Introduction

The composability that is intrinsic to DeFi represents a stack structure that is built on top of existing primitives such as decentralized exchanges and money markets. As new money legos are combined, novel use cases are created which further catalyze the evolution of this independent financial system into a mature and capital-efficient market.

One of the characteristics that unifies the different components of DeFi is yield. This yield can be generated through multiple mechanisms such as liquidity provision, inflationary incentives, lending capital, and protocol fees.

Considering that the present value of money is superior to its future value (because it presents opportunity), it is possible to conclude that capturing future yield in advance represents a crucial financial instrument for any market. This dichotomy between present and future value is commonly exchanged in mature traditional markets where yields can be traded. In such markets, it is possible to swap floating interest rates into fixed rates and vice versa. Through this mechanism, market participants can hedge against a decline in interest rates, alternatively, it is possible to speculate and long yields.

Novel DeFi protocols such as Pendle and APWine seek to capture this value proposition and create an entirely new market within DeFi by tokenizing future yield. To do so, these protocols separate the ownership of the underlying yield-bearing asset and its corresponding yield. This process empowers DeFi market participants with the option to sell future yield in return for immediate liquidity (thus fixing rates), while simultaneously retaining full ownership of the underlying asset. Alternatively, it also allows speculators to gain a pure yield exposure that constitutes a new and capital-efficient form of leverage that poses no liquidation risks.

Tokenizing future yield is a non-trivial endeavor that entails complex mechanisms. Among these mechanisms, it is worth highlighting Pendle’s novel time-dependent AMMs which support tokens with time-decaying characteristics. This innovative AMM design represents a new milestone for DeFi that empowers developers with tools that can be used to support tokens modeled after options and bonds.

This report addresses a new primitive within DeFi protocols focused on the tokenization of future yield and it provides an overview of their structure, the existing similarities, and differences. Furthermore, it also explores futures use cases that can be unlocked with generalized yield tokenization which can be expanded beyond the currently supported yield-bearing assets.

Pendle Finance

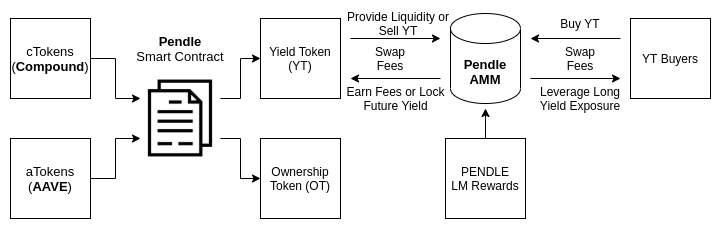

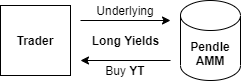

Pendle is a DeFi protocol that allows holders of yield-bearing assets to tokenize and trade future yield using established money markets (i.e. AAVE and Compound). To do so, the system separates the ownership of the underlying asset from its yield using two different tokens, the Ownership Token (OT) and the Yield Token (YT).

With this dual-token model, it is possible for yield-generating token holders to mint both OT and YT tokens. These tokens can then be traded in Pendle’s native AMM which minimizes the time-dependent impermanent loss that is inherent to time-decaying tokens such as YT.

Pendle’s value proposition empowers yield-bearing asset holders to tokenize their yield into YT tokens and sell them. Through this process, YT sellers can swap a floating-rate future yield into a fixed-rate present value and lock their respective returns. Conversely, Pendle empowers traders to gain exposure to the fluctuation of future yield without the need to lock up the underlying asset, this strategy represents a form of leverage with no liquidation risk which is novel to DeFi.

The dynamic relationship that is established between YT buyers and sellers creates a new type of DeFi derivative that enables capital-efficient speculation over yield and fixed interest rates. Furthermore, discounts and premiums over the price of YT tokens (compared to current yields), represent an indicator in market sentiment for future yields and DeFi’s time value.

Lastly, Pendle also allows yield-bearing token holders to generate additional yield as liquidity providers. For this purpose, YT holders can deposit their tokens into the protocol’s native AMM and receive fees and liquidity mining rewards in return. Figure 1) shows Pendle’s system overview.

