yield | 6051 | – | 713 | 146 | – |

Data Source: Dune Analytics, Social Media

- Hifi has the largest number of token holders and the biggest Twitter community.

- Hifi’s token (MFT) was launched back in 2018

- Notional has the highest number of total users

- BarnBridge’s user count is based on usage of their core SmartYield product and excludes 620 yield farming wallets as their yield farming program ends in the first half of April.

- BarnBridge and HiFi also have sizeable Discord groups

Teams and Investors

88mph – 88mph is founded by Guillaume Palayer (a.k.a Guillaume McFly). Guillame is also running a nutrition app called Nutrita and a blockchain development team called Bacon Labs. There is no information on private investments into 88mph.

BarnBridge – BarnBridge is co-founded by Tyler Ward, Troy Murray, and a Romanian development group called Digital Mob. Tyler Ward is the “acting CEO”, having in mind the project is community governed. He’s an active seed investor in DeFi and has recently co-founded an NFT project called Non-Fungible Universe. Investors in BarnBridge include Stani Kulechov (Aave), Kain Warwick (Synthetix), and Parafi Capital.

Notional – Notional is founded by Teddy Woodward, (ex-Barclays) and Jeff Wu (ex-Splunk and Atlassian). With a small team of 4, Notional is backed by Coinbase Ventures, Parafi, 1 Confirmation, and Nascent. Teddy Woodward’s Barclays experience and the presence of Coinbase Ventures could poise Notional for attracting institutional capital into their platform.

Yield – Yield is founded by Allan Niemerg and currently has a small team of 4. Yield is backed by Paradigm.

Potential Risks

Notional

- Governance is still centralized, although the team has disclosed plans to decentralize.

Hifi

- There seems to have been no lending/borrowing activity for almost a month.

- MFT token does not seem to be related to the Hifi product in any way.

- Governance is still centralized with no roadmap on decentralization.

- Liquidity on the platform is still very low, i.e can’t deposit $25K or more

88mph

- Documentation is relatively scarce and could take users some time to make their way around 88mph’s investment products and more so, the MPH rewards mechanism

- The UX/UI design doesn’t really help in that aspect. While it’s supposed to look cool (resembling the 80’s era), the UX feels overwhelming at times.

BarnBridge

- Liquidity on the platform might dampen once Liquidity Pool 1 Closes

- Barely 20% of the total $BOND supply has been put into circulation so far, so there is inflation risk

- There’s currently only a Compound integration on the Smart Yield bonds, although Aave and Yearn integrations are on the roadmap. So there’s currently a platform risk.

Yield

- There’s currently low liquidity on the platform, i.e. can’t deposit $30K or more.

- There’s little information on governance or plans for decentralization.

Key Takeaways

- Fixed-Rate Lending in DeFi (and fixed-term) lending seems to be the next frontier of DeFi lending protocols and potentially attractive for institutional investors.

- Currently, the fixed-rate lending innovations are happening mostly on Ethereum

- Established lending protocols (like Maker, Aave, and Compound) are also looking towards fixed rates through integrations.

- We’re still early in the existence of fixed-rate lending and there are no clear market leaders as of yet, although 88mph and BarnBridge are showing good traction in their early days.

- Incentive programs (additional rewards in native token) are proving to be successful in user/liquidity acquisition.

Disclosure: Albaron Ventures maintains policies designed to manage conflicts of interest related to its investment activities. Albaron Ventures abides by a No Trade Policy for the assets listed in this report for 3 days following its public release. At the time of publication, Albaron Ventures does not own any of the fixed-rate lending tokens mentioned in this report.