Yield Tokenization

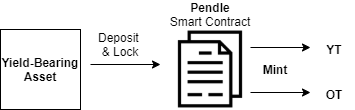

Pendle allows its users to deposit yield-bearing assets into a smart contract and mint Yield Tokens and Ownership Tokens. While minting Yield Tokens, the depositor tokenizes the right to the underlying asset’s yield for a fixed period.

Currently, the only yield-bearing assets that are supported by Pendle are aUSDC and cDAI, regardless, the protocol can be extended to other assets that are entitled to future yield. Furthermore, the underlying asset can always be redeemed with an equal amount of Yield and Ownership Tokens.

Yield Token (YT)

YT tokens represent the right to the future yield that is inherent to the underlying asset for a fixed period. These tokens have a time-decaying value that reaches zero at the expiration date. Before expiry, YT tokens can be traded in Pendle’s AMM or used to provide liquidity.

YT token holders are entitled to the underlying asset’s yield which accrues over time until the expiration date is reached. The accrued interest can be claimed at any time by YT holders on Pendle’s dashboard.

Lastly, YT tokens are characterized by an underlying asset and an expiration date. Due to this, YT tokens with the same underlying asset and expiry are fungible.

Ownership Token (OT)

OT tokens represent the underlying asset that is staked and they are transferable. Furthermore, these tokens and their corresponding YT counterpart are required to withdraw the underlying asset that is deposited in Pendle’s smart contract.

Protocol Functions

Mint

The mint function represents the entry point to Pendle’s system. Through this function, Pendle users can deposit yield-bearing assets (aUSDC and cDAI) and mint YT and OT tokens for a given expiry date. In the future, Pendle will incorporate a UI option that allows users to deposit assets without yield into the protocol (i.e. deposit USDC into Pendle and receive the respective YT and OT tokens without directly interacting with AAVE).

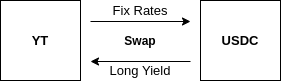

Swap

The swap function enables the exchange of baseTokens (USDC) and YT through Pendle’s AMM. This mechanism represents the core of Pendle’s value proposition by allowing YT sellers to fix rates and YT buyers to gain exposure to future yield in a capital-efficient manner.

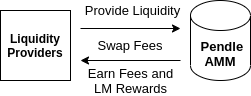

Liquidity Provision

Pendle users can provide liquidity to the protocol’s AMM with YT and USDC. Similar to other AMMs, liquidity providers (LPs) are rewarded with swap fees and PENDLE liquidity mining rewards.

While providing liquidity, LPs can opt to provide dual or single assets. In return, LPs receive PendleLP tokens that represent the ownership of pooled assets. To obtain PENDLE liquidity mining rewards, LPs are required to stake PendleLP tokens.

Redeem

The redeem function allows users to withdraw the underlying asset at any time. Before the contract’s expiry, it is necessary to provide an equal amount of OT and YT tokens, upon doing so, it is possible to withdraw the underlying yield-bearing asset. After the contract’s expiry, it is only necessary to provide OT to redeem the underlying at a 1:1 ratio (note that after the contract’s expiry YT is worthless).

Pendle AMM

The main challenge in the tokenization of future yield lies in the intrinsic time-decaying characteristics associated with its representation. One of these challenges is directly tied to the fact that yield tokens converge to zero as they approach the contract expiry. As a result, while providing liquidity to pools with time-decaying tokens, there exists a guaranteed time-dependent impermanent loss besides the normal market impermanent loss.

Due to this limitation, Pendle developed a novel AMM design that accounts for the token’s value decay using a time-variant. This approach allows mitigating the time-dependent impermanent loss which is inherent to YT tokens with a dynamic pricing model expressed as a function of time.

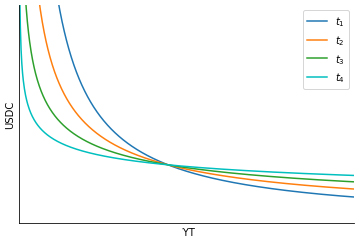

To implement this model, Pendle’s AMM shifts its bonding curve at different time intervals to approximate the YT token price (defined by the slope of the curve) to zero as time converges to the token’s maturity (shown in figure 6).

(source: Pendle)

This time-dependent shift follows the pricing model of options, where the rate of price decline accelerates throughout the contract’s duration. Using this model, Pendle relies on a parameter R that controls the curve shift degree and consequently expresses YT’s time decaying characteristics.

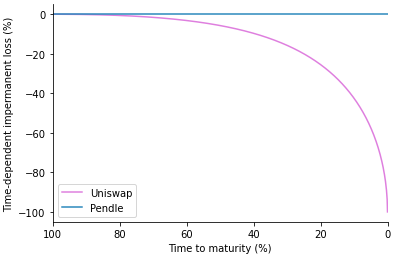

The implications of Pendle’s AMM design are reflected in the absence of a time-dependent impermanent loss which would otherwise result in guaranteed losses if conventional constant-product bonding curves were considered (i.e. Uniswap). This comparison between Pendle and Uniswap AMMs is depicted below in figure 7.

(source: Pendle)

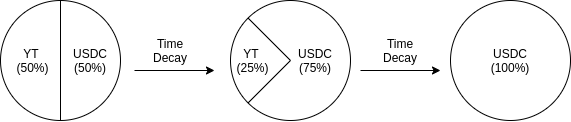

To illustrate this mechanism let’s consider a pool that is initialized with a balanced amount of YT tokens and USDC. As time progresses towards YT’s expiry, Pendle’s AMM gradually shifts the weight of YT tokens in the pool such that near expiry YT’s weight reaches zero. This implies that as the contract approaches maturity, liquidity providers will be mainly exposed to USDC (or other base tokens). Figure 8 shows this example’s pool composition at different time intervals.

Market States

Due to YT’s time-decaying characteristics, Pendle’s markets are divided into the following three different states:

- Active – During this state, Pendle users can freely swap and add liquidity to the pool. This represents the longest state of any YT contract and it comprises most of its market cycle;

- Frozen – As YT’s contract approaches its expiry there will be a margin of error in the accuracy of token quantities. Due to this, once 95% of the contract’s duration has elapsed the market enters the frozen state. During this state, it is only possible to withdraw liquidity with duals tokens and accrue YT’s yield. Swapping and liquidity provision are both disabled;

- Expired – When YT’s contract reaches expiry all incentives are ceased. At this stage LPs can remove their liquidity (which will be fully denominated in the baseToken), and renew the expired OT or redeem the underlying asset;

Implied Yield

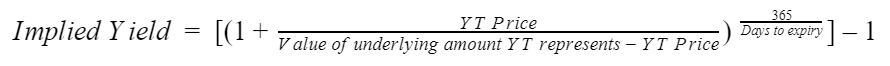

The current price of YT tokens determines the annual yield associated with the underlying asset. As YT’s price fluctuates according to supply and demand, the implied yield defined by the market changes accordingly. Figure X shows the relation between the implied yield and YT’s price.

While analyzing the implied yield formula it is trivial to conclude that an increase in YT’s price corresponds to an increase in the underlying asset’s implied yield. Considering that YT is subject to a time-decaying component that converges to zero at expiry, it becomes evident that a direct comparison of YT’s price is insufficient to assess the yield associated with the underlying asset. As a result, the implied yield formula takes into account the contract’s time component which characterizes YT’s time-decay and enables direct comparisons with the yield-bearing token’s current yield.

Using the implied yield as an indicator it is possible to gauge the market sentiment with regard to future yields, this indicator is given as follows:

- Implied Yield > Current Yield = Bullish Market Sentiment;

- Implied Yield < Current Yield = Bearish Market Sentiment;

Tables 1 and 2 show the implied and current yields for the different expiry dates available on Pendle:

| Expiry | Implied Yield | Current Yield (AAVE) | Liquidity | 24h Volume |

| 30-Dec-2021 | 10.27% | 2.91% | $253K | $0.00 |

| 29-Dec-2022 | 9.39% | 2.91% | $2.56M | $3K |

(source: Pendle)

| Expiry | Implied Yield | Current Yield (Compound) | Liquidity | 24h Volume |

| 30-Dec-2021 | 10.48% | 2.51% | $251K | $0.00 |

| 29-Dec-2022 | 10.48% | 2.51% | $2.61M | $28.94K |

(source: Pendle)

Considering that all expiries currently available for both aUSDC and cDAI have implied yields far superior to the current yields offered on AAVE and Compound, there is an opportunity to fix interest rates. Regardless, this opportunity is constrained by the low available liquidity currently provided on Pendle.

It is worth noting that although the implied yields are superior to the current yields this doesn’t necessarily correspond to a bullish market sentiment. This is due to the existing market inefficiencies and high PENDLE liquidity mining rewards that are present in Pendle’s pools and thereby create an unnatural demand. As liquidity increases, the existing asymmetry between both yields will diminish and better reflect the market sentiment.

Fee Structure

Pendle’s fee structure contemplates the following two different types of fees:

- Forge Fees: 3% of the interest that is generated by yield-bearing tokens deposited into the protocol accrues to Pendle’s treasury;

- Swap Fees: All swaps executed in Pendle’s AMM incur a 0.35% swap fee. This fee is distributed to LPs (0.3%) and Pendle’s treasury (0.05%);

This fee structure is subject to changes through the protocol’s governance system. Furthermore, as the protocol evolves, part of the existing fees will likely accrue to PENDLE token holders to improve its value accrual model.

Main Use Cases

At its core, Pendle offers three different main use cases to its users: locking future yield with fixed rates, yield speculation, and yield arbitrage. Furthermore, by combining simple buy and sell strategies for both YT and OT tokens, it is possible to create more advanced use cases (i.e. lock yield and buy OT with a discount).

Upfront Yield and Fixed Rates

Yield farmers can use Pendle to hedge against a decline in yields. To do so, farmers can lock future yield and fix rates by depositing the underlying yield-bearing asset into the protocol, minting both YT and OT tokens, and selling YT tokens in exchange for baseTokens (i.e. USDC) using Pendle’s AMM. This simple hedging strategy is shown in figure 9.

Yield Speculation

Buying YT tokens grants the buyer all rights over the underlying asset’s future yield for YT’s contract duration. This implies that speculators can leverage long yields with a pure yield exposure which doesn’t require owning the underlying asset. This novel DeFi financial instrument allows a new form of capital-efficient leverage which poses no liquidation risks for YT buyers.

Arbitrage

With yield tokenization instruments it is possible to exploit arbitrage opportunities with low-risk profiles. To illustrate this consider a money market (i.e. AAVE), which offers stable borrow rates. Supposing that a yield farming opportunity arises (i.e. Yearn vaults), with a variable yield that is higher than AAVE’s stable borrow rates, there is an immediate arbitrage opportunity to lock the future yield associated with the aforementioned yield farming opportunity and profit from the difference between stable and variable rates. This new form of arbitrage enabled through the tokenization of future yield will reduce the existing market inefficiencies within DeFi.

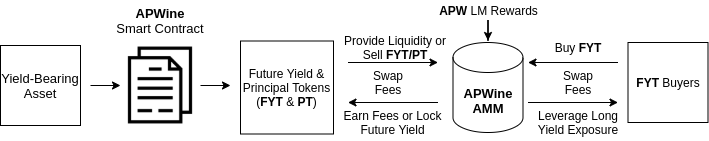

APWine

APWine was the first DeFi protocol to develop a proof of concept for the tokenization of future yield using contracts called Futures (smart contract that tokenizes future yield for a specific time period). The project started in August of 2020 at the peak of “DeFi Summer” and it was motivated by the market’s high yield fluctuations. APWine’s value proposition is simple: sell future yield in advance and hedge against yield fluctuation risks.

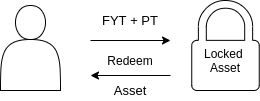

To do so, the protocol separates the user’s yield-bearing assets into two different components, Principal Tokens (PTs), and Future Yield Tokens (FYTs). PTs represent the ownership over the user’s deposit while FYTs represent the right to the future yield generated by the underlying asset for the contract’s duration (i.e. the beta version featured 1 month cycles).

Through this dual-token model, APWine empowers its users with the possibility to swap floating interest rates into fixed rates. This allows yield-bearing asset holders to hedge against a decline in yield while simultaneously providing immediate liquidity. Alternatively, yield speculators can acquire FYT tokens and leverage long yields without requiring to own the underlying asset. This strategy enables a capital-efficient form of leverage that poses no liquidation risks for speculators.

The yield that is generated by yield-bearing assets that are deposited into the protocol is locked in APWine’s smart contract. At the end of the contract’s duration, FYT holders can claim this yield. If depositors wish to redeem the underlying asset prior to the contract’s expiry they are required to provide an equal amount of PT and FYT tokens and they will lose the yield which was accrued during the contract’s duration.

It is important to note that FYT has a maximum level of entropy at the beginning of each cycle. As the contract approaches its expiry, the speculative opportunity that exists within FYT will diminish and its value will converge to the yield accrued over the contract’s duration.

Once a cycle ends, users can roll over PTs to the next cycle and maintain their assets deposited into APWine. When this happens, the PT owner receives new FYTs which represent the future yield for the new cycle.

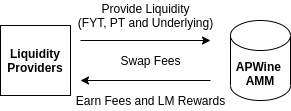

Lastly, APWine’s liquidity providers can contribute with liquidity to the protocol’s AMM in exchange for swapping fees and APW rewards (APWine’s native token). This contribution can be done with PT, FYT and the pool’s underlying asset. Furthermore, the V1 mainnet launch is scheduled for late August 2021. Figure 11 shows an overview of APWine.

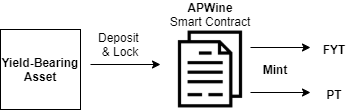

Yield Tokenization

To tokenize future yield, APWine employs a dual-token model which divides the yield-bearing asset into Principal Tokens (PTs) and Future Yield Tokens (FYTs). These tokens can be freely transferred and traded. To mint PTs and FYTs, APWine users must deposit yield generating assets into the protocol’s smart contract and lock the underlying asset. Additionally, both tokens are always denominated in the same units as the underlying asset.

Principal Tokens (PTs)

PTs represent the ownership of the assets deposited into APWine’s smart contract. These assets are only associated with the underlying token without any form of time dependency. To withdraw the underlying asset from APWine’s smart contract it is necessary to burn an equal amount of PTs and FYTs to unlock the deposit.

Future Yield Tokens (FYTs)

FYTs represent the right over the underlying asset’s generated yield for a given contract period. These tokens are always associated with a specific time period. Once the contract reaches its expiry, FYT holders can claim the accrued yield that was generated by the underlying.

Protocol Functions

Mint

The mint function allows users to deposit and lock yield-bearing assets into APWine in exchange for PTs and FYTs. As previously mentioned, FYTs are only eligible for a given contract period, however, PTs do not have time-based restrictions and they will grant holders the ownership over the underlying and the right to new FYTs at the beginning of each contract.

Additionally, APWine’s minting process does not strictly require a yield-bearing asset. As an example, DAI holders will be able to deposit DAI directly into APWine and convert it to PTs and FYTs without explicitly using AAVE.

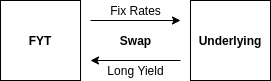

Swap

The swap function enables the exchange of PTs, FYTs and the underlying asset using APWine’s AMM. Akin to Pendle, this mechanism represents the core of APWine’s value proposition by allowing FYT sellers to fix rates and FYT buyers to gain exposure to future yield in a capital-efficient manner.

Liquidity Provision

APWine users can provide liquidity to the protocol’s AMM with PTs, FYTs and the underlying asset. Additionally, liquidity providers (LPs) are rewarded with swap fees and APW liquidity mining rewards.

Redeem

APWine users can redeem at any time the underlying yield-bearing asset from the protocol by burning the FYTs and PTs which are associated with the underlying. It is important to note that exiting the contract prior to its expiration implies that the depositor forfeits the accrued yield associated with that cycle.

APWine AMM

APWine’s AMM has yet to launch, however, it is planned to be a three asset Balancer based AMM. Using Balancer’s implementation, APWine intends to create yield markets that support three different assets: PTs, FYTs and the underlying. With this market structure it is possible to exchange both PTs and FYTs for the underlying asset.

Considering that FYTs are associated with a specific contract duration, they need to be renewed at expiry. To avoid recreating a new pool at the end of each period, and in order to preserve a regular interaction flow for liquidity providers in APWine’s pools, the protocol has developed a custom AMM that automatically rolls out future contracts. This functionality enables a frictionless user experience for liquidity providers.

Main Use Cases

Through the dual-token model that separates the ownership of the underlying yield-bearing asset from its future yield, APWine is able to offer four main use cases to its users: upfront yield with fixed rates, yield speculation, yield arbitrage and yield delegation.

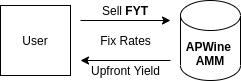

Upfront Yield – Floating to Fixed Interest Rate Swaps

APWine empowers its users with the possibility to unlock immediate liquidity from future yield and hedge against a decline in yields. In order to do so, APWine users can deposit and lock yield-bearing assets into the protocol and mint PTs and FYTs. By selling FYT tokens to the protocol’s AMM and exchanging it for the underlying asset, APWine users are able to fix rates and receive upfront liquidity.

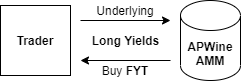

Yield Speculation

Speculators that want to long yields can do so by purchasing FYTs in APWine’s AMM. Through this mechanism, speculators are able to leverage long yields with a pure yield exposure that doesn’t require owning the underlying asset. This new financial instrument enables a capital-efficient form of leverage which poses no liquidation risks for YT buyers.

Yield Arbitrage

By creating yield markets through FYTs, APWine enables an arbitrage mechanism for yields from different protocols. As a result, it is possible to exploit immediate arbitrage opportunities whenever stable borrow rates are lower than floating yield farming opportunities. This yield arbitrage will mitigate the current market inefficiencies that exist in DeFi.

Future Yield Delegation

APWine depositors and PT buyers are entitled to new FYTs at the beginning of each new contract. Considering that the user wants to delegate newly minted FYTs to another address it is possible to do so. For that purpose, the FYT holder can give another address access to the yield generated by the underlying yield-bearing asset without conceding the right to access the underlying itself.

Comparative Analysis of APWine and Pendle

APWine and Pendle have the same purpose, the tokenization of future yield. To do so, both protocols employ a dual-token model that separates the ownership of the underlying yield-bearing asset and its yield rights. Despite the existing similarities, there are several functional differences that create distinct product market fits for both protocols. At the core of these functional differences lies the different approach to the yield token design.

Claiming Yield

The core difference between APWine and Pendle lies in the capital flexibility provided by both protocols when it comes to claim the yield that is associated with the respective yield tokens.

Pendle allows its users to claim YT’s realized yield during the entire contract. This continuous yield claiming mechanism empowers YT holders with capital flexibility which enables them to realize the underlying asset’s accrued yield at any given time. Contrastingly, APWine only allows its users to claim FYT’s realized yield at the end of the contract period.

Considering that YT’s yield can be claimed at any time, YT’s value converges to zero at expiry due to its inherent time decay. This introduces a time-dependent impermanent loss to Pendle which has to be mitigated through its AMM design that supports time decaying tokens. Alternatively, FYT’s yield can only be claimed at the end of the contract, as a result, FYT’s value converges to the underlying accrued yield at expiry.

The distinct approach between both protocols represents a tradeoff between capital flexibility and composability. This is particularly evident while observing the required AMM design for each yield token, YTs can only be traded in Pendle’s AMM due to the existing time-decay while FYTs can be integrated with existing AMM designs (i.e. Balancer pools).

Liquidity Provision

APWine and Pendle rely on an AMM model, as a result, both protocols need liquidity providers to facilitate trades. As liquidity providers, users can contribute with the following tokens to each platform:

- APWine – While providing liquidity to APWine’s AMM, users can deposit FYTs, PTs, and the underlying asset;

- Pendle – While providing liquidity to Pendle’s AMM, users can deposit YTs and baseTokens (i.e. USDC);

It is worth noting that APWine liquidity providers can deposit tokens that represent ownership of the underlying asset (PTs) into the protocol’s AMM. In Pendle’s case, ownership tokens (OTs) can only be provided to secondary markets such as SushiSwap.

Furthermore, Pendle’s liquidity providers are required to unstake LP tokens at the end of each contract period, remove the liquidity which was provided, and renew the expired ownership tokens. In APWine’s case, liquidity providers have a “set and forget” solution where at the beginning of each period PT holders automatically receive new FYTs. This composable form of providing liquidity offers a convenient and capital-efficient solution for liquidity providers.

Lastly, Pendle supports yearly contract durations and initially APWine will support monthly contracts. In the future, APWine will support different contract durations depending on the volatility of the underlying asset.

Tokenomics and Fee Structure

The token economic model and the protocol fee structure are crucial components to assess both competitiveness and the existing incentives for all protocol shareholders. As of now, these are the following value accrual models for APWine and Pendle native tokens:

- APW – APWine’s native token follows an economic design which is similar to Curve’s CRV model. As a result, APW holders will be able to vote-lock APW into the protocol as veAPW up to 2 years. Longer locking periods will grant veAPW token holders larger voting weights and protocol rewards. Furthermore, token holders will be entitled to APWine’s 5% performance fees over all collected yield and 0.05% swap fees on all trades conducted in the protocol’s AMM;

- PENDLE – As of now, Pendle’s native token serves purely utility purposes. Once the protocol is sufficiently mature, the token will serve governance purposes and it will capture Pendle’s value accrual model (yet to be defined);

Additionally, fee structures are subject to changes through the governance process, currently these are the current fees in place and planned for both AMMs:

| Protocol | Performance Fees | Swap Fee |

| APWine | 5% | 0.30% |

| Pendle | 3% | 0.35% |

(source: APWine and Pendle)

Analyzing the aforementioned fee structures it is possible to conclude that Pendle offers more competitive performance fees and APWine offers more competitive swap fees. Considering that APWine will support a wider range of assets that benefit from higher yields it is reasonable to have a performance fee premium.

Lastly, it is important to analyze how both protocol distribute the respective native token allocations, table 4 shows this distribution for both APW and PENDLE:

| Token | Investors | Team | Community | Liquidity Bootstrapping | Advisors |

| APW | 8.264% | 28.056% | 56% | 7% | 0.68% |

| PENDLE | 15% | 22% | 55% | 7% | 1% |

(source: APWine and Pendle)

Comparing both distributions it is clear that both protocols have similar allocations for community and liquidity bootstrapping purposes. The largest discrepancy that can be observed lies in the investor’s token allocation which mainly represents a trade-off with the tokens allocated to both teams.

Supported Assets

As of now, Pendle is the only live protocol that tokenizes future yield using both aUSDC and cDAI as the underlying yield-bearing assets. Table 5 shows Pendle’s currently supported assets and APWine’s planned integrations at launch.

| Protocol | AAVE | Compound | Lido | Harvest | Yearn | StakeDAO |

| APWine | aDAI, axSushi | – | stETH | iFARM | yUSD | xSDT |

| Pendle | aUSDC | cDAI | – | – | – | – |

(source: APWine and Pendle)

Additionally, Pendle is planning to expand the platform’s supported assets to LP tokens, staking tokens and vaults. As a result, new integrations and use cases will soon be unlocked with both protocols.

Security Audits

New protocols have security risk premiums that can only be minimized with battle tested codebases and security audits. In order to mitigate these risks, Pendle and APWine conducted the following audits:

| Protocol | Security Audits |

| APWine | Peckshield and Quantstamp |

| Pendle | Least Authority and Independent Whitehats |

(source: APWine and Pendle)

Furthermore, Pendle is currently trying to integrate the platform with insurance DeFi protocols such as Nexus Mutual and InsurAce. A successful integration with such protocols can prove to be a catalyst to start attracting capital from large funds with minimized security risks.

Conclusion

While observing Ethereum’s DeFi primitives such as AMM-based DEXs and lending markets, it is possible to conclude that yield represents the common denominator that lies at the core of DeFi’s composability stack. This composability stack has evolved to a point where users can get returns on idle assets using either the aforementioned primitives or yield aggregators that are built on top of them. However, these present returns cannot be subject to future extrapolations due to the drastic yield fluctuations that are dictated by market forces and their inherent cycles.

APWine and Pendle are two protocols focused on solving this issue through the tokenization of future yield. To achieve this goal and enable floating to fixed interest rate swaps, these protocols rely on a dual-token model that separates the ownership of yield-bearing assets from future yield rights. As a result, holders of yield-bearing assets can deposit and lock funds into APWine or Pendle and mint two tokens: an ownership token and a future yield token.

With this dual-token model, the following main use cases are enabled: fixed rates and upfront liquidity, or yield speculation. To fix rates users are required to deposit the underlying yield-bearing asset into the protocol, mint both tokens, and sell yield tokens to the protocol’s AMM. This use case is particularly useful for users that want to hedge against a decline in yields or require immediate liquidity. Alternatively, traders that want to long yields can do so by directly buying yield tokens without owning the underlying assets. This simple method represents a capital-efficient form of leverage that poses no liquidation risks. Additionally, by creating yield markets it is possible to profit from immediate yield arbitrage opportunities whenever a difference between stable and variable rates arises in different markets.

Despite the existing similarities between APWine and Pendle, these protocols offer different value propositions that come with trade-offs between capital flexibility and composability. As an example, Pendle allows users to claim the accrued yield at any given time. Due to this, Pendle’s yield tokens have time-decaying characteristics that fracture composability with existing AMMs. Conversely, APWine only allows users to claim the accrued yield at the contract’s expiry. As a result, the protocol is more composable with existing DeFi platforms. Furthermore, APWine aims to allow the permissionless creation of new yield markets, by doing so, the protocol can leverage its composability and catalyze a massive user adoption. With regard to integrations with DeFi protocols and assets, APWine is set to support a wide variety of options when compared to Pendle. Lastly, APWine will support more contract durations depending on the volatility of the underlying assets.

The main obstacle for both protocols lies in the lack of liquidity and its possible fragmentation across different yield markets. These issues are evident in Pendle’s present market inefficiencies that are reflected in the existing discrepancies between implied and current yields. It is worth noting that these inefficiencies are expected for an early stage project. Once APWine launches, it will be possible to compare the liquidity depth in both protocols and adjust risk accordingly.

In summary, both APWine and Pendle create an entirely new market category in DeFi. The addressable market for these protocols can be extended to all yield-bearing assets (i.e. stETH, LP tokens, vaults and lending markets). As a result, it is possible to infer that there is a highly asymmetric risk and opportunity within this emergent DeFi category. With the addition of new features such as leveraged yield speculation and options, new use cases and composability possibilities will be unlocked through the tokenization of future yield. Leveraging unprecedented forms of innovation, this new DeFi category is poised to grow and capture Ethereum’s yield economy through the creation of yield markets.

Disclosure: Albaron Ventures maintains policies designed to manage conflicts of interest related to its investment activities. Albaron Ventures abides by a No Trade Policy for the assets listed in this report for 3 days following its public release. At the time of publication, Albaron Ventures has positions in both PENDLE and APW tokens.

References

1. Pendle. (n.d.). Pendle Documentation. Retrieved July 4, 2021, from

2. APWine. (n.d.). APWine Documentation. Retrieved July 16, 2021, from

3. Medium. (2021, July). YT Capital Efficiency. Retrieved July 12, 2021, from

https://medium.com/pendle/yt-capital-efficiency-bc447366d38b

4. Medium. (2021, July). Pendle x Rari Fuse Pool. Retrieved July 21, 2021, from

https://medium.com/pendle/pendle-x-rari-fuse-pool-6016713a0d2

5. Medium. (2021, July). APWine Tokenomics. Retrieved July 24, 2021, from

https://apwine.medium.com/apwine-tokenomics-50e0db1cc33d

6. Medium. (2021, July). The Grapevine — APWine Ecosystem News, V1 Launch Update. Retrieved July 24, 2021, from

https://apwine.medium.com/the-grapevine-apwine-ecosystem-news-v1-launch-update-ffb09ce23e42